TABLE OF CONTENTS

- Why Folks Purchase NFTs

- What You Get When You Purchase an NFT

- Misconceptions About NFT Possession

- How NFT Worth Is Decided

- Potential Advantages Of Proudly owning NFTs

- Dangers And Challenges Of Proudly owning NFTs

- Backside Line

- Ceaselessly Requested Questions (FAQs)

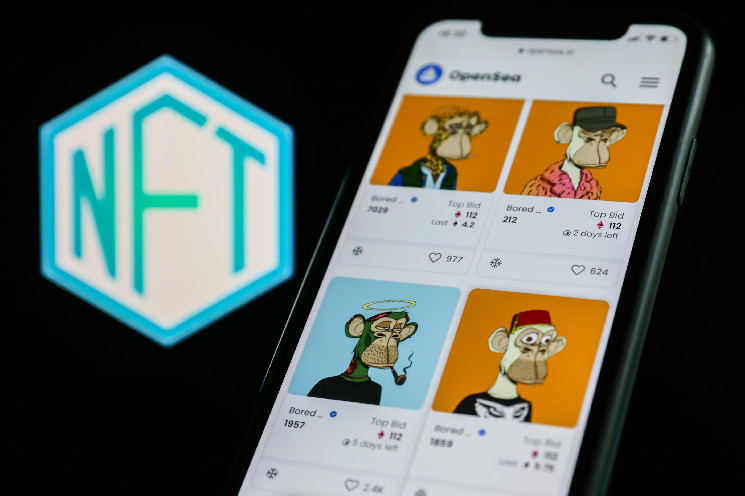

NFT purchases elevate questions on what patrons really purchase. This text examines the realities of NFT possession, together with rights, digital asset elements and blockchain implications.

I will tackle misconceptions, discover elements affecting NFT worth, and focus on potential advantages and dangers. Our aim is to offer a transparent understanding of NFTs, serving to readers make knowledgeable choices on this digital asset market.

Why Folks Purchase NFTs

NFT patrons chase digital uniqueness and verifiable possession. Buyers search revenue from reselling uncommon tokens, whereas collectors worth the exclusivity of limited-edition digital artwork. Some buy NFTs to assist favourite creators straight, bypassing conventional intermediaries.

Digital identification expression drives many acquisitions, with patrons utilizing NFTs as profile photos or digital vogue gadgets in on-line areas. Tech fanatics are drawn to blockchain’s potential for revolutionizing digital possession and creator royalties. The attract of collaborating in rising applied sciences and doubtlessly transformative developments additionally fuels purchases.

Neighborhood engagement performs a big position, with NFTs granting entry to unique teams, occasions or perks. Some patrons are attracted by the gamification elements, similar to tokens that evolve over time or present in-game advantages. Market dynamics, together with hypothesis and shortage, additional drive curiosity on this novel asset class.

What You Get When You Purchase an NFT

Buying an NFT entails buying a digital token on a blockchain, representing a declare to a selected digital merchandise. This transaction contains a number of elements, every with its personal implications and limitations.

Possession Of A Distinctive Digital Asset

NFT possession grants a blockchain-recorded declare to a digital merchandise. This file permits for promoting, buying and selling or transferring the token. Nonetheless, “possession” within the NFT context differs from conventional property rights.

NFT possession would not routinely confer copyright or mental property rights to the underlying work. The client usually receives restricted utilization rights, whereas the creator retains copyright. Some NFTs provide extra in depth rights, however this varies case by case.

The digital asset linked to the NFT usually is not saved on the blockchain attributable to dimension constraints. As a substitute, the token accommodates a hyperlink to the asset saved elsewhere, elevating questions on long-term accessibility.

Proof Of Authenticity And Shortage

NFTs present a blockchain-based file of an asset’s origin and transaction historical past. This may also help confirm authenticity, but it surely would not forestall the creation of an identical or extremely comparable NFTs by the identical or totally different creators.

Shortage in NFTs is artificially created by limiting the variety of tokens minted for a selected asset. Whereas this will affect perceived worth, it would not assure monetary appreciation or liquidity.

