Ethereum (ETH), the second-largest cryptocurrency by market capitalization, has skilled vital worth actions lately, pushed by numerous market forces and whale actions. Whereas Ethereum has been battling to keep up its place amid market challenges, its potential for restoration stays robust. This text examines the most recent developments, together with whale transactions, key resistance ranges, and Ethereum’s ongoing technological developments.

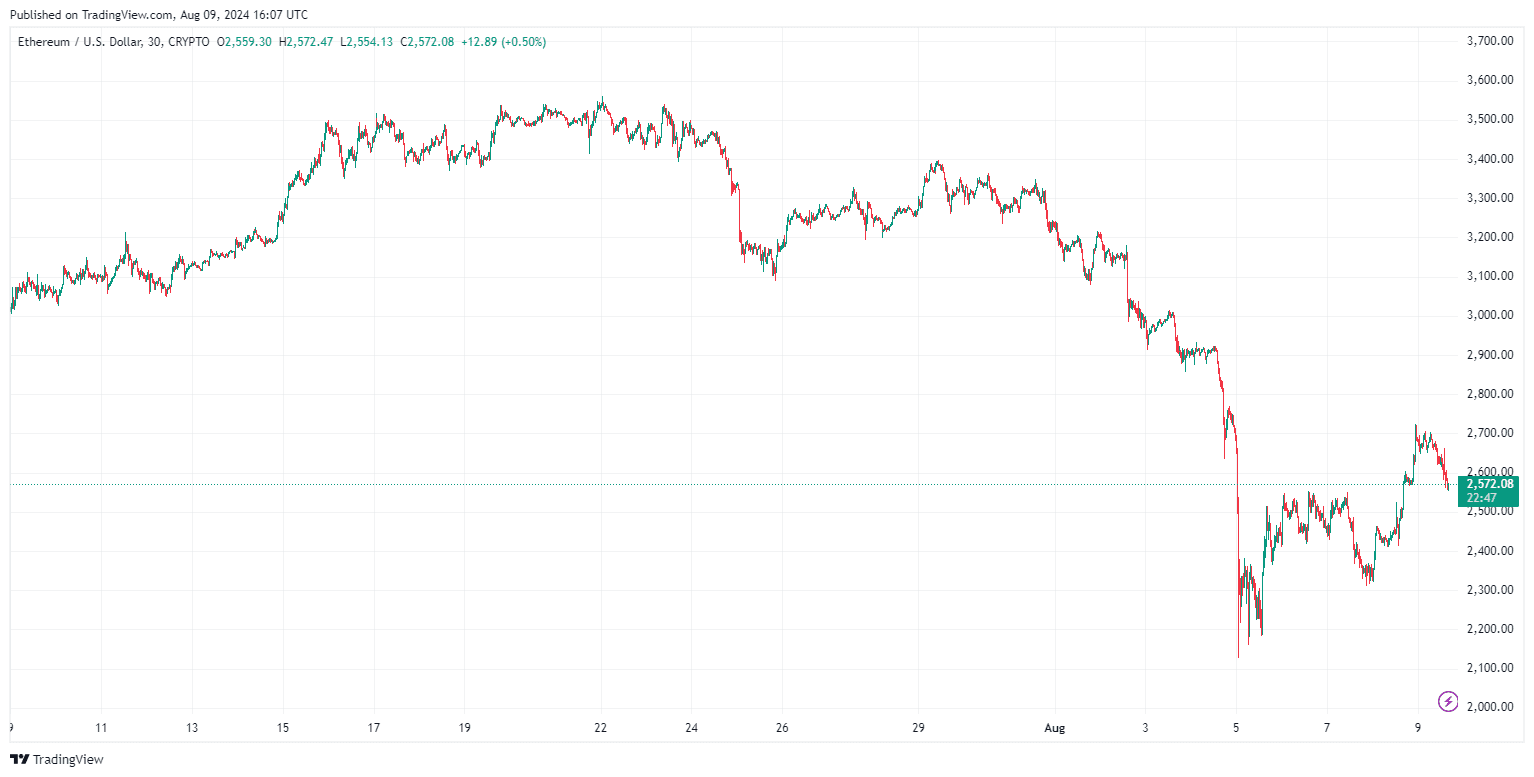

By TradingView – ETHUSD_2024-08-09 (1D)

Ethereum Value Evaluation: What Are ETH Value Developments Just lately?

