Regardless of the Bitcoin worth correction cracking beneath $56,000, the potential curiosity minimize in September might spark a renewed restoration development.

As Bitcoin’s downtrend continues, the broader market uncertainties develop intense. With an absence of bullish momentum associated to elevated outflow from U.S.-Based mostly Bitcoin spot ETFs, the bulls anticipate the upcoming Fed minimize as the following uptrend catalyst.

Bitcoin Coils Up Momentum Below Strain

The Bitcoin worth is at the moment buying and selling at $55,499, with a 24-hour drop of two.5% and a decline of 6.2% over the previous seven days. Within the each day chart, the BTC worth has dropped beneath the essential help of $57,500, suggesting the market dynamics are in bearish gear.

With an enormous 3.10% drop yesterday, a bearish engulfing candle is seen within the each day chart. This marks the primary closing beneath the $57,000 mark in nearly a month.

The intraday candle reveals a 1.3% drop from its opening worth of $56,179, as BTC now trades at round $55K. The bearish affect is clearly seen with the 50-day and 200-day EMA prepared for a demise cross occasion.

As well as, nonetheless, the BTC day worth chart tasks a bullish flag sample sustained in the long run, contrasting the continued short-term correction part. The bullish flag sample maintains a counter-trend transfer in distinction to the momentary correction part of BTC.

If the sample holds, the BTC worth decline to $53,500, accounting for a 5.17% drop.

Curiosity Charges and Job Market Avenue

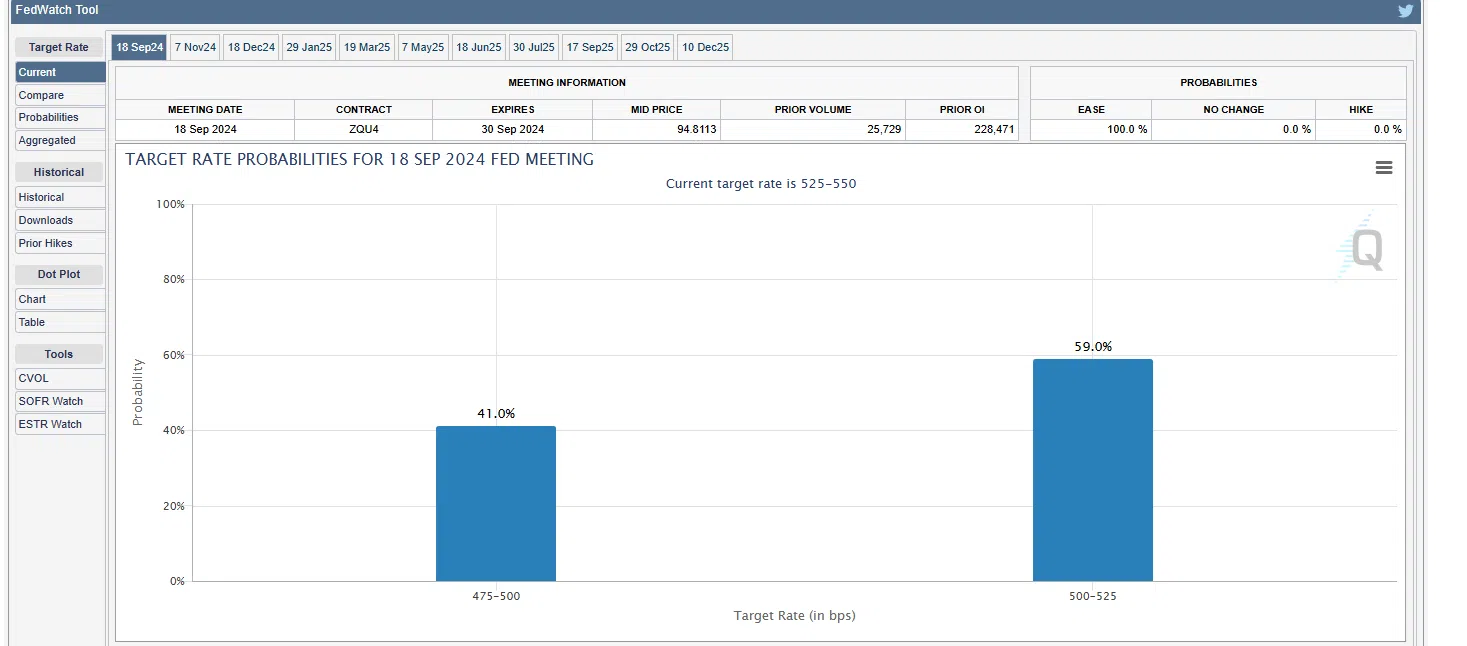

Amid the short-term bearishness and the elevated volatility, the backdrop bullish catalyst of a possible fee minimize stays hope for BTC consumers. In accordance with the Chicago Mercantile Alternate FedWatchTool, the chance of a 50-basis level fee minimize in September has risen by 41%.

FED Watch Software

With the lowered rates of interest, the elevated risk of a cash stream out there might enhance the costs of dangerous belongings like Bitcoin and different cryptocurrencies.

Nevertheless, the yet-to-come unemployment knowledge, which is able to replicate the general well being of the labor market, will play a serious function in figuring out the potential for a fee minimize.

A current tweet from Peter Berezin, Director of Analysis at BCA Analysis, attracts consideration to a regarding development within the US job market. In accordance with knowledge from Certainly, new job postings have declined considerably, diverging from the comparatively steady development in complete job openings.

Berezin highlights the implications of this decline, noting that the job openings fee has fallen to 4.55%, simply above the 4.5% threshold talked about by Fed Governor Christopher Waller. This downward development in job openings is predicted to negatively impression labor demand, finally resulting in slower financial development as fewer firms create new positions.

The place is Bitcoin Headed?

Notably, the higher-than-expected unemployment knowledge might immediate the Federal Reserve to implement a 50-basis level fee minimize if the present scenario persists. On this situation, a weakening labor market, as mirrored by declining job numbers, would possibly sign that the economic system wants a lift, triggering this rate-cut occasion.

Then again, lower-than-expected unemployment knowledge would point out a powerful labor market and will lead to a extra modest 25-basis level fee minimize. In both case, the Bitcoin worth is predicted to rebound from its essential help ranges of $50,000 or $53,500.

Within the worst-case situation, if the speed cuts are delayed, the continued correction might probably result in worry, uncertainty, and doubt (FUD) out there, inflicting the worth to fall beneath the $50,000 psychological mark and probably hit the $45,000 stage.