At press time, with bitcoin floating comfortably above $76,000, the flagship cryptocurrency holds its floor because the ninth largest asset worldwide by market capitalization.

Bitcoin Overtakes Meta, Units Sights on Silver within the International Asset Race

On Fri., Nov. 8, 2024, bitcoin (BTC) formally takes its place because the ninth largest asset globally, overtaking Meta’s market cap—Meta, previously often called Fb, now holds round $1.48 trillion. At 12:30 p.m. Japanese Time that day, bitcoin trades at $76,349, giving it a stable $1.51 trillion market valuation.

In the meantime, the valuable steel silver ranks simply above, holding the eighth-largest market cap at $1.771 trillion, with every ounce of .999 wonderful silver valued at $31.47. Silver’s latest worth hike over the previous few months retains it forward of BTC. However what would bitcoin must dethrone silver?

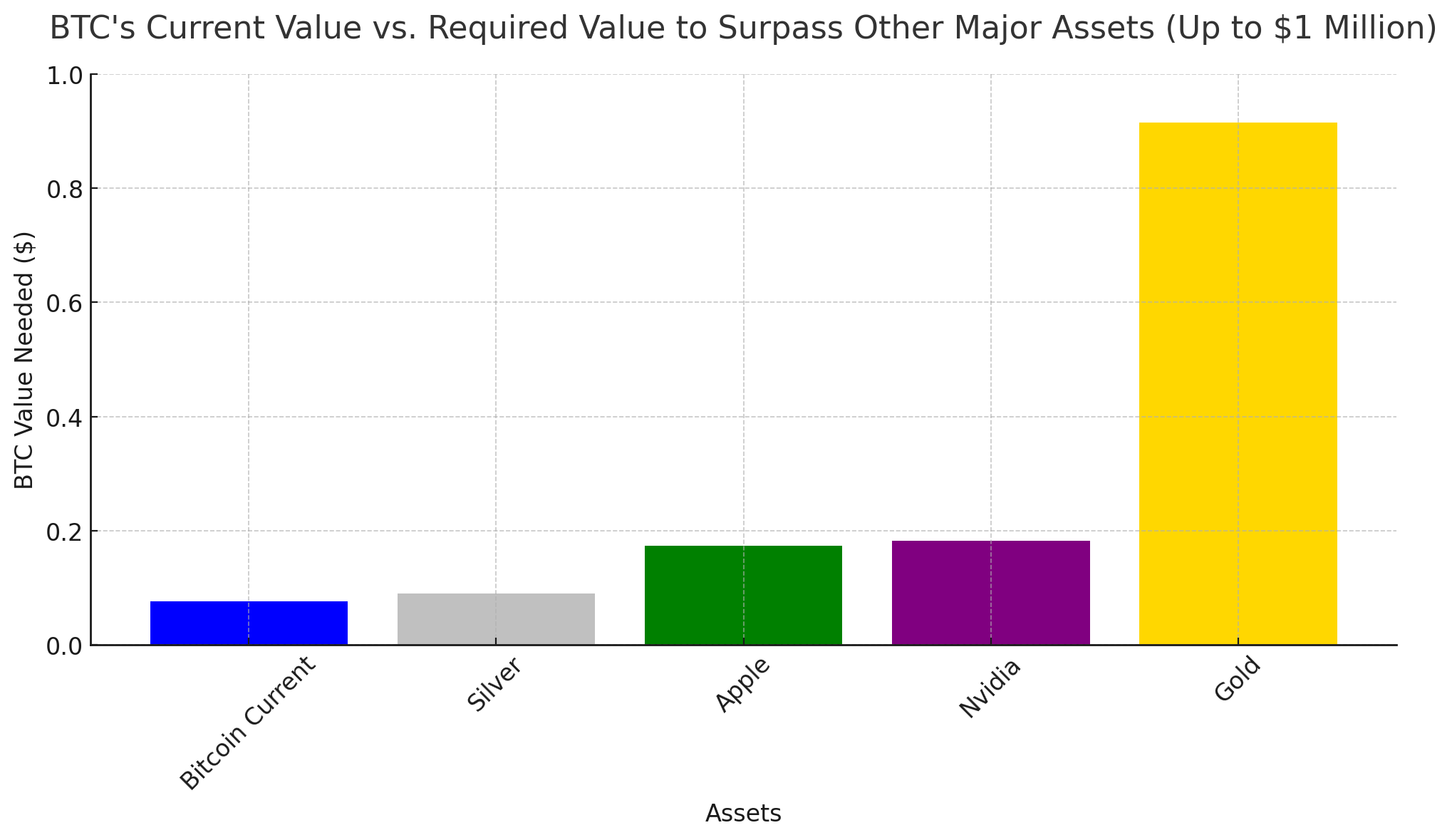

$89,581.70 per bitcoin—that’s the worth wanted for BTC to outshine silver’s market cap. Furthermore, the tech large Apple holds the place because the third largest asset globally, with a market cap of $3.429 trillion. For bitcoin (BTC) to overhaul Apple’s valuation, its value would wish to climb to round $173,444.60 per coin. Nevertheless, surpassing Nvidia, the second largest by market cap, would require a fair larger leap.

To edge out Nvidia’s $3.609 trillion valuation, BTC would wish to hit $182,549.87 per coin. However to topple the reigning large—gold, the protected haven asset—bitcoin has a monumental job forward. As of now, with gold priced at $2,694 per ounce, its market cap stands at an astonishing $18.087 trillion.

BTC would wish to strategy the million-dollar mark per coin, although not precisely, to say the crown. To surpass gold’s present market cap, bitcoin’s value must attain $914,850.58 per coin. Whereas some bitcoin advocates anticipate this might occur, gold champions like Peter Schiff firmly disagree. Regardless of the end result, because the ninth most precious asset globally, BTC has undeniably established itself as a formidable contender.