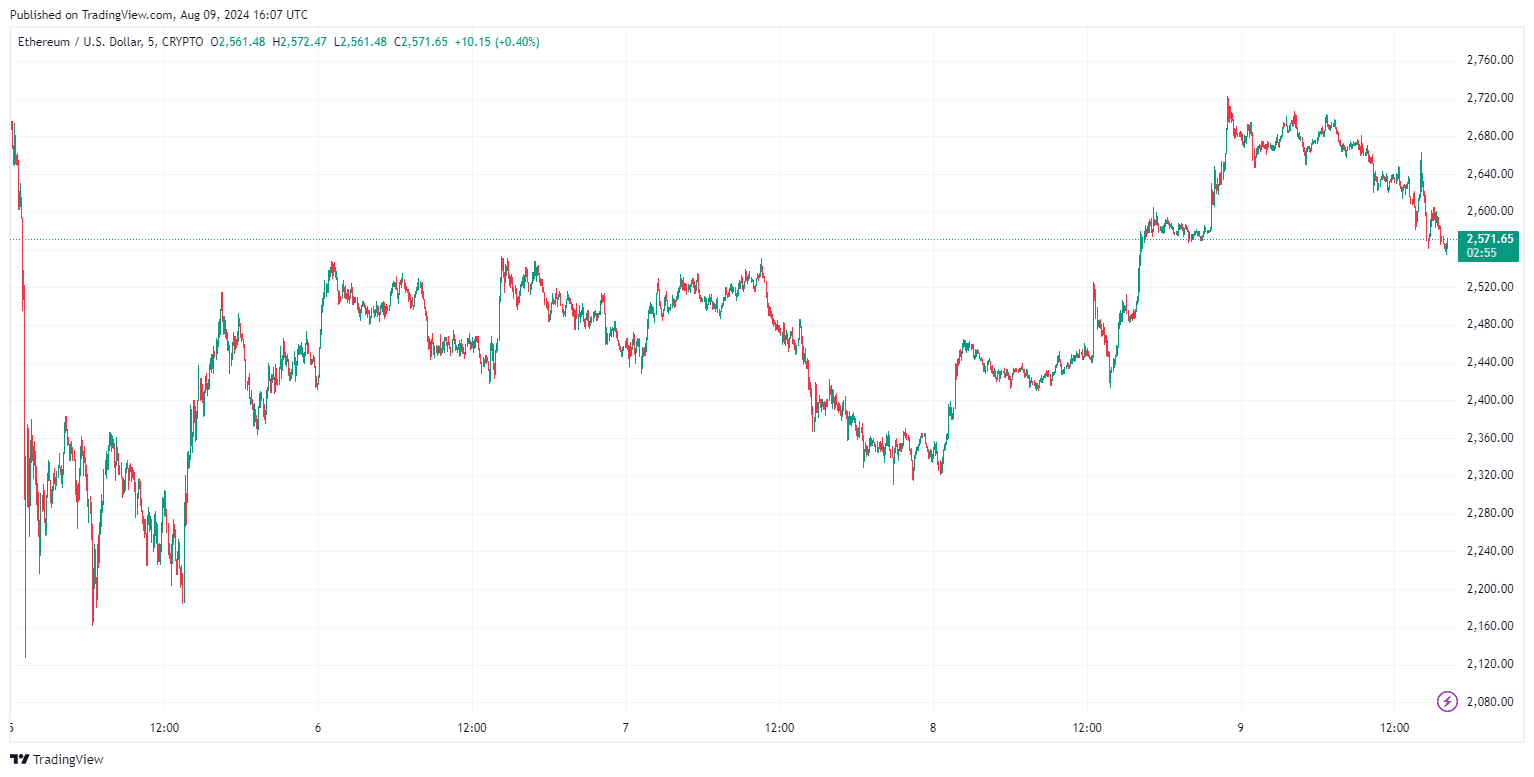

Ethereum has proven resilience within the face of market volatility, managing to climb above the $2,550 resistance zone. At the moment buying and selling round $2,680, ETH is eyeing a possible rise above the $2,720 resistance stage. The presence of a bullish development line on the hourly chart means that Ethereum may break by means of the $2,865 resistance, paving the best way towards the $3,000 mark. Nonetheless, if the $2,720 resistance is not cleared, a downward correction may convey ETH again to the $2,550 help zone or decrease.

By TradingView – ETHUSD_2024-08-09 (5D)

How Did Whale Exercise Increase Market Confidence?

Whale exercise has been a big think about Ethereum’s current worth actions. Just lately, two massive transactions, totaling practically $56 million, have been made by Ethereum whales. Such large-scale purchases are sometimes seen as bullish indicators, indicating long-term confidence within the asset. The whales’ tendency to carry fairly than promote throughout market dips may help Ethereum’s worth, decreasing the chance of a big sell-off and probably fueling additional worth will increase.

Challenges Amid Market Uncertainty: Push ETH Value Down?

Regardless of some constructive indicators, Ethereum has confronted appreciable challenges, together with a pointy decline in worth, presently hovering round $2,400. Market pessimism, excessive transaction charges, and scalability points have all contributed to Ethereum’s struggles. Because of this, its place because the second-largest cryptocurrency is underneath risk, with opponents like Solana gaining floor.

Technological Developments and Future Prospects: Increase ETH Value Up?

On the brighter facet, Ethereum’s ongoing technological developments, resembling the combination of GPU-efficient STARK proving code, are strengthening its basis. These updates, essential for scaling and securing the community, reveal Ethereum’s dedication to innovation and will play a significant function in its restoration. Moreover, Vitalik Buterin’s current switch of 200 ETH has sparked curiosity, signaling potential market shifts and the community’s resilience.

By TradingView – ETHUSD_2024-08-09 (1M)

Ethereum’s journey has been turbulent, marked by each constructive and unfavourable forces. Whereas market challenges stay, the mixture of whale exercise, ongoing technological developments, and strategic resistance ranges means that Ethereum has the potential to get better and probably thrive sooner or later.