Welcome to the On the Margin Publication, dropped at you by Ben Strack, Casey Wagner and Felix Jauvin. Right here’s what you’ll discover in in the present day’s version:

- The most recent motion within the ether ETF saga after preliminary SEC approvals, and what must occur earlier than the merchandise hit your brokerage account

- A possible stand-off is brewing after Riot Platforms’ “hostile bid” to accumulate Bitfarms

- A glance forward at what Congress is as much as and whether or not or not the brand new crypto payments will truly make it to the President’s desk

$19,925,658,064

That’s the property below administration in BlackRock’s iShares Bitcoin Belief (IBIT) as of Thursday, in keeping with the fund large’s web site. That makes it the world’s largest bitcoin ETF — trumping the roughly $19.7 billion in Grayscale Bitcoin Belief (GBTC).

The rating change-up occurred mid-week, lower than 5 months after US spot bitcoin ETFs hit the market. Whole inflows for IBIT over that span are $16.5 billion. GBTC has hemorrhaged roughly $17.8 billion since changing to an ETF in January.

The IBIT AUM lead is one BlackRock could by no means relinquish, given its model, liquidity and aggressive charges.

The SEC isn’t messin’ round

All shouldn’t be quiet on the ether ETF entrance.

New filings counsel diligence by fund issuers and the SEC to get such merchandise buying and selling sooner somewhat than later — a welcome register a world usually marred by regulatory purple tape.

As you should know by now, the SEC on Might 23 accepted the 19b-4 proposals by the exchanges on which these ETH funds would record. However the path to launch shouldn’t be finished.

By noon Friday, fund issuers VanEck, BlackRock and Grayscale had turned in amended registration statements, or S-1s — the opposite paperwork in want of clearance earlier than the funds can hit the market.

Extra fund teams have been anticipated to submit amended functions shortly after.

A supply accustomed to the filings advised Blockworks that the SEC has given the issuers “casual steerage” that the company will supply feedback on their S-1 amendments by the tip of subsequent week.

We’ve come a great distance. Keep in mind, in the beginning of this 12 months, many crypto and finance trade watchers didn’t even know what 19b-4s and S-1s have been.

The SEC must clear each forms of proposals earlier than you see these funds present up in your brokerage platform of alternative. Except you’re a buyer of Vanguard, in fact, which blocks the buying and selling of crypto ETFs.

The anticipated fast feedback again from the SEC, per the supply, would again the premise that the SEC’s sign-off on the 19b-4 proposals was certainly on account of a political about-face.

It might imply the company desires these to launch and isn’t messing round. Identical to how 71 Democratic Home members stunned many by voting for the pro-crypto FIT21 Act final week. Maybe each are supposed to ship a message.

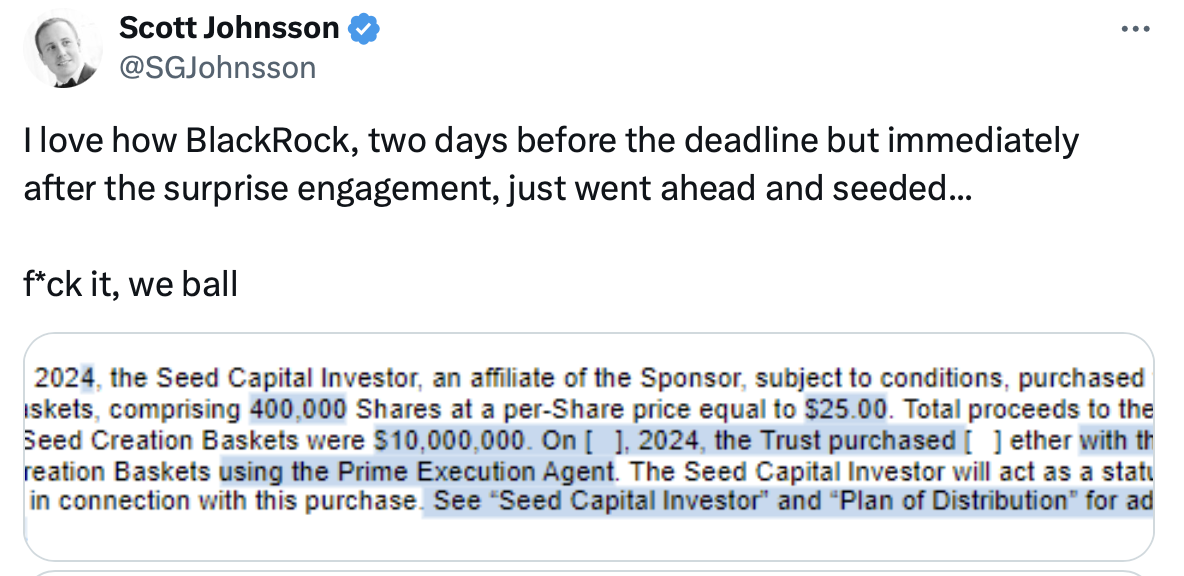

BlackRock revealed seed capital amounting to $10 million in its newest S-1. It named BMO Capital Markets, Jane Road Capital, Macquarie Capital and Virtu Americas as licensed individuals.