Metadata And Sensible Contracts

NFT metadata contains details about the asset and any related rights or advantages. This information is essential for outlining what the NFT represents, however its integrity depends upon the reliability of off-chain storage methods.

Sensible contracts automate sure elements of NFT possession and transactions. They will allow options like royalty distributions or entry controls. Nonetheless, the effectiveness of those contracts depends upon market assist and could be circumvented by off-platform gross sales.

Potential Royalties For Creators

Some NFTs embrace provisions for creator royalties on secondary gross sales. This technique goals to offer ongoing compensation to artists, but it surely has limitations.

Royalty enforcement depends on gross sales occurring on platforms that honor sensible contract phrases. Not all marketplaces assist automated royalty funds, and off-platform or non-public gross sales can bypass these mechanisms solely.

The long-term viability of NFT royalties stays unsure, with ongoing debates about their enforceability and affect on market dynamics.

Misconceptions About NFT Possession

NFT possession usually comes with misconceptions. Many patrons assume they’re buying full rights to the underlying asset or assured monetary returns. Understanding the restrictions and realities of NFT possession is crucial for knowledgeable participation on this market.

You Do not Personal Copyrights Or Mental Property Rights

Buying an NFT usually would not switch copyright or mental property rights to the client. These rights often stay with the unique creator or copyright holder. NFT possession usually grants restricted utilization rights, similar to displaying the related paintings for private use.

Exceptions exist the place creators explicitly switch extra in depth rights with the NFT sale. Nonetheless, such circumstances are uncommon and require cautious examination of the sale phrases. Consumers mustn’t assume they will freely reproduce, distribute or create spinoff works from their NFT with out permission.

What You Can And Can’t Do With Your NFT

NFT homeowners can usually show their token’s related content material for private, non-commercial use. They will additionally promote or switch the NFT itself. Nonetheless, industrial exploitation, public show or creating spinoff works usually require express permission from the copyright holder.

House owners can not declare broader rights than these specified within the NFT’s phrases. Utilizing the NFT’s content material in ways in which violate copyright legal guidelines or the creator’s rights can result in authorized penalties. Some NFTs embrace further privileges like entry to unique content material or occasions, however these differ extensively and usually are not inherent to all NFTs.

The Distinction Between Proudly owning An NFT And Proudly owning The Underlying Asset

Proudly owning an NFT is basically totally different from proudly owning the underlying digital asset. An NFT represents a token of possession recorded on a blockchain, whereas the digital asset itself (e.g., a picture or video) usually exists individually, usually on centralized servers.

NFT possession would not assure perpetual entry to the underlying asset. If the server internet hosting the asset goes offline or the hyperlink within the NFT’s metadata breaks, the proprietor might lose entry to the content material. This contrasts with proudly owning a bodily asset or having full copyright possession, the place possession and management are extra direct and complete.

How NFT Worth Is Decided

NFT values fluctuate primarily based on varied elements, primarily pushed by market demand. Creator repute considerably impacts costs, with established artists or manufacturers usually commanding larger values. Shortage performs a vital position, as restricted version or one-of-one NFTs usually fetch larger costs than these with bigger provide. Historic significance, similar to being the primary NFT in a selected class, may enhance worth.

Utility options embedded in NFTs affect their value. These might embrace entry to unique content material, real-world experiences or in-game advantages. The perceived future potential of the NFT mission or related platform can drive speculative worth. Market developments and general cryptocurrency sentiment usually have an effect on NFT costs, inflicting volatility.

Aesthetics and cultural relevance contribute to an NFT’s attraction and worth. Viral memes, culturally important moments, or visually putting paintings can command premium costs. Provenance and transaction historical past might enhance worth, particularly for NFTs beforehand owned by celebrities or influential collectors. The repute and quantity of {the marketplace} the place the NFT is listed may affect its perceived worth and liquidity.

Potential Advantages Of Proudly owning NFTs

NFT possession affords varied potential benefits, starting from digital gathering to funding alternatives. These advantages stem from the distinctive properties of blockchain-based digital property and their rising ecosystem.

Digital Amassing And Standing Symbols

NFTs allow digital gathering, permitting fanatics to personal verifiably distinctive or limited-edition digital gadgets. This appeals to collectors who worth rarity and authenticity within the digital realm. Some NFTs, significantly from high-profile initiatives or artists, function standing symbols in on-line communities.

