Regardless of widespread acknowledgment that MicroStrategy has issued an amazing quantity of debt to accumulate most of its bitcoin, some star-struck novices consider that billionaire CEO Michael Saylor has no liquidation danger on this debt.

Though the nuances of the time period ‘liquidation’ are vital, there are individuals who truthfully consider that MicroStrategy can not default on its debt irrespective of how low the value of bitcoin goes.

That isn’t true. There isn’t any free lunch on Wall Avenue.

Lenders to MicroStrategy do have a danger of default. Particularly, they’re loaning USD to MicroStrategy and anticipate USD or USD-equivalent compensation. Even lenders in latest sequence who waived all curiosity funds anticipate to obtain their principal again at maturity.

To be clear, no lenders have agreed to simply accept compensation in bitcoin, and no lenders have agreed to denominate their principal compensation in bitcoin. They lent USD and anticipate the USD, or its equal or further quantity of MSTR shares, upon mortgage maturity.

Debt conversion is only a fancy USD compensation

Sure, most of MicroStrategy’s debt is convertible debt. This sort of industrial paper permits lenders to simply accept compensation of their principal and unpaid curiosity by way of conversion of their mortgage into MSTR shares.

In different phrases, their convertible bond is embedded with a free name possibility.

Every sequence of MicroStrategy’s convertible bonds specifies a conversion ratio and timeline, specifying what number of shares of inventory the bondholder can obtain upon conversion inside a date and MSTR value vary.

That is similar to a name possibility. Calls, as their identify suggests, are securities that let the proprietor to name shares from the decision vendor at a specified value and predetermined date. That is advantageous if the value of the share rises above this strike by the predetermined date.

Simply as calls enable the proprietor to purchase shares at a predetermined value throughout a rally above this strike, so too does MSTR convertible debt enable a bondholder to transform a mortgage into shares. Because of this, it’s common information that convertible debt embeds a de facto name possibility.

Learn extra: The maths behind MicroStrategy’s bitcoin guess

Lenders pay and MicroStrategy should repay them

To recap, lenders pay MicroStrategy:

- Capital (the mortgage principal),

- The chance of default (the probability-weighted price of not getting their a refund), and

- The chance price of their capital (say, the common return of the S&P 500).

As compensation for this capital, MicroStrategy guarantees to repay lenders:

- Quarterly curiosity (relevant to most however not all of its debt sequence),

- Principal (at maturity), and

- Non-obligatory conversion into inventory (embedded name possibility).

As of press time, MicroStrategy has excellent commitments to repay lenders tens of billions of {dollars} at varied maturities starting from subsequent yr via 2032.

The agency can both repay the mortgage and curiosity in USD, or enable the bondholder to transform its USD worth into widespread shares. The implied conversion value of those loans into MSTR shares — i.e. their call-like strike costs — vary from $39.80 to $672.40 per share.

MicroStrategy’s future means to repay lenders

The overwhelming majority of the corporate’s excellent loans are backed by its belongings and creditworthiness. As a result of MicroStrategy has minimal enterprise operations in addition to holding bitcoin, these loans are largely backed by the corporate’s 386,700 bitcoin steadiness.

To be clear, MicroStrategy’s money owed are unsecured. In different phrases, lenders don’t possess bitcoin as collateral. They’ve merely accepted MicroStrategy’s promise of compensation.

Because of this, MicroStrategy doesn’t have a danger of liquidation within the sense of a lender forcing the corporate to promote bitcoin if bitcoin have been to crash beneath a sure value. No lender can drive MicroStrategy to liquidate bitcoin if it instantly crashes intraday.

Nonetheless, MicroStrategy does have the chance of bitcoin liquidation — not at a selected value set off, however as time progresses.

Learn extra: MicroStrategy bulls assume Michael Saylor can pump it to 10X its BTC

The calendar, not the value, might liquidate MicroStrategy’s bitcoin

Particularly, MicroStrategy should earn or promote sufficient bitcoin to make quarterly curiosity funds on its debt. Upon annual maturities via 2032, MicroStrategy should possess, increase, or promote sufficient USD to repay any non-converted loans due.

Once more, its loans mature beginning subsequent yr and almost yearly via 2032. Though most of those lenders are more likely to waive USD compensation and convert into MSTR shares, if the value of bitcoin declines and drags MSTR down with it, lenders have the best to demand USD compensation.

If bitcoin is down, MSTR declines, after which lenders demand USD compensation of their principal upon maturity of their mortgage, MicroStrategy can be in huge bother.

At that time, it should search additional financing, probably diluting shareholders or issuing higher-yield or different kinds of punitive debt. If bitcoin and MSTR decline too far, the corporate might go bankrupt in a worst-case situation.

Collectors are senior to widespread shareholders. They are going to be repaid first out of any chapter, earlier than any belongings can be distributed to anybody else.

