It has been over ten months, and thru 2024, tether (USDT), the main stablecoin by market worth, has expanded its provide by 34.27%.

Tether’s USDT Expands by 34% in 2024

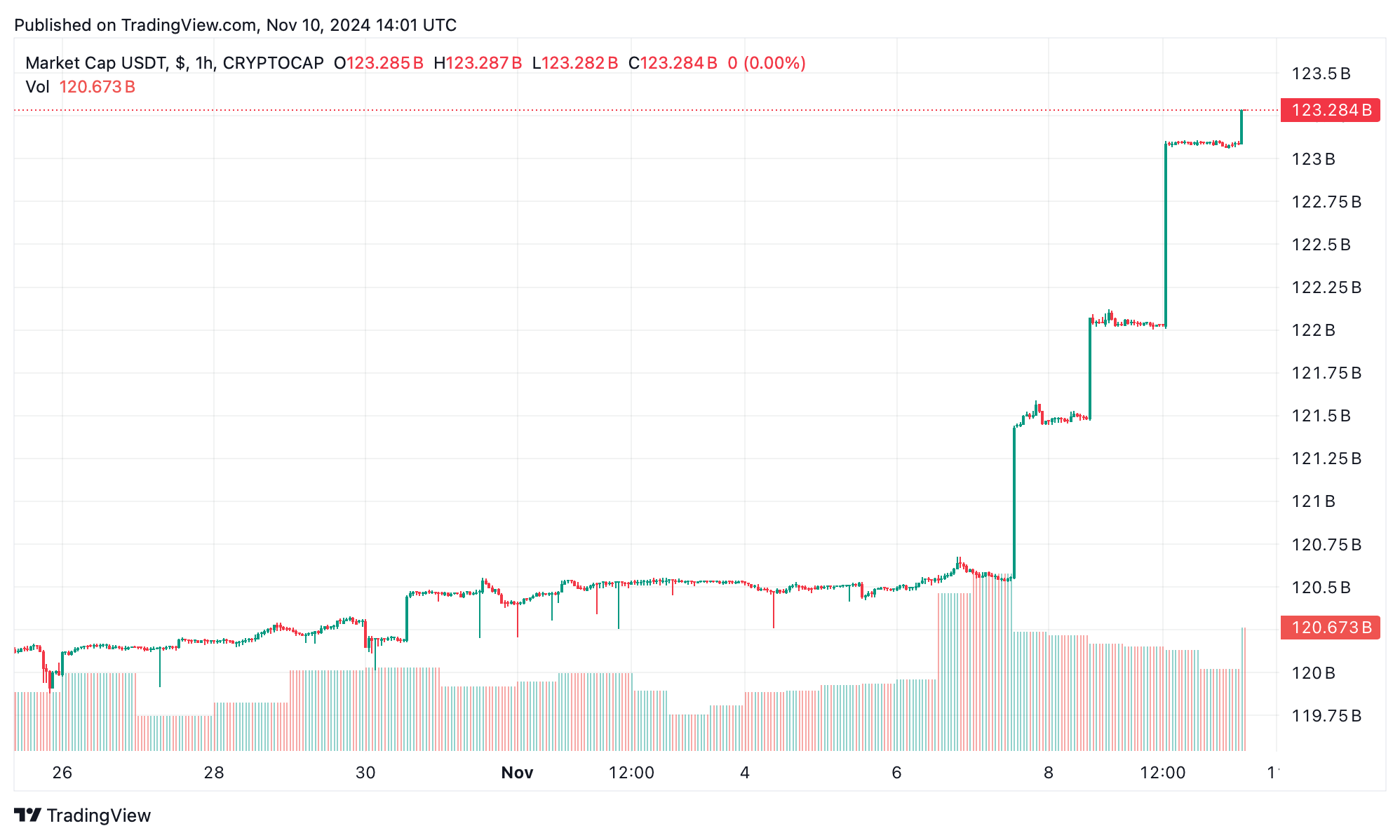

Over the previous yr, USDT’s provide climbed by 34.27%, rising from $91.73 billion to $123.17 billion. Tether, launched 9 years and eight months in the past with a market cap of simply $304,476, now holds a staggering $123.17 billion valuation, marking a progress of over 40,000,000%. In distinction, its closest competitor by market cap, usd coin (USDC), noticed a 50.57% improve since Jan. 1.

Of the 123.2 billion USDT in circulation, 61.79 billion exist on the Tron blockchain, and 57.93 billion are on Ethereum. The Ton blockchain holds 1.22 billion, and Avalanche has 1.19 billion. Solana holds roughly $1.88 billion, with the remaining USDT distributed throughout Close to, Celo, Cosmos, Omni, EOS, Tezos, Polkadot, Aptos, Algorand, and Liquid. Past its scale, USDT additionally outperforms its friends and the broader market in day by day commerce quantity.

USDT Market cap as of Nov. 10, 2024.

For instance, on Nov. 9, buying and selling quantity decreased by 17.91% from the day past to $104.28 billion. Of this, $81 billion, recorded throughout a whole bunch of world exchanges, was tied to USDT. Tether stays the highest buying and selling pair with BTC, ETH, SOL, XRP, DOGE, and numerous different belongings. Whereas bitcoin is usually seen because the dominant crypto asset, USDT has arguably change into the stablecoin king, sustaining a pervasive presence regardless of ongoing scrutiny.

With its in depth market share and grip on buying and selling quantity, it’s troublesome to examine a competing stablecoin overtaking USDT anytime quickly. With USDT’s market cap standing at round 3.33 instances that of USDC, the hole between the 2 stablecoin leaders raises questions on market dynamics. Beneath USDC, the following contender, USDS, holds a market cap of lower than $6 billion—a determine that pales compared to these two main gamers. As smaller rivals try to determine their footing, the appreciable hole suggests an extended lead.

Current shifts within the stablecoin market reveal a pivot towards yield-bearing rewards, aiming to entice customers and stand aside from established names. Rising tokens like Ethena’s USDE and Sky’s USDS now provide incentives to establishments and customers contributing liquidity or merely holding tokens. This transfer is motivated by ambitions for transparency, broader adoption, and increasing decentralized finance (defi) avenues.

Though USDT maintains a robust presence within the defi world, yield-bearing stablecoins provide a definite method by sharing returns from belongings or reserve income so as to add worth for holders whereas promising stability. Sky’s USDS ranks third in market cap, and Ethena’s USDE is fifth. Whereas these yield-bearing choices spark curiosity, USDT’s place stays unchallenged—at the least for now.