Cathie Wooden’s enterprise has acquired a dose of dangerous information because the earnings season wraps up. Most of its Change Traded Funds (ETFs) have shed substantial property after years of underperformance. For instance, the ARK Innovation Fund (ARKK) has misplaced billions of {dollars} and now has over $6.8 billion in property. At its peak, it had billions of {dollars} in property underneath administration.

ARK ETFs have seen substantial outflows

The identical is true with the ARK Autonomous Tech & Robotics (ARKQ) and ARK Fintech Innovation ETF (ARKF), which have continued to underperform the broader S&P 500 and Nasdaq 100 indices.

The dangerous information to observe on Thursday is that one firm that exists in ARKK, ARKW, and ARKF ETFs reported weak monetary outcomes, pushing its inventory sharply downwards within the prolonged hours.

ARKW vs ARKK vs ARKF vs ARKQ

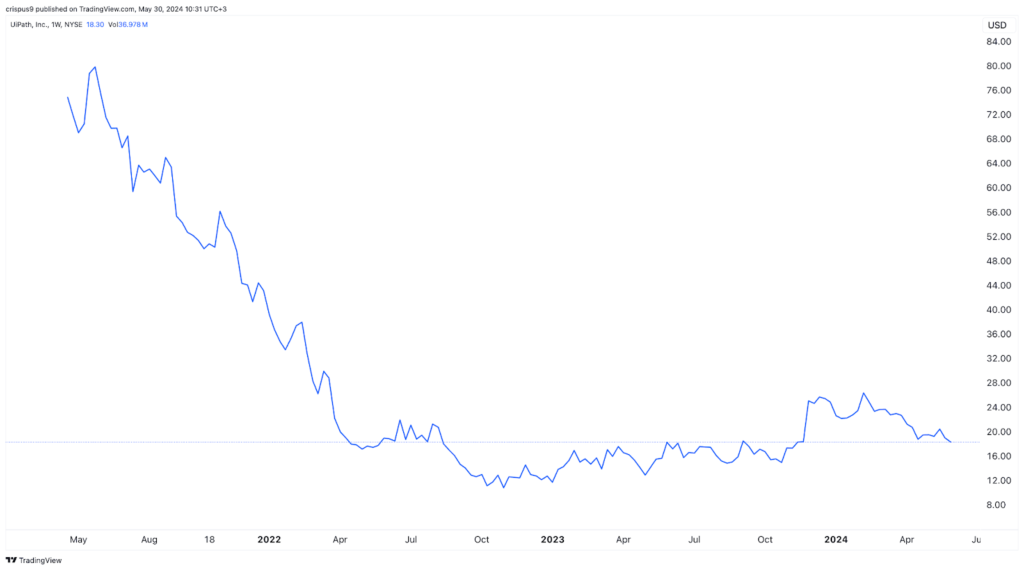

UiPath (NYSE: PATH) inventory worth plunged by over 34% and reached its lowest degree since January 2023. It has now plummeted by over 56% from its highest level this yr and by greater than 86% from its all-time excessive. It’s now hovering close to its all-time excessive whereas its market cap has tumbled from over $44 billion to lower than $10 billion.

UiPath’s inventory worth tumbled even after the corporate printed encouraging monetary outcomes. Its revenues rose by 16% within the first quarter to over $335 million whereas its Annual Recurring Income (ARR) soared by 21% to over $1.5 billion.

Nonetheless, the corporate warned that its enterprise noticed “elevated deal scrutiny and lengthened gross sales cycle” signalling that its enterprise was slowing down. It now expects that its income can be between $300 millon and $305 million within the second quarter. For the yr, it sees its income rising to between $1.40 billion and $1.41 billion.

UiPath inventory chart

UiPath will substitute its CEO

Along with its gradual development, the inventory crashed after the CEO, Rob Enslin, stepped down. He can be changed by Daniel Dines, the previous founder and the previous CEO of the corporate. Normally, such CEO transitions sign that an organization will not be doing effectively and that it wants a turnaround technique. We’ve got seen that with corporations like Starbucks and Disney.

UiPath is a crucial firm in Cathie Wooden’s portfolio since it’s a part in most of her ETFs. It’s the fifth-biggest firm within the Ark Innovation Fund after Tesla, Coinbase, Roku, and Block. The fund has over 18.6 million shares value over $349 million.

UiPath can also be the fifth greatest firm within the ARKQ ETF after Tesla, Teradyne, Kratos Protection & Safety, and Iridium. It’s the sixth greatest constituent of the ARK Fintech Innovation ETF (arkf) after Coinbase, Shopify, Block, DraftKings, and Robinhood. Additionally, the corporate is the eighth greatest a part of the Ark Subsequent Era Web ETF (ARKW).

Cathie Wooden loves UiPath due to its position in company America. The corporate supplies enterprise automation and AI options to corporations like Wells Fargo, Orange, Merck, and Siemens.

The put up Very dangerous information for Cathie Wooden’s ARKW, ARKF, ARKF and ARKQ ETFs appeared first on Invezz