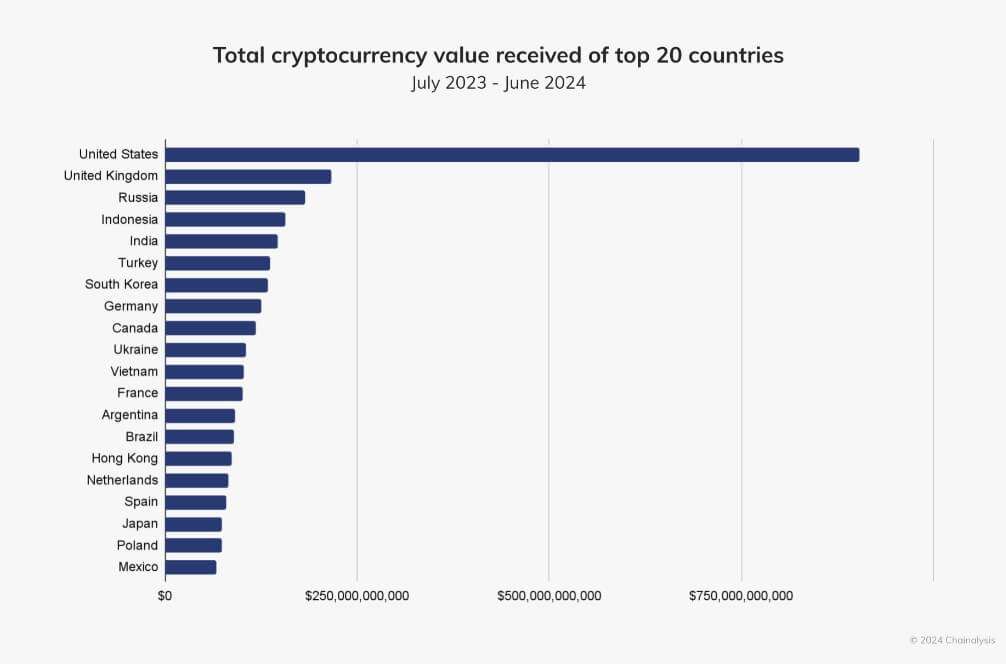

North America has as soon as once more claimed the highest spot because the world’s most vital crypto market because of elevated institutional exercise within the US, in line with an Oct. 17 Chainalysis report.

Between July 2023 and June 2024, North America generated $1.3 trillion in on-chain worth, representing 22.5% of the worldwide complete. Chainalysis credit this dominance to heightened institutional exercise, particularly within the US, the place large-scale transactions exceeding $1 million account for 70% of the area’s crypto transfers.

Whereas the US leads the North American crypto panorama, Canada follows, with $119 billion in on-chain worth throughout the identical interval.

US dominance

The US stays dominant in North America’s crypto market, primarily as a consequence of vital institutional actions round spot Bitcoin and Ethereum exchange-traded funds (ETFs).

Nevertheless, this management is just not with out challenges. Chainalysis notes that the US market has been extra risky than its international counterparts.

The report said:

“In current quarters, the U.S. has demonstrated heightened sensitivity to each bull and bear markets. When cryptocurrency costs rise, the U.S. market exhibits bigger will increase in development than the worldwide market — and the inverse is true when cryptocurrency markets decline.”

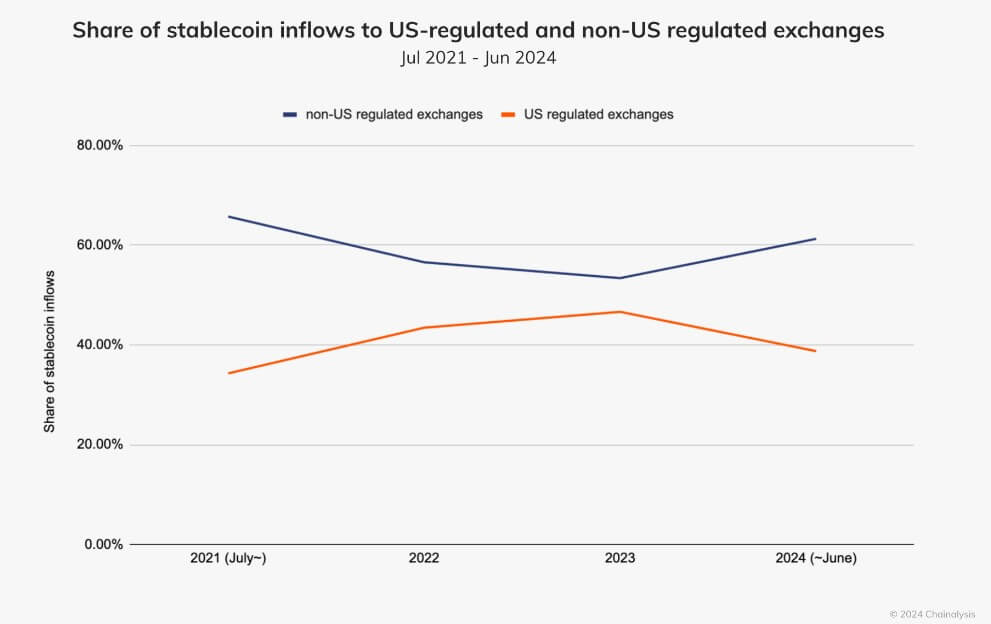

Though crypto adoption has grown within the US, the nation has seen a pointy drop in stablecoin holdings on exchanges. The share of stablecoin transactions on US-regulated exchanges fell from about 50% in 2023 to beneath 40% in 2024.

Chainalysis reported that this decline could possibly be linked to the regulatory uncertainty surrounding these digital property within the US. Circle, the issuer of the USDC stablecoin, has identified that unclear rules within the US have prompted stablecoin initiatives to hunt extra favorable environments in Europe and the UAE.

Stablecoin use rises outdoors the US

In distinction, stablecoin transactions have surged outdoors the US, accounting for greater than 60% of transactions in non-US markets by 2024.

This pattern is especially robust in growing markets, the place stablecoins present customers entry to US {dollars} with out counting on conventional banking techniques. Circle confirmed this shift, reporting that 45% of US greenback banknotes in circulation have been held overseas as of late 2022.

The rising use of stablecoins outdoors the US displays a broader pattern. World markets more and more view US dollar-backed stablecoins as each a retailer of worth and a extra inexpensive methodology of transaction.

Tether’s CEO Paolo Ardoino has additionally emphasised the significance of USDT in inflation-hit nations like Argentina, the place it provides stability throughout financial uncertainty.

Talked about on this article