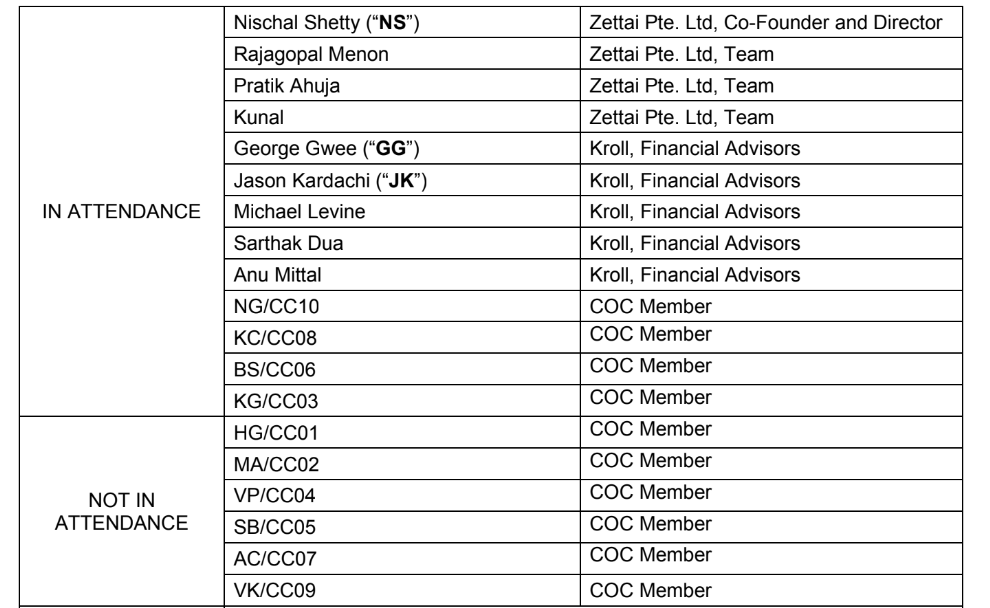

WazirX held its first creditor assembly on October 15 as a part of its restructuring efforts after the July hack. Solely 4 out of ten Committee of Creditor (COC) members attended, elevating issues about illustration.

Throughout the assembly, the corporate, alongside monetary advisors from Kroll, touched upon the restructuring course of and plans to deal with the asset shortfall and potential profit-sharing.

WazirX has famous the absence of 6 COC members

Crypto trade WazirX introduced that it had concluded its first creditor assembly on October 15. The assembly touched upon the restructuring course of after the July safety breach, however solely 4 collectors attended.

WazirX co-founder Nischal Shetty and the corporate’s high executives attended the assembly with the monetary advisors from Kroll. Whereas the names of the CoC members are confidential, all 10 collectors are assigned a CC quantity with initials. Six of the chosen CoC members have been lacking from the assembly which mentioned the following steps within the Court docket course of.

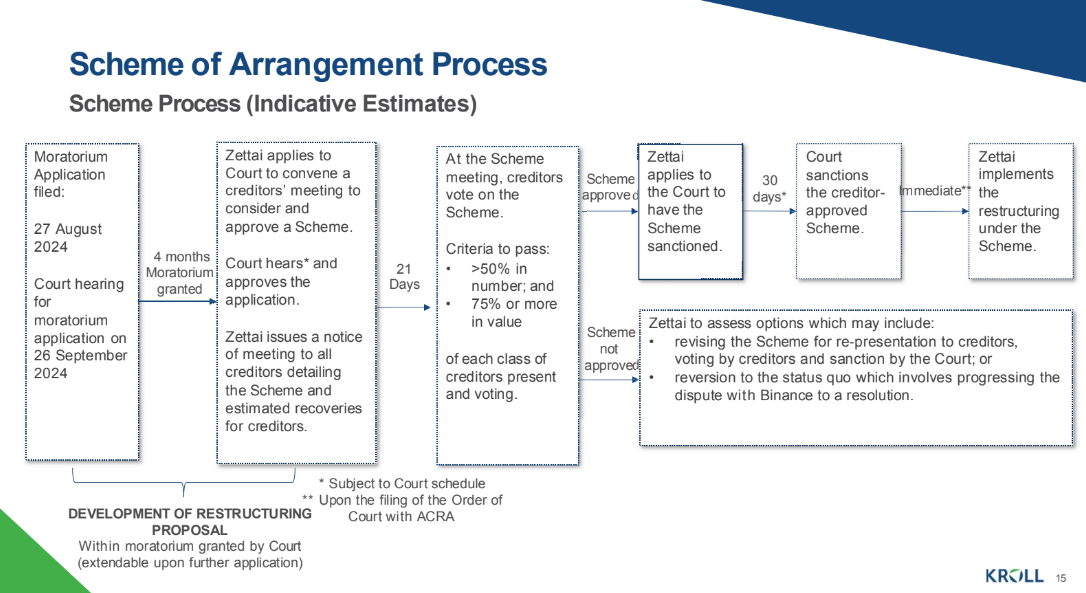

WazirX restructuring proposal

The corporate fashioned a committee of collectors (COC) to signify collectors’ pursuits as a part of the Singapore Court docket-sanctioned moratorium. 10 collectors have been randomly chosen as a part of the trade course of to change into a part of the committee. Whereas being a part of the CoC was based mostly on creditor discretion, as soon as chosen, the members wanted to attend the conferences.

The trade had beforehand mentioned that failure to stay an energetic member might result in elimination from the COC. The assembly concluded that the trade would observe up with the non-attending members and exchange them if they don’t plan to actively take part.

Zettai might enchantment to increase its 4-month moratorium

Regardless of the absence, the assembly addressed key issues from COC members about representing tens of millions of collectors and managing suggestions. Members appeared involved in regards to the duty that comes with the choice, dealing with questions, and the tight moratorium timeline. Some collectors urged dashing up the method, however the firm defined the constraints of courtroom schedules. As well as, the corporate plans to use for an extension of the moratorium interval earlier than its expiry.

Questions have been additionally raised about setting apart funds for emergencies, holding the trade partially operational, and the potential restoration from the asset deficit. At the moment, the trade has a forty five% asset deficit. The corporate additionally clarified that rebalancing is required earlier than withdrawals may be initiated.

In the meantime, Zettai’s restructuring proposal will tackle the asset shortfall by equitably distributing them to the collectors. The corporate notes in its monetary advisory that it’ll permit collectors to decide on the kind of tokens for distributions whereas they try to recuperate stolen tokens, pursue partnerships for profit-sharing alternatives, and probably reopen WazirX’s enterprise to generate earnings that may very well be shared with collectors.

WazirX COC members and executives in attendance

Moreover, Zettai is exploring the creation of a secondary debt market to supply early liquidity for collectors who want it. The following key dates to be careful for this yr can be in November when Zettai would search permission to carry a Scheme assembly. The collectors would evaluation and vote on the restructuring proposal on this assembly. However the Court docket would hear this software for approval in early 2025. The Scheme assembly is anticipated to convene in February.