Donald Trump’s election victory and promised crypto-friendly insurance policies may speed up digital asset adoption in Latin America, the place stablecoins and Bitcoin already function inflation shields and remittance channels for hundreds of thousands, specialists say.

Regional exchanges are reporting a spike in crypto exercise because the President-elect’s pro-Bitcoin stance resonates in inflation-hit economies.

The president-elect’s pledge to determine a nationwide Bitcoin reserve and ease regulatory burdens arrives as Latin America emerges as a key progress market, processing over $85 billion in crypto transactions yearly, in keeping with Chainalysis knowledge.

Regional gamers see Trump’s win as a possible catalyst for elevated institutional adoption and cross-border flows.

“Trump’s second time period within the White Home may additional increase the crypto market, giving room for additional appreciation,” Sebastian Serrano, CEO of Argentina-based alternate Ripio, mentioned in statements shared by Cointelegraph. “We’re observing a decisive interval for Bitcoin and the cryptocurrency market as a complete.”

The implications could possibly be significantly vital for international locations battling foreign money instability.

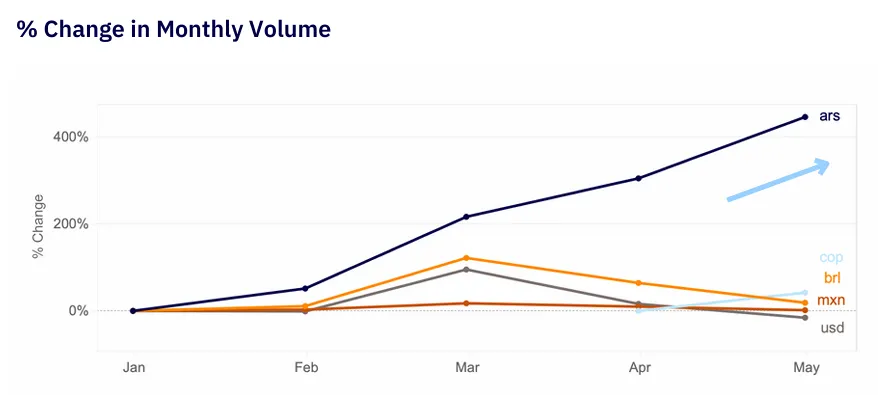

In Argentina, the place the poverty charges spiked to over 53% beneath Milei’s libertarian administration, Bitcoin buying and selling volumes surged 160% in October—and greater than 400% in 2024— as customers sought refuge from devaluation. Venezuela reveals comparable patterns, with over 92% of crypto exercise flowing by centralized exchanges as residents search options to the bolivar.

Picture: Poder360

Regional crypto companies are already positioning themselves for potential progress. Lemon Money, which lately expanded to Peru, reported processing over $20 million in native foreign money transactions in its first three months.

“Clear U.S. laws may assist us speed up adoption throughout extra LatAm markets,” mentioned Marcelo Cavazzoli, Lemon’s CEO, in an interview with Decrypt en Español.

“Donald Trump’s victory gave (crypto) a further increase, as his marketing campaign confirmed clear help for the sector,” Cavazzoli added, “Trump put ahead insurance policies to incentivize Bitcoin mining in the US, aligning with the rising curiosity within the crypto market. This was particularly mirrored in Argentinean and Peruvian customers, who started accumulating Bitcoin on the finish of October.

Cavazzolli instructed Decrypt that Bitcoin buying and selling quantity hit a report on November 6 in Argentina, with Peru additionally seeing a 160% in buying and selling exercise vs the day prior.

Some regional gamers, nonetheless, warning that Trump’s marketing campaign guarantees, whereas encouraging market sentiment, nonetheless want to handle the basic adjustments dealing with LatAM’s crypto ecosystem and don’t clear up the true wants of the crypto trade.

“The regulatory shift helps, however we nonetheless want to resolve basic infrastructure challenges,” famous Matías Reyes from TruBit alternate in an interview with Decrypt en Español. “Cross-border settlement and banking relationships are essential for our area.”

Latin America’s distinctive mixture of excessive crypto consciousness, difficult financial situations, and vital remittance flows positions it to doubtlessly profit from Trump’s crypto agenda. Regional exchanges report rising institutional curiosity as regulatory readability improves.

“We’re seeing elevated inquiries from conventional monetary gamers,” mentioned Hongyi Tang of TruBit. “U.S. coverage shifts may speed up this development by offering clearer frameworks for banks and fee suppliers.”

For a area the place centralized exchanges deal with over 60% of transaction quantity—considerably above the worldwide common of 48%—diminished regulatory friction may unlock new progress. Brazil, Argentina, and Mexico already rank among the many prime 20 international locations globally for crypto adoption.

The prospect of a Bitcoin-friendly U.S. administration comes as Latin American international locations grapple with their very own regulatory frameworks. Argentina’s CNV is finalizing guidelines for digital asset service suppliers, whereas Brazil carried out complete crypto laws in 2023 and is predicted to launch its blockchain-based CBDC subsequent yr.

“Regional regulators watch U.S. coverage intently,” defined Alfonso Martel Seward from Lemon Money. “A extra accommodating U.S. stance may affect native frameworks, particularly round stablecoins and alternate operations.”

As Trump prepares to take workplace, the US-Latin America crypto market—at the moment processing round $300 million in day by day transfers—stands at a possible inflection level.

Whether or not Trump’s marketing campaign guarantees translate into insurance policies that profit regional adoption, drifting away from what he did and mentioned on his first mandate, stays to be seen, however native gamers are cautiously optimistic.

Edited by Sebastian Sinclair and Josh Quitter. Marco Lanz contributed to this story.