NFT collections could be showcased in digital galleries or social media profiles, offering a brand new type of digital self-expression. The power to show possession of uncommon or useful digital property has created a brand new dimension of on-line status and identification.

Entry To Unique Content material And Communities

Many NFTs provide holders entry to unique content material, occasions or on-line communities. This may embrace non-public Discord channels, digital meetups or real-world experiences. Some initiatives use NFTs as membership tokens, granting holders voting rights in decentralized autonomous organizations.

These neighborhood elements can present networking alternatives, insider data or collaborative areas for NFT holders. Unique content material may embrace behind-the-scenes materials, early entry to new releases or interactive experiences with creators.

Funding Potential And Resale Alternatives

Some NFT patrons view their purchases as investments, hoping for appreciation in worth over time. Profitable flips of high-profile NFTs have garnered media consideration, fueling curiosity in NFTs as speculative property. Nonetheless, the NFT market is very unstable and unpredictable.

The power to simply commerce NFTs on varied marketplaces supplies liquidity and resale alternatives. Some NFT initiatives provide ongoing advantages or royalties to holders, doubtlessly creating passive revenue streams. But, traders ought to pay attention to the excessive dangers and the potential for important losses on this nascent and infrequently speculative market.

Dangers And Challenges Of Proudly owning NFTs

NFT possession comes with a number of dangers and challenges. These vary from monetary volatility to authorized uncertainties, environmental considerations and safety points. Understanding these potential drawbacks is essential for anybody contemplating coming into the NFT market.

Volatility And Market Fluctuations

NFT costs can expertise excessive volatility, with fast and unpredictable worth modifications. This volatility stems from elements like market hypothesis, altering developments and the general cryptocurrency market sentiment. Excessive-profile gross sales can create momentary value bubbles, resulting in important losses for late patrons.

The dearth of established valuation strategies for NFTs contributes to cost instability. Many NFTs lose worth rapidly after preliminary hype subsides, doubtlessly leaving homeowners with property value far lower than their buy value. This volatility makes NFTs a high-risk funding, unsuitable for these searching for steady returns.

Authorized And Regulatory Uncertainties

The authorized panorama surrounding NFTs stays unclear in lots of jurisdictions. Copyright infringement points can come up when creators mint NFTs of content material they do not personal. Consumers might unknowingly buy NFTs with disputed possession, risking authorized issues.

Regulatory frameworks for NFTs are nonetheless growing, with potential future rules impacting possession rights, buying and selling and taxation. The classification of NFTs as securities in some circumstances might result in regulatory scrutiny. These uncertainties create dangers for each creators and patrons within the NFT house.

Environmental Impression Considerations

Many NFTs depend on energy-intensive blockchain networks, significantly Ethereum

Some initiatives are transferring in direction of extra energy-efficient blockchain options, however the environmental affect stays a big concern. As consciousness grows, NFTs linked to high-emission networks might face decreased demand or worth depreciation.

Safety Dangers And Digital Theft

NFT possession depends on safe administration of personal keys and digital wallets. Lack of entry to those may end up in everlasting lack of NFTs. Phishing assaults, malware and social engineering ways goal NFT homeowners, doubtlessly resulting in theft of useful property.

Sensible contract vulnerabilities can expose NFTs to hacks or exploits. Centralized storage of NFT metadata and linked digital content material presents dangers of information loss or manipulation. These safety challenges require NFT homeowners to keep up vigilant cybersecurity practices and perceive the technical elements of their digital property.

Backside Line

NFT possession affords distinctive alternatives in digital asset possession however comes with important dangers and limitations. Consumers purchase blockchain-recorded tokens representing digital gadgets, not essentially full rights to the underlying property. Understanding the distinctions between NFT possession, copyright and bodily asset possession is essential.

Whereas NFTs can present advantages like digital gathering, neighborhood entry and potential funding returns, in addition they current challenges. These embrace market volatility, authorized uncertainties, environmental considerations and safety dangers. Potential NFT patrons ought to fastidiously weigh these elements and conduct thorough analysis earlier than coming into this complicated and evolving market.