Bitcoin’s worth has been consolidating in a decent vary, giving no indication about whether or not it’s going to recuperate or expertise a deeper correction. Determining whether or not there’s an accumulation or a distribution occurring can be key to figuring out the longer term route of the market.

Technical Evaluation

By Edris Derakhshi (TradingRage)

The Day by day Chart

On the every day chart, the worth has been transferring sideways since breaking beneath the $100K stage, whereas additionally being supported by the $92K stage.

Whereas the RSI has been displaying values beneath 50%, which signifies the momentum is bearish, the market nonetheless stays above the 200-day transferring common, which is presently positioned at across the $80K mark. But, there’s nonetheless the potential of a deeper drop towards the $80K zone earlier than a bullish continuation might be anticipated.

The 4-Hour Chart

Wanting on the 4-hour chart, it’s evident that the worth has been making a symmetrical triangle sample, which is but to be damaged to both facet.

Presently, the market is prone to check the decrease boundary of the sample as soon as once more, because it has just lately been rejected from the upper one, and the RSI has additionally dropped beneath 50%, which additional strengthens the chance of a bearish transfer within the short-term. If the triangle is damaged down, a decline towards the $92K space can be imminent.

On-Chain Evaluation

By Edris Derakhshi (TradingRage)

Change Reserve

The BTC worth motion has been fairly uneven and has failed to start a definitive transfer in both route. Subsequently, analyzing the buildup and distribution conduct of market members might be very useful.

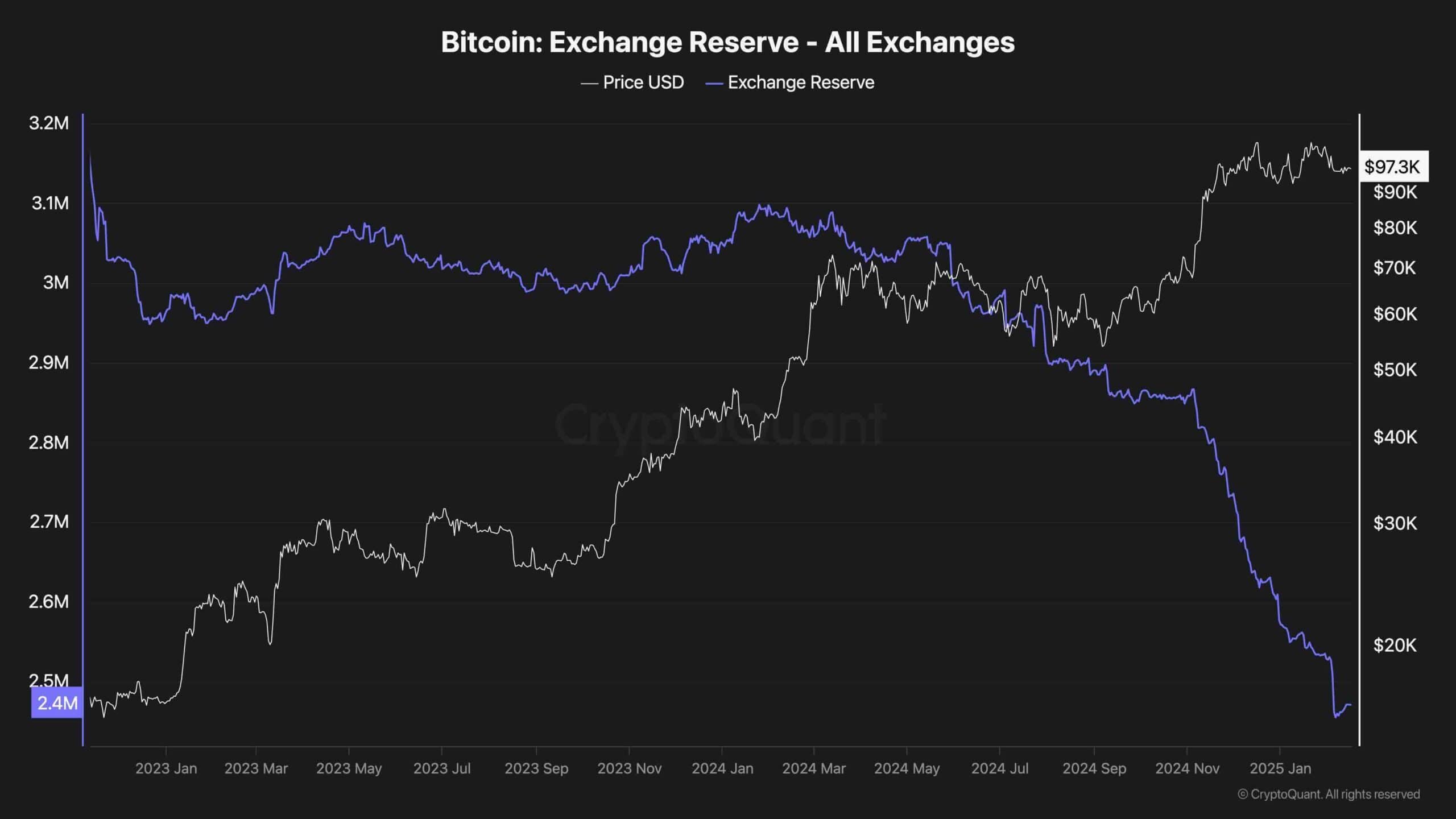

This chart presents the BTC trade reserve metric, which measures the quantity of Bitcoin held in trade wallets. It’s normally seen as a proxy for provide, as these cash will be offered rapidly and add to the promoting stress.

Because the chart suggests, the trade reserve has dropped quickly over the previous few weeks. Nevertheless, in current days, there was a slight improve, which could point out market members’ uncertainty and lack of conviction a few worth rally within the short-term. Consequently, if this improve continues, the worth will probably drop decrease within the upcoming days.