As bitcoin (BTC) surpassed $100,000 and hit an all-time excessive on December 4, many MicroStrategy (MSTR) traders have been hoping for his or her baggage to levitate. Sadly, their shares — together with these of the corporate’s CEO Michael Saylor — dipped significantly the next morning.

MicroStrategy is a BTC acquisition firm that’s primarily valued on a a number of of its BTC holdings. Its shares commerce independently of BTC out there primarily based on sentiment, provide, and demand. MSTR closed at $406 on Wednesday however fell one other 4.8% by Thursday.

That shut logged an embarrassing 28% retracement from the corporate’s $543 all-time excessive on the identical day that BTC achieved its personal peak.

Granted, that decline roughly matched BTC’s decline over the identical interval. Nevertheless, value monitoring doesn’t reassure traders who hope for MSTR’s outperformance.

MicroStrategy is meant to, within the minds of many traders who knowingly purchased its shares at a premium a number of on its property, by some means enhance that a number of for long-term traders.

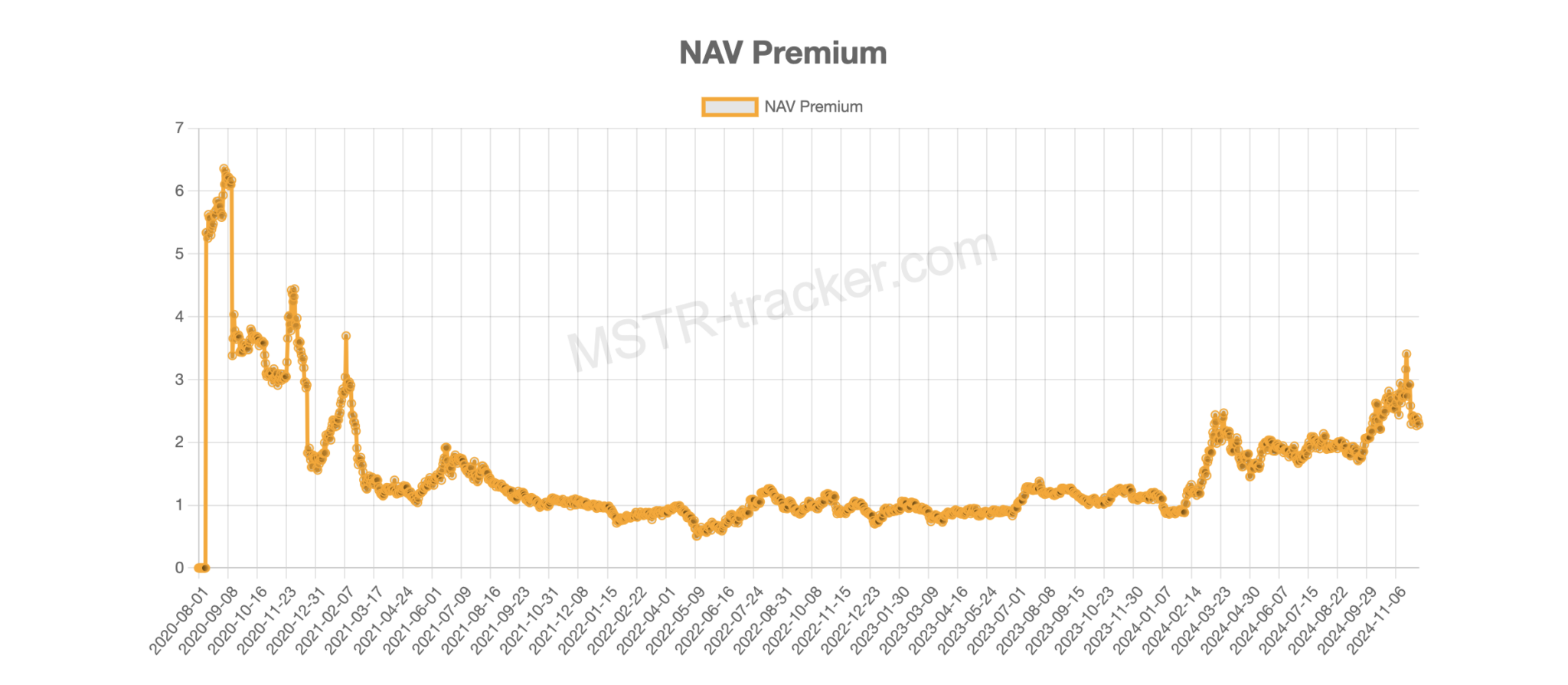

At present valued at 2.3X its BTC holdings, MSTR traded at 3.4X as not too long ago as November 20. Bullish traders hope to see that quantity attain high-single if not double digits.

MSTR closed at $406 on Wednesday however fell practically 5% the following day. Picture courtesy of MSTR-tracker.com

How a lot is bitcoin ‘yield’ value?

Regardless of MicroStrategy’s disappointing Thursday, the corporate and its CEO positively have their followers. Many stay obsessed with what Saylor refers to as “bitcoin yield,” which appears to work otherwise to the monetary business’s definition of yield.

BTC, in fact, doesn’t supply native yield, emissions, earnings, or dividends. MicroStrategy claims to reap yield, nevertheless, from bond markets and arbitrage methods to the good thing about its shareholders.

Anyway, excluding sure future obligations, Saylor boasted yesterday that he accreted 63.3% extra BTC per assumed diluted share excellent of MSTR for the reason that begin of 2024. Sadly, that factoid didn’t stop a pre-market flash crash from $443 to $379, nor did it stop shares from ending Thursday’s session 4.8% decrease than the prior day’s shut.

Learn extra: Bitcoin has hit $100,000 and is the world’s seventh largest asset

Some bullish merchants title their Saylor fan golf equipment with degenerate self-awareness and resort to hyperbole. One fan refers to MicroStrategy as “the brand new Federal Reserve.” Many reward Saylor’s indiscriminate hoovering up of BTC at any value with obscure, future hopes of financializing its trove by way of “bitcoin financial institution” providers — no matter meaning.

MicroStrategy’s dependence on BTC has brought on it issues earlier than. In 2022, Michael Saylor resigned as CEO. A serious motive for the resignation? A quarterly report containing $917 million in BTC impairment losses.

Since then, nevertheless, and as a mere non-executive chairman, Saylor has turned that funding round and develop into the best-performing large-cap inventory on US markets. MSTR is up over 500% this 12 months and now ranks among the many high 50 corporations within the Nasdaq-100 (QQQ) index.

In complete, it has earned a formidable 68% return on all of its BTC purchases thus far.

In reality, the NASDAQ 100 committee is contemplating rebalancing its index so as to add MicroStrategy as a constituent. Information of that call will arrive by December 13.