Cryptocurrency costs are doing properly this yr, with most of them outperforming conventional belongings just like the S&P 500, Nasdaq 100, and the Dow Jones. These indices have all jumped by over 15%, whereas Bitcoin has risen by virtually 60%, and is hovering close to its all-time excessive.

MEW and Popcat tokens are hovering

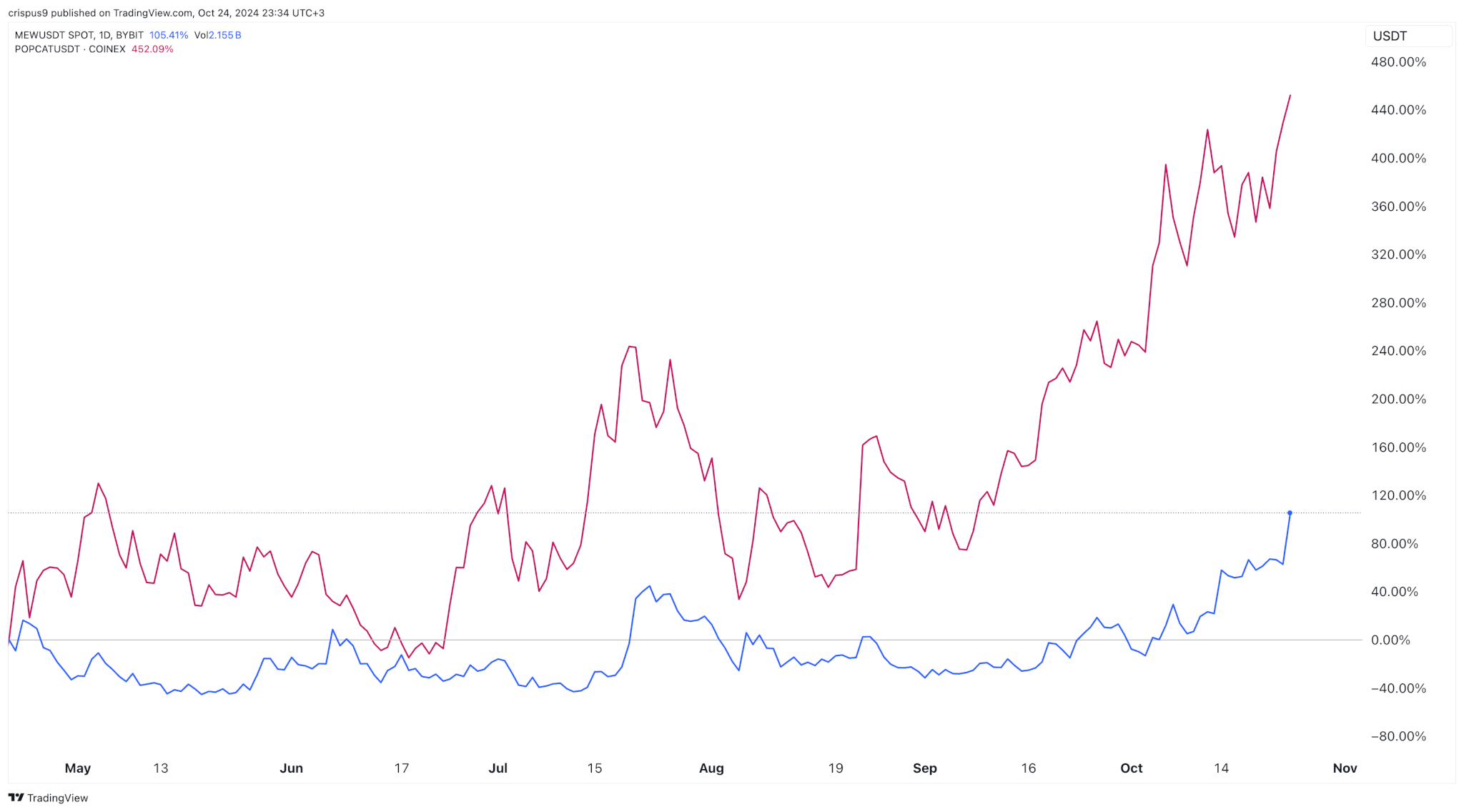

Cat in a canine world (MEW) and Popcat (POPCAT) have soared by over 1,000% this yr, giving them a market cap of over $1 billion. Analysts imagine that these tokens have extra upside within the coming months due to their deep liquidity, concern of lacking out (FOMO), and their substantial volumes within the spot and futures market.

MEW and Popcat even have constructive technicals, with the 2 of them rising above their short-term and medium-term shifting averages. On high of this, there are indicators that Bitcoin could also be about to have a bullish breakout, which may see it soar to a file excessive.

It has remained beneath the important thing resistance stage at $70,000 this week, that means that it solely wants one catalyst to have this breakout. Many specialists imagine that this rally is feasible. For instance, analysts at Bernstein have predicted that it’ll rise above $200,000 in 2025. John Paulson, a billionaire investor, has additionally expressed optimism in Bitcoin.

A powerful Bitcoin breakout could be a constructive factor for meme cash like Cat in a canine world and Popcat. Traditionally, as we noticed earlier this yr, meme cash do higher than Bitcoin when it makes a bullish breakout.

Vantard would be the subsequent huge factor

Crypto analysts and buyers at the moment are betting on Vantard, an upcoming meme coin impressed by the success of Vanguard, the second-biggest asset supervisor on the earth with over $7 trillion in belongings below administration.

Vantard began its pre-sale occasion this week and has raised $163,000 from world buyers in its first stage. The preliminary value was $0.00010, and can improve throughout the ten phases, with the subsequent value being $0.00011, a ten% improve.

In line with its white paper, 75% of the devoted treasury funds might be allotted to fundraising. 5 billion tokens went to the pre-seed spherical, whereas the continued seed fund could have a restrict of 40 billion tokens, equal to 55.56% of the entire. The opposite 40 billion tokens will go to sequence A and sequence B.

Vantard’s key to success is what it calls the first-ever Meme Index Fund (MIF), which goals to present buyers entry to the best-performing meme cash in a single asset.

The fund might be totally decentralized, with its earnings being distributed to holders by means of the $VTARD token. This fund is impressed by common Vanguard exchange-traded funds (ETF) just like the one monitoring the S&P 500 index, which has added over $60 billion in belongings this yr.

Vatard’s MIF fund can even have a surge pricing mannequin, the place buyers pays a 0% payment in periods of low exercise and as much as 50% throughout high-peak demand durations. The aim of this payment is to discourage mass redemptions.

The opposite high profit is that it’ll give buyers entry to one of the best meme cash within the business. As such, as an alternative of shopping for tens tokens hoping to catch the subsequent huge factor, an investor within the fund could have entry to one of the best of them. You may study extra about Vantard right here.