UNI, the native token of decentralized alternate (DEX) Uniswap, has surged 9% to turn out to be the highest gainer within the crypto market at this time.

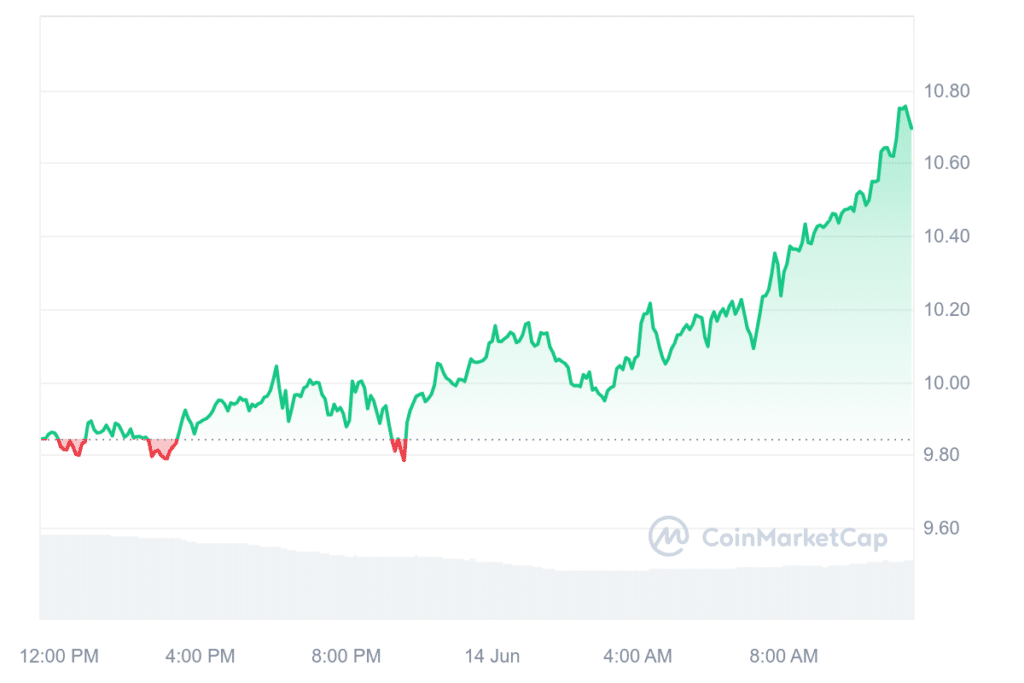

On the time of writing, UNI has been buying and selling at $10.69, which is up 8.5% over the previous day. In the identical timeframe, the crypto asset skilled a 31% drop in buying and selling quantity, suggesting current holders is likely to be holding onto their UNI tokens in expectation of an additional value rise.

UNI 24-hour value chart | Supply: CoinMarketCap

In the meantime, Uniswap’s market cap had risen to $6.4 billion, bringing the token to the 18th largest crypto asset asset per information from CoinMarketCap.

The most recent surge in value comes because the decentralized alternate shared a brand new enigmatic X publish early on June 14 that includes the message: “Locked in. Prepared for the Endgame.” The message was paired with a picture of a person intently sitting ahead in his chair, a meme utilized by players when issues are getting critical.

A following connected publish from June 1 subsequently urged that Uniswap v2 is gearing up so as to add assist for a brand new Layer-2 blockchain.

Locked in.

Prepared for the Endgame. https://t.co/IjhbYvyccH pic.twitter.com/Y50eMLCAoB

— Uniswap Labs 🦄 (@Uniswap) June 13, 2024

Though the particular L2 protocol was not disclosed, hypothesis among the many crypto group on X leans in the direction of ZKsync, a famend trustless Layer 2 answer recognized for scalable, low-cost Ethereum transactions.

In the meantime, a number of members of the group additionally expressed discontent relating to the potential deployment on ZKsync.

Hey , do not assist this rip-off challenge please .

You have been among the finest tasks that distributed a fairdrop and customers have been glad .

You already know what we are saying and what we’re going by way of . They scammed all of the customers for 4 years and simply tousled nowadays .#zkscam #zksyncscam— behnamsasani (@BehnamSasani) June 14, 2024

You may additionally like: zkSync faces group backlash over lack of anti-Sybil measures in ZK airdrop

One other potential trigger for the current value surge in UNI may very well be the spectacular progress in L2 quantity processed by way of the Uniswap Protocol, as highlighted in a June 13 X publish by Uniswap Labs.

It took 22 months to hit the $100 billion mark, 10 months to succeed in $200 billion, and simply 3 months to surpass $300 billion,’ the Uniswap workforce famous, exhibiting information from analytics platform Dune. The exponential progress outlines the rising utility and adoption of Uniswap’s providers within the defi house.

Moreover, an X consumer with the pseudonym “Kyledoops” identified the rising recognition of Uniswap v2 swimming pools on numerous L2 options like Optimism, Arbitrum, and Polygon.

Uniswap v2 swimming pools are taking off on Layer 2 options like Optimism, Arbitrum, and Polygon.

This progress is fueled by the demand for scalability, decrease charges, and a greater consumer expertise.

Whereas #Ethereum nonetheless leads in decentralized finance (DeFi), these L2 networks ship… pic.twitter.com/4fHmy5y5NC

— Kyledoops (@kyledoops) June 13, 2024

These platforms are being favored for his or her promise of scalability, diminished transaction charges, and enhanced consumer expertise, additional contributing to the demand for Uniswap’s choices.

Whereas Ethereum continues to guide in defi, the combination of L2 networks with Uniswap is evidently propelling faster and extra economical transactions, positioning these networks as sturdy contenders within the evolving crypto house.

Learn extra: Uniswap v3 enterprise supply license expires, builders free to fork