Bitcoin has surged to a brand new all-time excessive, approaching the $90K threshold in an impulsive rally. The mixture of one other Federal Reserve price reduce and President Trump’s re-election has fostered a risk-on sentiment within the markets, driving demand for threat belongings like Bitcoin.

Technical Evaluation

By Shayan

The Each day Chart

On the each day chart, Bitcoin’s worth motion displays a sturdy shift towards a bullish market construction. It just lately broke previous each the 100-day and 200-day transferring averages with vital momentum and reached an ATH of $90K.

Then again, the 100-day MA has crossed above the 200-day MA, marking a Golden Cross. This technical indicator indicators bullish dominance, sparking FOMO amongst individuals who’re speeding to build up Bitcoin.

Nonetheless, after this sharp rise, the market is predicted to enter a corrective retracement part. For this pullback, the 0.5 ($74K) to 0.618 ($70K) Fibonacci retracement ranges, aligned with Bitcoin’s prior swing excessive, could function important assist zones, offering a goal for profit-taking and re-entry within the mid-term.

The 4-Hour Chart

On the 4-hour chart, Bitcoin stays in a bullish worth channel, constantly marking greater highs and better lows, which is attribute of a wholesome uptrend.

The worth just lately noticed a robust rebound from the channel’s decrease boundary close to $70K, fueling the push to the brand new ATH of $90K.

Now that the worth has reached the channel’s higher boundary, consolidation is underway. For the quick time period, a interval of distribution close to this degree is predicted, adopted by a slight correction again to the channel’s center boundary round $80K.

Though the present uptrend is robust, warning is suggested towards FOMO. The market usually provides a number of alternatives for strategic entries, and a wholesome correction would offer a extra sustainable basis for future features.

On-chain Evaluation

By Shayan

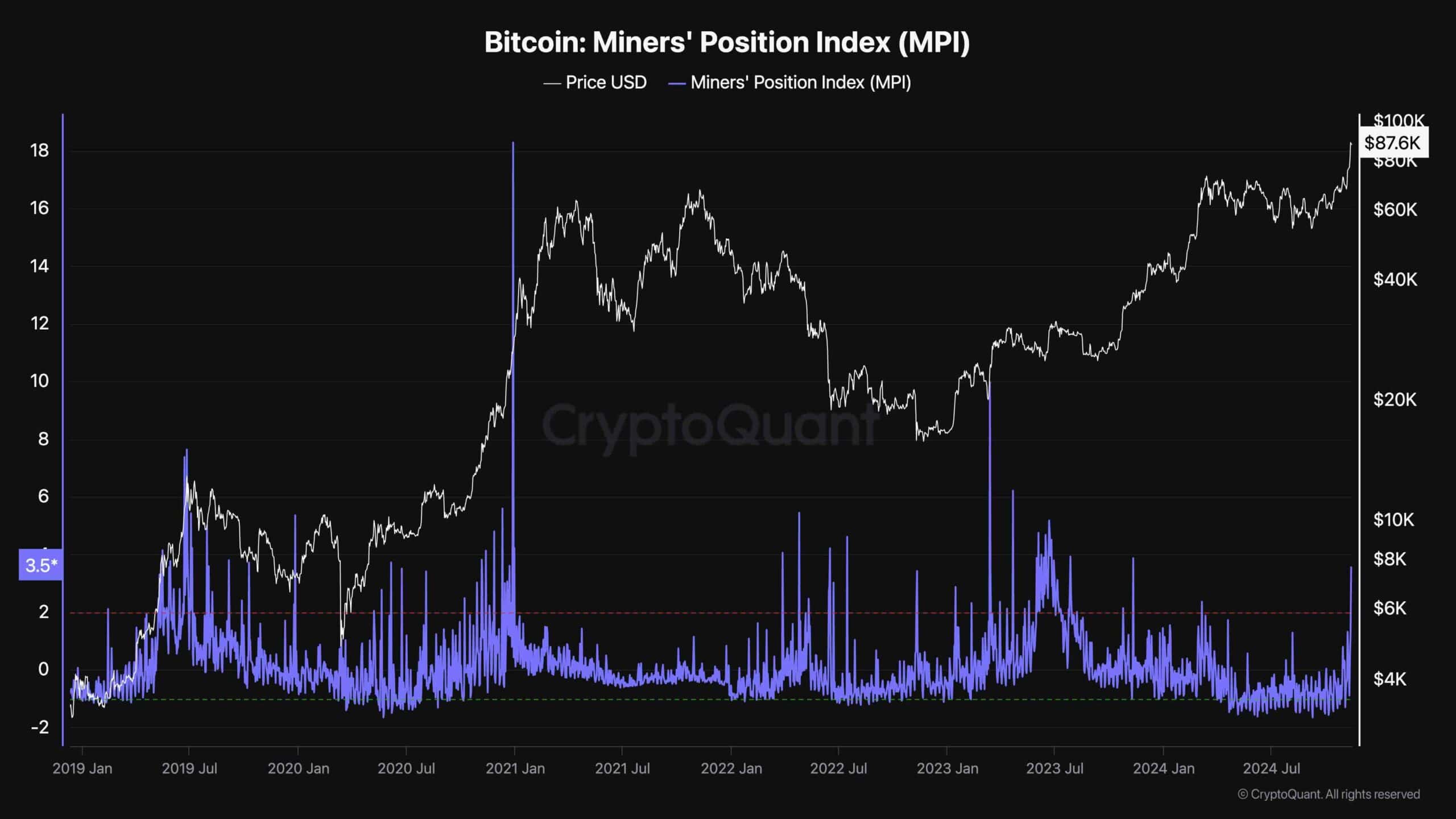

Bitcoin’s latest surge to a brand new all-time excessive of $90K has prompted many market individuals to take income, with miners notably contributing to the promoting strain.

The Miners Place Index (MPI), which gauges miners’ promoting strain, has surged previous the important degree of two, marking a yearly excessive. Values above two sometimes sign intensified promoting strain from miners. This spike means that miners are offloading a considerable portion of their holdings, more likely to cowl operational prices given Bitcoin’s elevated worth ranges.

Since miners maintain a substantial share of Bitcoin’s provide, their elevated promoting can intensify total promoting strain, particularly if it coincides with a discount in demand. Nonetheless, within the present context, the place market individuals have already been profit-taking at ATH ranges, there’s an elevated threat of worth corrections. With out ample buy-side assist within the quick time period, the market could expertise a deeper retracement because the promoting continues.