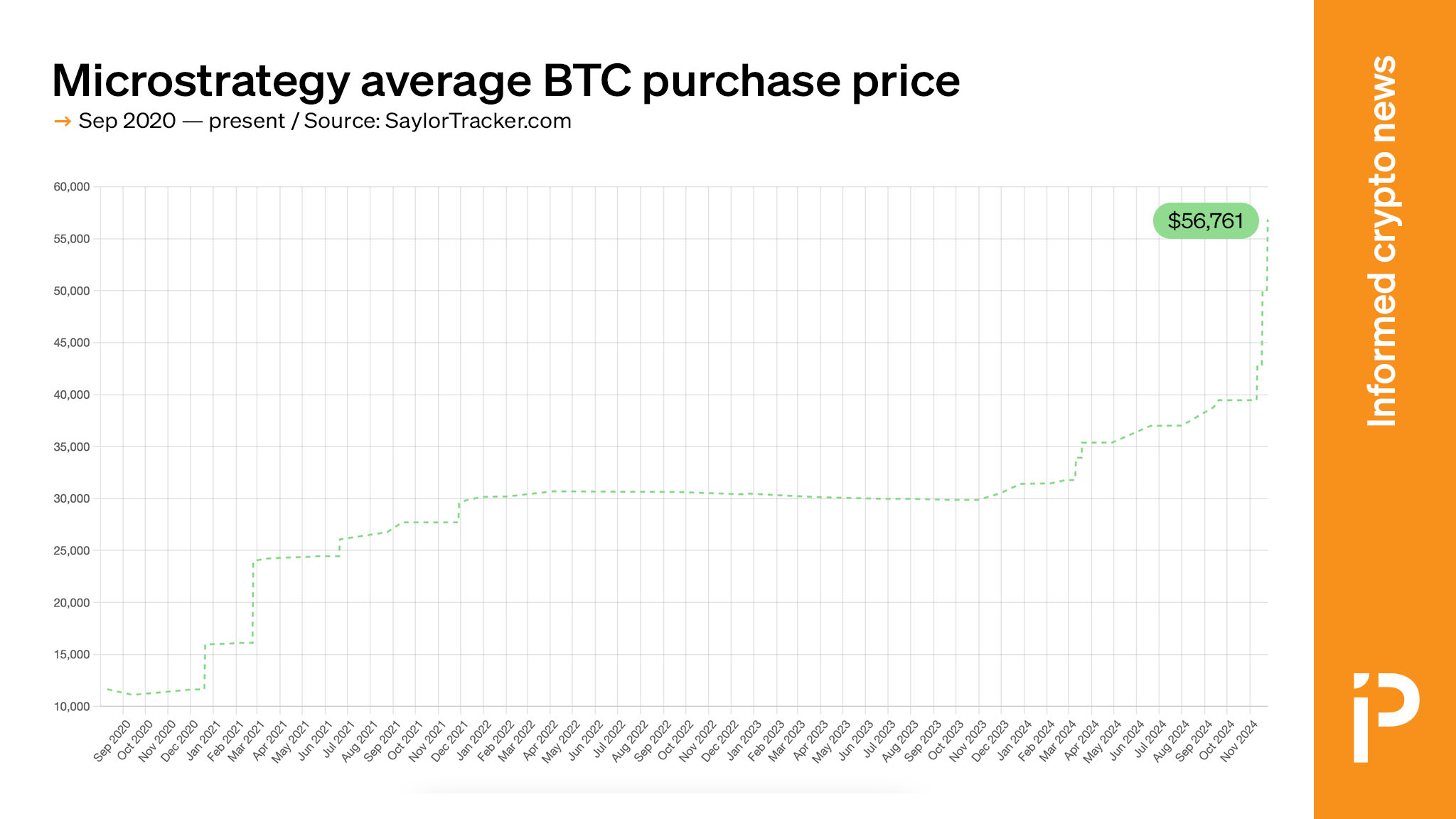

MicroStrategy’s common bitcoin buy value is at present round $56,761. If bitcoin drops beneath this value, MSTR will definitely commerce decrease and bondholders will develop into fearful.

Click on to enlarge.

Learn extra: Michael Saylor has misplaced voting management of MicroStrategy

A slight dip is manageable. Saylor might promote some shares, challenge extra debt, or liquidate a couple of bitcoin to service curiosity or principal funds of near-term maturities.

The worst case situation for Saylor, nonetheless, is a protracted bear market. If bitcoin stays beneath MicroStrategy’s price foundation for a few years, Saylor could have issue servicing his USD obligations to lenders. As years transpire, the calendar will encourage bitcoin liquidations to service his principal repayments.

Clearly, MicroStrategy buyers are bullish on bitcoin and downplay the chance of this bearish outlook. Betting on greater costs has actually paid off this yr. Whether or not it’s a technique that can proceed to carry out is unsure.