Ethereum worth resumed its downward pattern this week as odds of Donald Trump successful subsequent week’s normal election retreated. Ether fell to $2,500, a couple of factors beneath this week’s excessive of $2,725.

Donald Trump’s odds of successful

Ethereum and different cryptocurrencies have retreated sharply prior to now few days as Polymarket information confirmed that Trump’s odds of successful the election fell to 62% on Friday, down from this week’s excessive of $67%. Kamala Harris odds have moved to 38%.

The identical pattern has occurred in different markets. His odds on Kalshi have dropped from 62% to 56%, whereas PredictIt’s odds have moved to 55%.

Whereas Trump has a lead in the direction of the final election, the pattern will not be shifting in the precise path.

On the similar time, merchants understand that this election might transfer in both path since official polls are tight. Knowledge from the New York Occasions reveals that each one swing states are inside the margin of error.

Polls have been improper prior to now. For instance, most of them gave Hillary Clinton a better probability of successful within the 2016 election. In addition they confirmed that Republicans would have a clear sweep in the course of the mid-term elections.

Due to this fact, there’s nonetheless uncertainty about what’s going to occur within the subsequent election. This additionally explains why Trump-themed belongings have dived. The Trump Media & Know-how inventory has plunged by over 35% from its highest degree this month.

Equally, Trump cryptocurrencies like MAGA, TREMP, and Trumpcoin have all crashed by double-digits prior to now few days.

Bitcoin and Ethereum costs do nicely when there are greater possibilities of Donald Trump successful the election within the US. Apart from, he could be the primary president with crypto holdings, which Arkhamestimates are value nearly $6 million.

Trump has additionally pledged to fireside Gary Gensler and appoint a crypto-friendly head of the Securities and Alternate Fee (SEC).

Nonetheless, the fact is that the position of a president within the crypto and inventory market is comparatively overestimated. Apart from, Ethereum and Bitcoin soared to their report highs throughout Joe Biden’s presidency.

Ethereum ETF inflows are struggling

Ethereum worth stays in a deep bear market as information reveals that its ETF inflows usually are not doing all that nicely.

Knowledge reveals that Ether ETFs had internet inflows of $13 million on Oct. thirty first, greater than the $4.36 million on Wednesday and $7.65 million a day earlier. Altogether, these funds have had internet outflows of over $480 million since their inception.

There are indicators that traders are actually extra targeted on Bitcoin ETFs, that are firing on all cylinders. Their inflows have soared to over $24.21 billion this yr, a pattern which will proceed within the foreseeable future.

The iShares Bitcoin ETF now has over $26 billion and is closing the hole with the iShares Gold ETF (IAU), which has $33 billion in belongings. That is notable since IBIT was launched this yr, whereas the IAU was launched in 2005.

Ethereum is dropping market share

On the similar time, there are indicators that Ethereum has weak fundamentals, which explains why its efficiency is lagging.

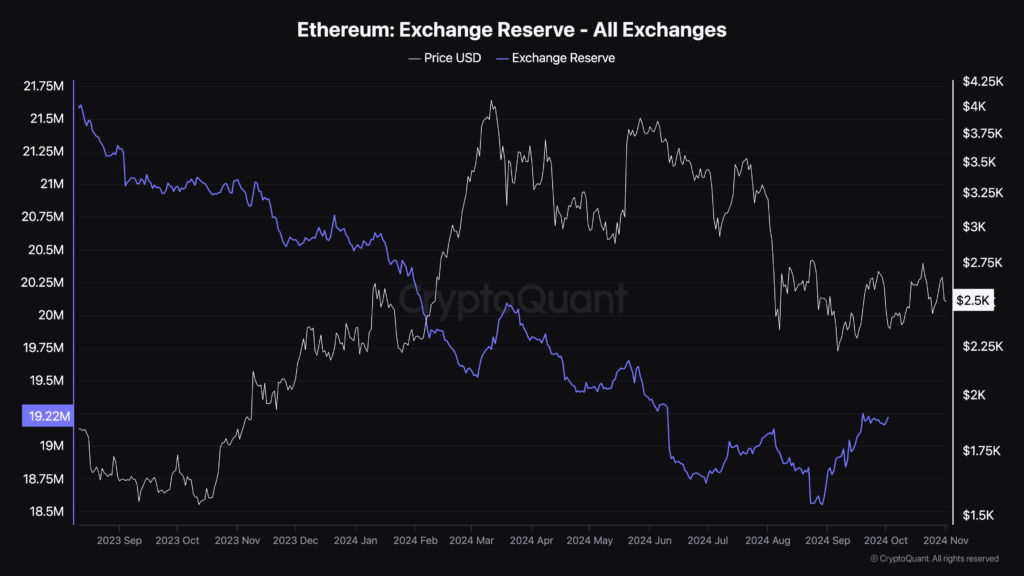

First, as proven beneath, the quantity of Ethereum in exchanges has elevated prior to now few weeks, which is an indication that some traders are promoting their cash. These change reserves rose to 19.5 million, its highest degree since July, and far greater than the year-to-date low of 18.65 million.

ETH reserves | Supply: CryptoQuant

On the similar time, Ethereum is dropping market share throughout industries like NFT and decentralized finance (DeFi).

Knowledge compiled by CryptoSlam reveals that Ethereum NFT gross sales dropped by over 34% in October to $119 million. That decline was a lot worse than the 27% and 23% drop in Bitcoin and Solana.

The overall worth locked (TVL) in Ethereum rose by 5% in October to $48 billion. In distinction, Solana’s TVL jumped by 11%, whereas Base soared by 12% to $2.45 billion.

What’s notable, nonetheless, is within the DEX trade, the place Solana dealt with transactions value $52 billion, whereas Ethereum had $41 billion. The largest networks within the Solana community had been Raydium and Orca.

Ethereum worth weak technicals

ETH chart by TradingView

The every day chart reveals that the worth of Ethereum has remained beneath intense strain prior to now few days.

Not like Bitcoin, it has remained beneath the 50-day and 100-day Exponential Shifting Averages, which means that bears are in management.

Ethereum has moved to the 61.8% Fibonacci Retracement level. Most significantly, it has fashioned a bearish pennant sample, which is made up of an extended line and a symmetrical triangle sample.

Due to this fact, there’s a rising risk that the coin could have a robust bearish breakout because the triangle is nearing its confluence degree. If this occurs, the following level to observe will likely be at $2,117, its lowest level in August.

Learn extra: Ethereum worth prediction: dangerous sample factors to a breakdown

The publish Ethereum worth prediction: unhealthy technicals, meet weak fundamentals appeared first on Invezz