Ethereum value quickly tumbled to a 25-day low of $3,428 on June 13, 2024, amid intense volatility within the wake of the US Fed price pause announcement; on-chain information traits recommend extra draw back forward.

Ethereum Worth Falls Under $3,500 First Time Since ETF Approvals

The crypto market has been in a consolidation part for the higher a part of the previous month. Throughout that interval, ETH managed to outperform the market common because of bullish tailwinds from the ETF approval from the US SEC in late Could.

Nevertheless, three weeks after the official approval verdict, the fund sponsors are nonetheless caught, making last changes to filings earlier than the official market itemizing of the Ethereum ETFs.

After one other week of little progress, with no tentative itemizing date in sight, buyers now appear to be rising impatient. This led to a serious value downswing on June 14, after the US Fed introduced a hawkish price pause, ending hopes of an H1 2024 reduce as many bullish analysts had anticipated.

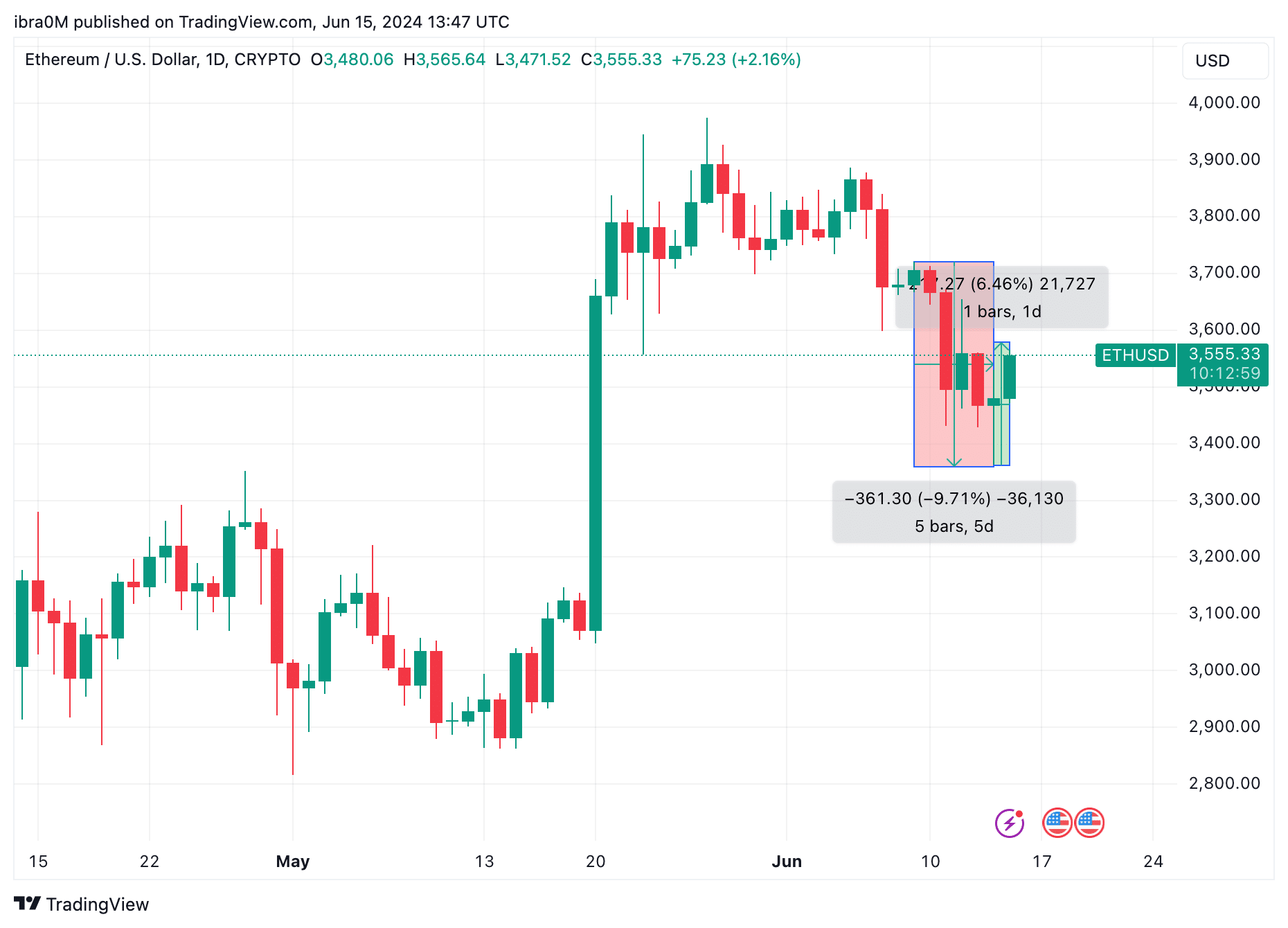

Ethereum Worth Motion ETHUSD | TradingView

As seen above ETH value fell 9.71% throughout the weekly timeframe, surrendering most of good points earned within the wake of the ETF approval. The chart reveals that as ETH tumbling in direction of $3,362 on June 14, earlier than rebound in direction of the $3,550 mark on the time of writing on Saturday June 15.