Van Buren Capital normal associate Scott Johnsson alluded to this flex by the world’s largest asset supervisor.

VanEck’s seed capital proceeds totaled $100,000, in keeping with its submitting. Grayscale didn’t supply such particulars in its registration amendments.

However these intricacies at this second should not as vital as the truth that issues are transferring alongside. In spite of everything, you already know what they are saying about stagnant water — dangerous micro organism like E. coli and Legionella can thrive in it.

You’ve by no means heard that? Nicely it’s a factor. That’s why individuals take pleasure in oceans and streams greater than swamps and marshes.

Bloomberg Intelligence analysts Eric Balchunas and James Seyffart have change into celebrities of kinds to a section of the crypto and finance inhabitants, notably on the platform previously referred to as Twitter.

Balchunas put out an off-the-cuff betting line on X of when spot ether ETFs might hit the market: “Finish of June launch a legit risk, [although] maintaining my [over/under] date as July 4th.”

Simply as some authorized and compliance groups possible spent a portion of Memorial Day weekend adjusting S-1 language, maybe extra barbecue-centric vacation gatherings can be ruined a bit over a month from now as last preparations are made.

— Ben Strack

Riot versus Bitfarms

Bitcoin mining large Riot Platforms desires to accumulate rival Bitfarms.

Bitfarms isn’t having it.

And whereas a particular committee is weighing buyout provides, the corporate mentioned it believes “continued execution in direction of this development plan maximizes shareholder worth.”

Sources have mentioned Bitfarms is more likely to drag out this course of, notably as the corporate has signaled it’s participating with different events.

“Clearly Riot tried to trump Bitfarms and different potential patrons with their buy of 10% of the corporate,” mentioned Tidal Monetary Group portfolio supervisor Dan Weiskopf. “The excellent news for BITF shareholders is that now individuals are on the desk along with a strategic options course of and it’s possible that Riot shouldn’t be alone.”

Upcoming proposals are more likely to be increased than the preliminary “hostile bid” of $2.30 per share, famous Architect Companions managing director Peter Stoneberg.

Bitfarms’ share value stood at $2.21 at 2 pm ET Friday — a roughly 11% improve from 5 days in the past. Riot inventory, at the moment, was down almost 4% over that span.

With Riot’s inventory value “on its again,” Weiskopf advised Blockworks, Riot CEO Jason Les “goes to have to indicate his playing cards very quickly.”

— Ben Strack

Congress has its plate full

The US Home was busy this month.

Lawmakers from each chambers return to the Capitol subsequent week after a quick recess. Don’t maintain your breath for any extra motion on laws, although.

Some trade members say a delay isn’t all unhealthy.

Representatives final week superior two payments: the Monetary Innovation and Know-how for the twenty first Century Act (FIT21) in a 279-136 vote and the CBDC Anti-Surveillance State Act in a 216-192 vote.

Each items of laws — full with a handful of amendments — handed with bipartisan assist, although far fewer Democrats jumped on board the anti-CBDC prepare. They now head to the Senate, the place they face harder odds.

However some trade members say now could be the time to pump the brakes. That getting a crypto invoice previous a full ground vote is victory sufficient, for now.

Some critics of FIT21 say the Act is simply too beneficiant in delegating energy to the SEC. Nonetheless, the probabilities that both of the 2 payments escapes the Senate with out new amendments are subsequent to none.

Rep. Wiley Nickel, D-N.C., one in all FIT21’s three Democratic co-sponsors, advised Blockworks he’s “optimistic” concerning the invoice’s probabilities within the Senate, and he’s been spending loads of time on the opposite facet of the Hill advocating for passage.

Even with 71 Democrats getting on board with FIT21 within the Home, these opposed are anticipated to foyer within the Senate simply as exhausting. Rep. Maxine Waters, D-Cali., who dubbed FIT21 the “Not Match for Goal Act,” mentioned final week the laws serves to decontrol the crypto trade.

Neither invoice has a date on which the Senate will vote on them. Given many lawmakers are busy engaged on their reelection campaigns, it could possibly be some time.

— Casey Wagner

Bulletin Board

- There was one other safety breach on the crypto entrance Friday. Japanese crypto trade operator DMM Bitcoin mentioned it suffered an “unauthorized leak” of greater than $300 million value of bitcoin.

- Coinbase continues to be preventing the SEC in courtroom. The trade on Friday submitted its closing transient within the Third Circuit difficult the SEC’s denial of Coinbase’s rulemaking petition.

- Keep tuned for this week’s On the Margin podcast roundup. Discover it Saturday morning on YouTube or wherever you get your podcasts.