The Uniswap (UNI) team-linked pockets offered practically $10 million of tokens on July 19 in a month promoting spree. To date, the labeled deal with has dumped 5.98 million UNI in July, value practically $50 million.

SpotOnChain reported this exercise, following the deal with ‘0x63b‘, which acquired 9 million UNI from the preliminary distribution in September 2020. In response to the platform, this allocation got here from the staff/investor/advisor class of the challenge’s disclosed tokenomics.

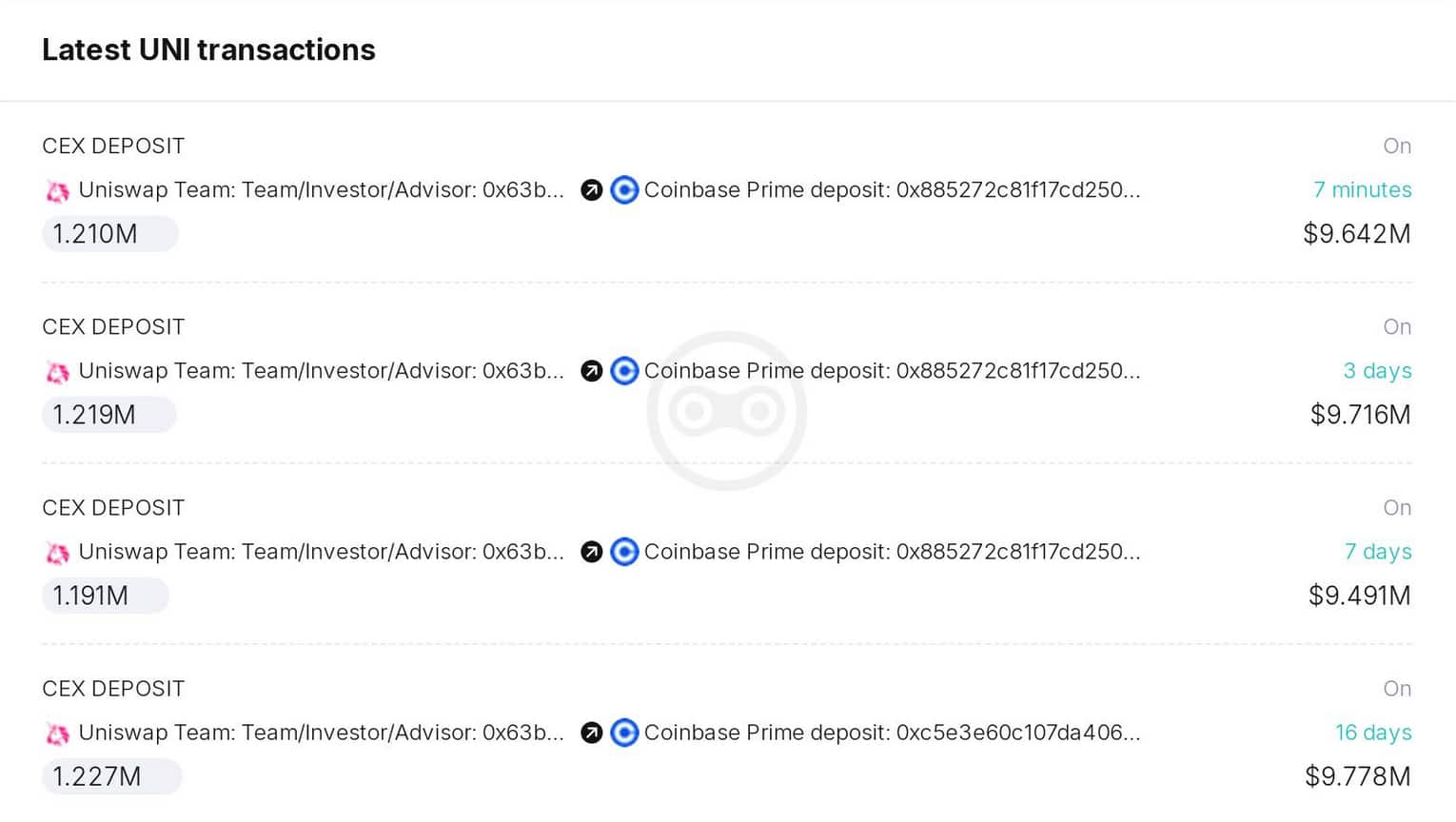

As reported, ‘0x63b’ has deposited 5.98 million UNI to Coinbase Prime at a mean of $8.26 since July 4, leading to a nominal worth of $49.4 million. Notably, the latest deposit was 1.21 million UNI in a single day, value $9.64 million.

Crypto whales take up Uniswap staff’s sell-off

SpotOnChain, nevertheless, noticed that these offloads had been “rapidly absorbed” by different Uniswap whale addresses, not considerably affecting the cryptocurrency’s value.

Significantly, 4 whale addresses stood out, withdrawing 1.04 million UNI from Coinbase Prime proper after the latest deposit. With that, these addresses alone absorbed 85% of the 1.21 million tokens from the Uniswap team-linked pockets.

This highlights a related demand for the Uniswap token.

Uniswap (UNI) value evaluation

Within the meantime, the Uniswap native token was buying and selling at $7.90 by press time, down 22% in a single month. Due to this fact, regardless of the latest whale shopping for exercise, UNI has suffered from a major promoting stress, impacting its value.

As of the reporting time, the ‘0x63b’ deal with held 3.02 million UNI, value $24.07 million, which is able to seemingly be deposited to Coinbase Prime at one level. Apparently, that is half the quantity the challenge staff has offered month-to-date.

Uniswap is the biggest decentralized change (DEX) within the cryptocurrency market, shifting related buying and selling quantity each day, though in a roundabout way benefiting the token’s fundamentals.

Now, decentralized finance (DeFi) buyers look additional to see whether or not the Uniswap staff’s actions will trigger from an financial perspective.

Disclaimer: The content material on this web site shouldn’t be thought of funding recommendation. Investing is speculative. When investing, your capital is in danger.