XRP commerce quantity spikes to excessive final witnessed earlier than the SEC’s lawsuit towards Ripple, per information sourced by analytics agency Kaiko.

Citing Kaiko information, blockchain researcher Colin Brown reveals that XRP’s market exercise has returned to ranges seen earlier than the SEC lawsuit. Based on him, XRP buying and selling volumes in U.S. markets have considerably elevated since Decide Analisa Torres’ abstract judgment choice final July.

Notably, the court docket ruling famous that XRP in itself shouldn’t be a safety. It additionally clarified that Ripple’s XRP gross sales by way of secondary buying and selling platforms aren’t thought of securities transactions, whereas direct gross sales to institutional buyers are labeled as such. Consequently, a number of U.S. exchanges, together with Coinbase and Gemini, listed XRP, tapping into the beforehand suppressed demand from U.S. merchants.

Buying and selling Quantity Surge

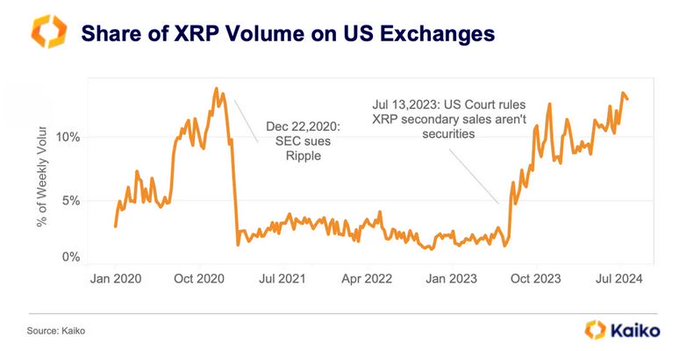

Kaiko Analytics’ chart, titled “Share of XRP Quantity on US Exchanges,” maps out the proportion of weekly buying and selling quantity of XRP on U.S. exchanges from January 2020 to July 2024. The chart highlights these essential occasions which have influenced XRP’s buying and selling exercise.

From January 2020 to December 2020, XRP’s buying and selling quantity remained secure between 5-10%, indicating regular market curiosity. Nevertheless, on December 22, 2020, the SEC initiated authorized motion towards Ripple, alleging that XRP was bought as an unregistered safety. This led to a steep decline in buying and selling quantity on U.S. exchanges, falling from about 10% to underneath 1%.

All through 2021 to mid-2022, buying and selling volumes have been constantly low, staying under 1%. Notably, from mid-2022 to early 2023, there was a gradual uptick in buying and selling quantity, reaching round 3-5%, probably as a consequence of developments within the authorized case and hopes for a optimistic decision.

On July 13, 2023, Decide Torres dominated that XRP shouldn’t be a safety. This resulted in a major spike in buying and selling quantity, leaping from round 5% to almost 15%. From late 2023 to July 2024, XRP’s buying and selling quantity remained elevated, fluctuating between 10-15%.

This Technical Indicator Concur

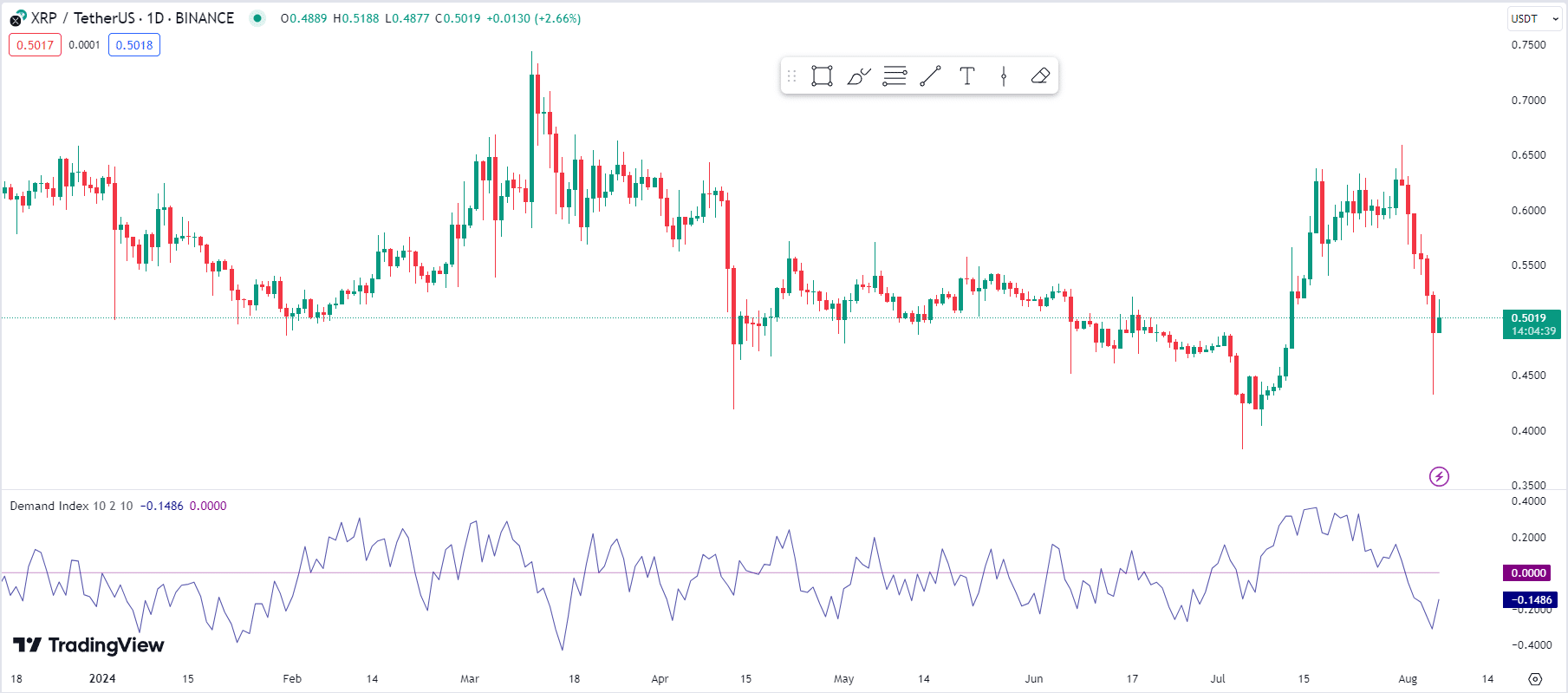

Technical indicators additionally sign a renewed curiosity in XRP, and potential results on worth. A chart from TradingView illustrates the day by day worth actions of XRP towards Tether (USDT) on Binance, incorporating the Demand Index indicator.

The latest uptick within the Demand Index from adverse to much less adverse values means that promoting strain is diminishing and shopping for curiosity is returning. This resurgence in demand, particularly if the DI crosses into optimistic territory, might sign a possible bullish reversal.

Rising Social Exercise

In the meantime, in accordance with The Crypto Fundamental, notable figures within the crypto group, like Nick, an entrepreneur and self-proclaimed “Crypto Crusader,” beforehand acknowledged XRP’s substantial development potential.

Nick expressed amazement on the surging demand, noting it reveals no indicators of subsiding. Utilizing information from market intelligence software Fiatleak, he highlighted that XRP had exceeded 1 million trades per minute globally.