Escalating tensions within the Center East triggered a pointy downturn within the crypto market on Tuesday. This volatility led to the liquidation of over $500 million in positions. Main altcoin Ethereum (ETH) was notably affected, with lengthy merchants struggling important losses.

Technical indicators recommend that this downturn has inspired bears to make a transfer for market management — they usually is likely to be succeeding. Is October off to a rocky begin?

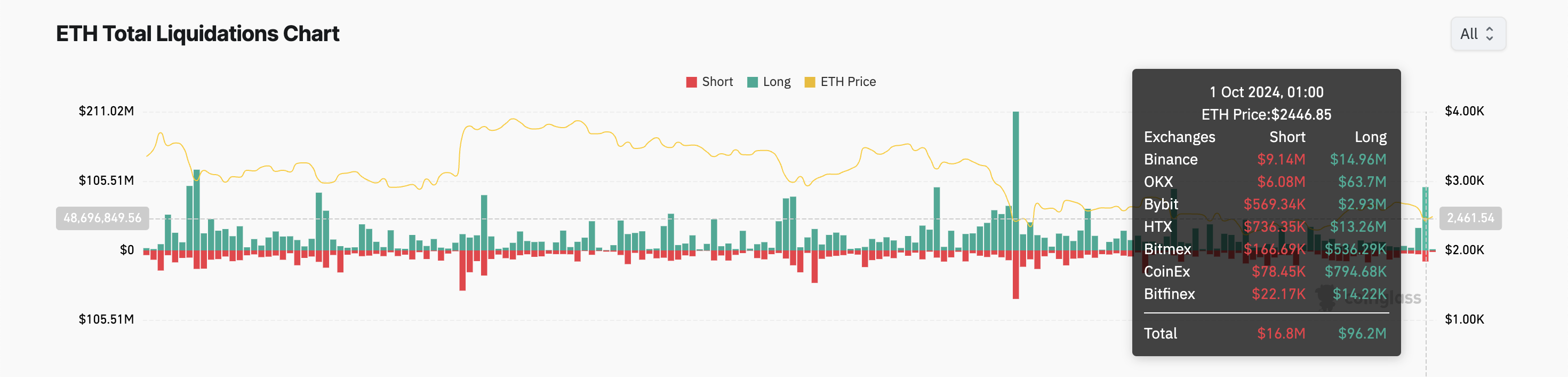

Ethereum Lengthy Merchants Depend Their Losses

On Monday, Ethereum’s worth fell to $2,447, a low final recorded ten days in the past. This sudden decline led to the liquidation of many lengthy trades that had been opened in favor of a continued worth rally.

When an asset’s worth strikes in opposition to a dealer’s place, the trade forcefully closes the place on account of inadequate funds to take care of it, leading to a liquidation. Lengthy liquidations occur when merchants with lengthy positions should promote the asset at a cheaper price to cowl their losses as the worth declines.

This sometimes occurs when the asset’s worth falls beneath a selected stage, compelling merchants betting on a worth rally to exit the market. In response to Coinglass information, ETH lengthy merchants skilled $96 million in liquidations on Monday, marking the best single-day liquidation in 57 days.

Learn extra: How one can Spend money on Ethereum ETFs?

Ethereum Whole Liquidations. Supply: Coinglass

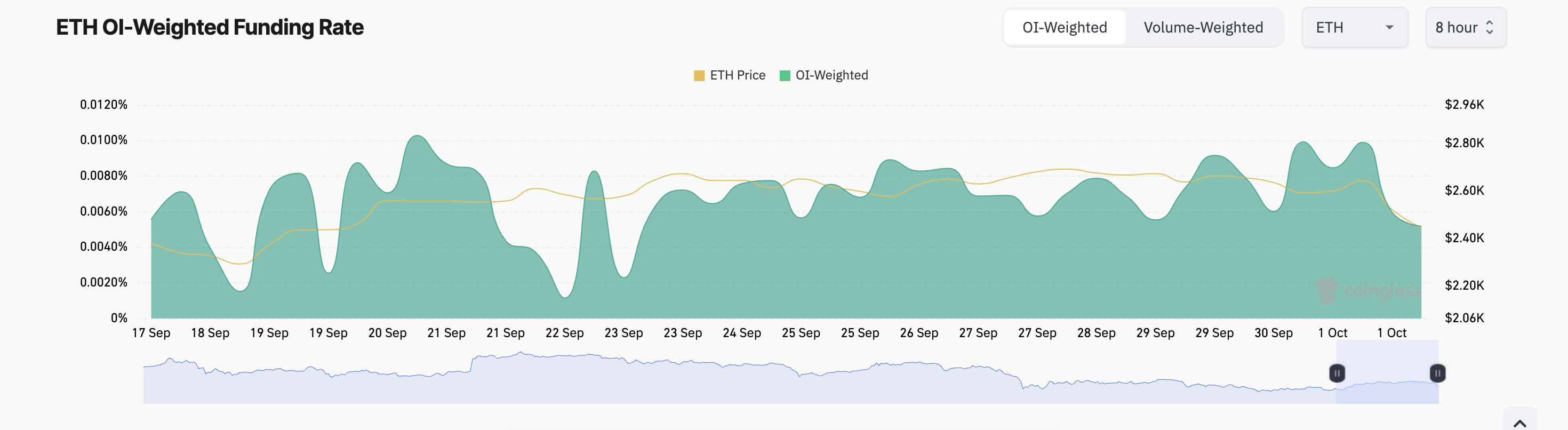

Regardless of latest losses, ETH futures merchants proceed to open extra lengthy positions. The coin’s funding price — the periodic charge paid to maintain its contract worth aligned with its spot worth — stays optimistic, signaling stronger demand for lengthy positions over shorts.

At present, the funding price stands at 0.0052%, reflecting ongoing optimism amongst ETH futures merchants.

Ethereum Funding Charge. Supply: Coinglass

ETH Worth Prediction: Spot Merchants Are Fearful

Ethereum’s technical setup means that its spot merchants have adopted a unique method, as readings from the coin’s each day chart sign that the bears have regained market management.

For instance, its Elder-Ray Index, which measures the connection between the energy of consumers and sellers, has turned destructive for the primary time since September 11. When this indicator is destructive, bear energy is dominant available in the market.

Moreover, in line with ETH’s shifting common convergence/divergence (MACD) indicator, its MACD line (blue) has crossed beneath its sign line (orange) and is poised to fall additional. This setup signifies a bearish outlook, signaling that momentum is shifting downward and an additional worth decline is probably going.

Learn extra: Ethereum (ETH) Worth Prediction 2024/2025/2030

Ethereum Worth Evaluation. Supply: TradingView

If promoting stress good points momentum, Ethereum’s worth may retest its August 5 low of $2,112. This represents a 15% drop from its present stage.

Nevertheless, if the broader market pattern improves, bulls might regain management and push Ethereum’s worth towards the resistance stage at $3,101.