However notably, the final time ETH value traded under $3,400 was Could 21, earlier than the rally that greeted the de-facto ETH ETF approval information damaged by the Bloomberg Analysts. This reveals that the delays encompass the ETFs official launch has adversely impacted demand for Ethereum this week, elevating the chance of extra value draw back.

Promoting Strain from ETH Lengthy-term Holders Rises 10%

Evidently, the current Ethereum market demand is now in decline as bulls have grown fatigued amid the 3-week hiatus across the official ETH ETF launch.

Nevertheless, trying on the on-chain information, current exercise amongst current ETH holders reveals the market volatility is probably not over but.

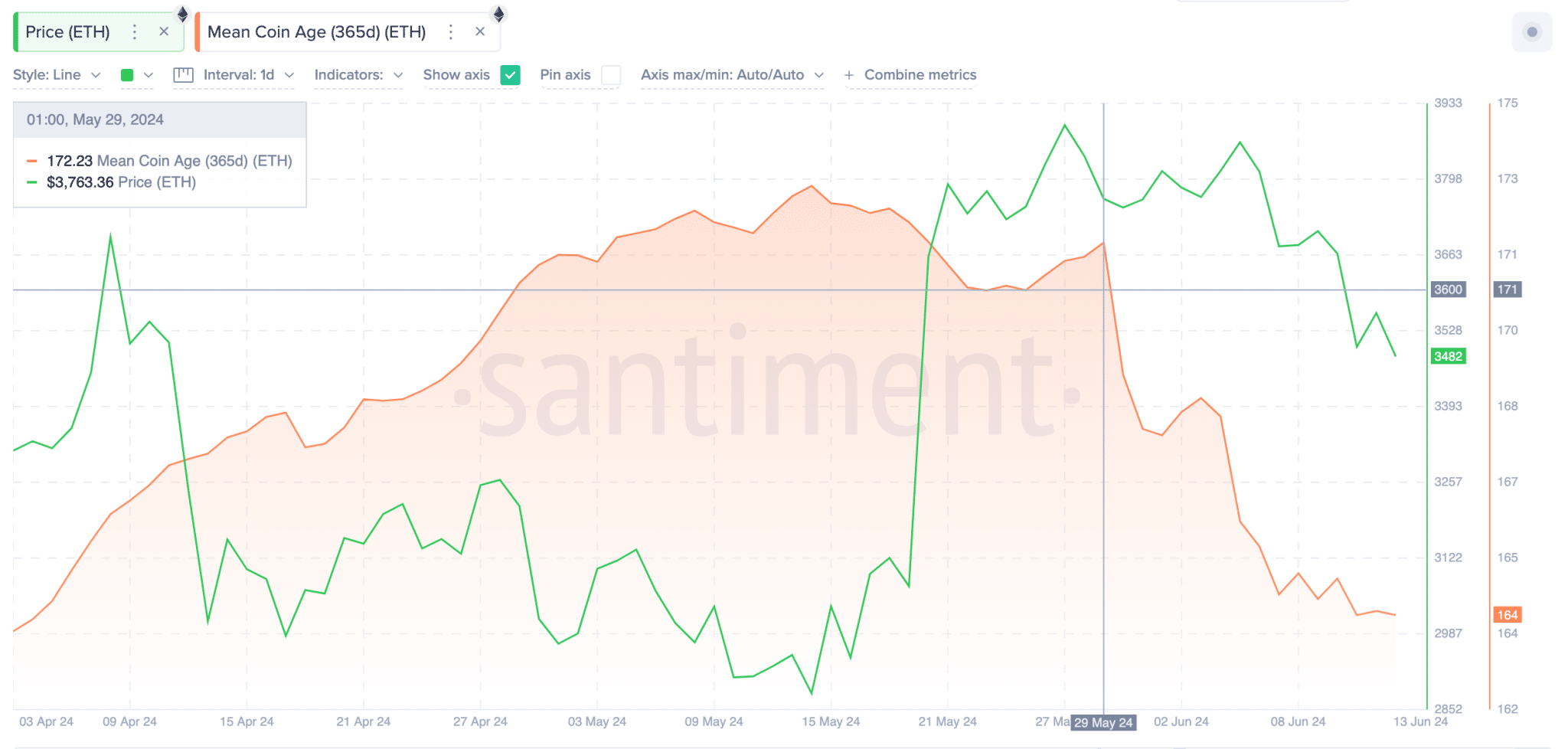

Santiment’s Imply Coin Age information tracks the typical quantity of days that each one ETH cash in circulation have spent of their present addresses. A decline in Imply Coin Age happens when a lot of long-term holders are actively promoting, and vice versa.

Ethereum Imply Coin Age vs ETH value | Santiment

The chart above illustrates how the ETH Imply Coin Age (365d) has been in a speedy decline since Could 29, because it grew to become evident that the Ethereum ETFs would take weeks to launch after the official SEC verdict on Could 24.

Between Could 29 and the time of publication on June 15, Ethereum’s imply coin age has declined 10% from 172.23 to 164 common days held.

Such a big decline inside a brief interval reveals a rising promoting pattern amongst long-term Ethereum buyers who had beforehand held their cash unmoved for one yr or extra. This implies that they’ve been promoting their cash behind the scenes, capitalizing on the value surge within the aftermath of the ETF approval.

With a big variety of cash locked-up for over yr now could be circulation once more, ETH value is prone to expertise extra volatility within the days forward.