As July approaches, spot Ethereum ETFs, which obtained the US SEC partial inexperienced gentle on Could 23, close to their official launch. Many traders marvel if the value of Ethereum (ETH) will observe Bitcoin’s (BTC) response to its associated monetary devices in January.

That reply, nonetheless, lies sooner or later, which can start in just a few days. Whereas ready, the on-chain evaluation offers actionable insights that may predict if the altcoin is following a possible sample.

The Altcoin Buyers Are in Excessive Spirits

Modification of registration paperwork is one issue that has delayed the stay buying and selling of the spot Ethereum ETFs. Nevertheless, in a latest interview, SEC Chair Gary Gensler confirmed that issues have been going easily.

Moreover, a report from nameless sources on the regulatory company reveals that the merchandise will launch on July 4.

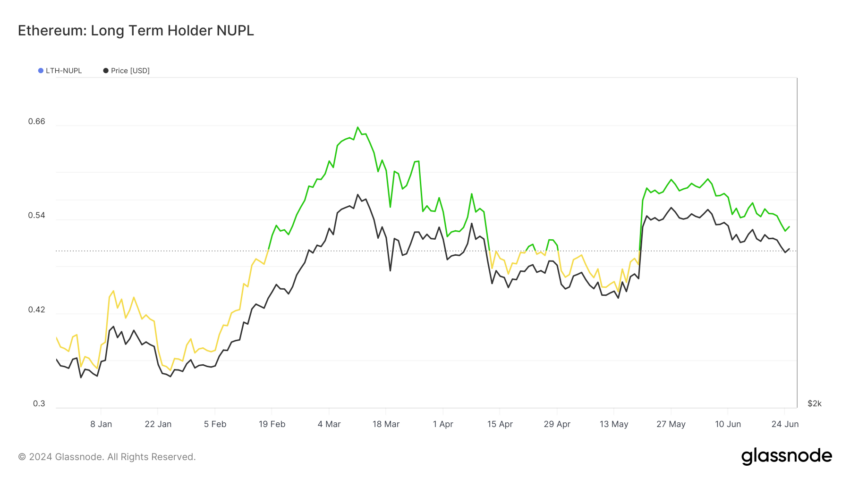

Following the event, BeInCrypto screens holder habits in the direction of ETH. In accordance with our findings, ETH holders show resolute confidence within the cryptocurrency. We found this after analyzing the LTH-NUPL supplied by the analytic platform Glassnode.

The metric stands for Lengthy Time period Holder-Web Unrealized Revenue/Loss. It measures the habits of holders who’ve owned a cryptocurrency for over 155 days. As seen within the chart beneath, totally different colours exist for various sentiments.

Learn extra: Ethereum ETF Defined: What It Is and How It Works

Ethereum LTH-NUPL. Supply: Glassnode

Whereas crimson signifies capitulation, orange means concern. Yellow signifies optimism, whereas blue suggests greed. At present, Ethereum’s LTH-NUPL is within the perception (inexperienced) zone. When this occurs, long-term traders are assured a couple of forthcoming worth enhance.

Nevertheless, ETH has skilled a 12.75% decline within the final 30 days whereas it trades at $3,365. In conditions like this, the broader sentiment is predicted to be bearish. Thus, as notion tilts towards confidence, the much-anticipated growth appears to be the rationale. If sustained until launch day, it will probably propel larger demand for ETH.

Ethereum Is Taking Bitcoin Out of the Method

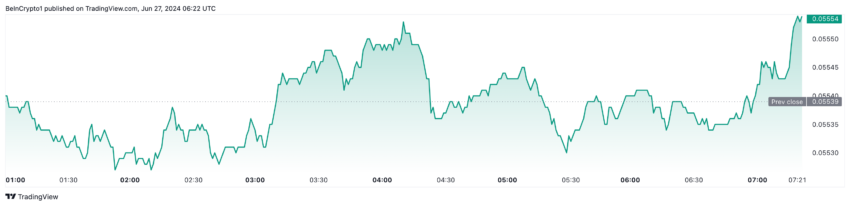

In the meantime, notion alone can’t push the value. Due to this fact, we consider one other indicator that may have an effect on the altcoin’s worth, which is the ETH/BTC ratio. This ratio tells whether or not Bitcoin is outperforming Ethereum or the opposite manner round. Particularly, if the ETH/BTC ratio is excessive, it implies that ETH is performing higher than Bitcoin.

Nevertheless, a low ratio implies that BTC is outperforming ETH. As of this writing, the ratio is 0.055—up 2.33% throughout the final seven days. Which means at this time, one ETH should buy 0.055 BTC.

ETH/BTC Ratio. Supply: TradingView

Ought to the ratio proceed growing, Bitcoin’s market dominance will lower. As such, Ethereum can step up whereas its worth could climb a lot larger. Contemplating Bitcoin’s efficiency, the value rose by 56.95% in lower than two months after approval.

If ETH mirrors the same transfer, the worth of the cryptocurrency can be price $5,308 earlier than the top of the third quarter (Q3). Now, let’s study the altcoin’s short-term potential.

ETH Worth Prediction: It Is Not Priced In

In accordance with the day by day chart, the 20 (blue) and 50 (yellow) EMAs sit above Ethereum’s worth. EMA stands for Exponential Shifting Common. It’s an indicator measuring development path over a given interval.

When the EMA is beneath the value, it signifies that bulls are defending it. Nevertheless, the indicator being above the value offers credence to the draw back. If circumstances stay the identical, ETH could drop to $3,278. This place additionally exhibits that ETH just isn’t but priced in.

In easy phrases, because of this the financial influence of the upcoming growth has but to be mirrored within the present market worth. Therefore, it may be assumed that the worth nonetheless has the potential to leap.

Nevertheless, each EMAs are getting ready to reaching the identical level. If this occurs, ETH’s worth will transfer sideways, probably consolidating between $3,355 and $3,610. Nevertheless, if the 20 EMA flips the 50 EMA (bullish crossover), the altcoin could key into the $3,866 resistance.

Learn extra: Ethereum (ETH) Worth Prediction 2024/2025/2030

Ethereum Day by day Evaluation. Supply: TradingView

In a extremely bullish state of affairs, ETH could replicate its efficiency between February and March, reaching $4,059 earlier than the top of July.

As well as, the worth of inflows is one main concern that traders have. From feedback on-line, a variety of analysts should not certain if the Ethereum ETFs can pull the type of quantity Bitcoin did.

Nevertheless, a earlier prediction positioned the inflows at $569 million month-to-month. Ought to Ethereum match this quantity, a rally previous the altcoin’s all-time excessive could occur inside a brief interval.

But when the reception to the event is “all speak no motion”, ETH’s worth could nosedive, probably reaching one other 10% decline.