Because the downward development within the main cryptocurrency Bitcoin continues, the worth dropped to the $ 56,000 ranges.

Whereas analysts state that the downward development in Bitcoin could proceed, all eyes on BTC and altcoins are actually turned to the financial information to come back from the USA.

The information introduced on the primary Friday of every month is carefully adopted by buyers and events to grasp the state of the economic system.

The information disclosed is as follows:

Nonfarm Payrolls Knowledge: 142k Introduced vs. 164k Anticipated vs. 114k Earlier

Unemployment information: Introduced 4.2% – Anticipated 4.2% – Earlier 4.3%

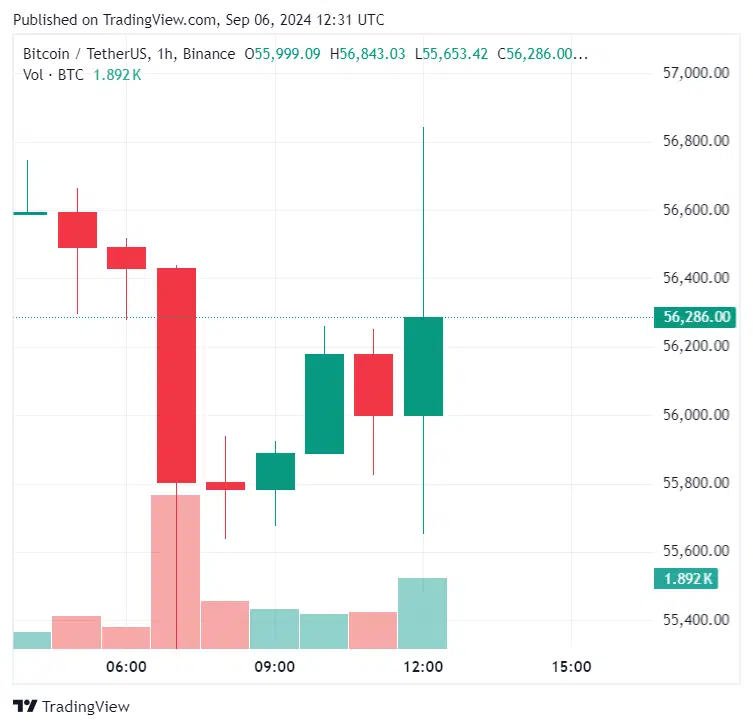

Bitcoin’s response after the information got here was as follows:

The Impact of Non-Farm Employment and Unemployment Knowledge on Costs!

A better than anticipated non-farm payrolls information is taken into account a sign of financial restoration in that nation and has a optimistic impression on the forex.

Modifications within the labor market have a major impression on the FED’s financial coverage. The FED, which believes that the labor market wants to chill down along with the decline in inflation, is carefully monitoring employment information.

If the introduced information is available in above expectations, we might even see the DXY (greenback index) rise and Bitcoin pull again a bit. If it is available in under expectations, we might even see a pullback within the DXY.

The rise in unemployment price might trigger us to see a pointy pullback in DXY, which might be optimistic for Bitcoin.

In each instances, volatility might be excessive within the minutes when the information is launched.

*This isn’t funding recommendation.