In a latest article, The New Yorker’s John Cassidy unveils a startling growth within the 2024 U.S. presidential race: Donald Trump’s surprising pivot to change into a champion of cryptocurrency, significantly Bitcoin.

Trump’s Crypto Conversion

The New Yorker studies that Trump, who in 2019 dismissed Bitcoin’s worth as “based mostly on skinny air,” has now positioned himself as its largest advocate. Based on the article, Trump’s look at a Bitcoin convention in Nashville noticed him promising to create a “strategic Bitcoin stockpile” and rework america into “the Bitcoin superpower of the world.”

Regulatory Rollback Issues

A key concern highlighted by The New Yorker is Trump’s pledge to fireside Gary Gensler, the present chair of the Securities and Change Fee (SEC). The article notes that Gensler has been a vocal critic of the crypto trade, describing it as having a “report of failures, frauds, and bankruptcies.” His removing, The New Yorker suggests, may sign a big loosening of regulatory oversight.

Parallels to Previous Monetary Crises

Drawing parallels to the 2008 monetary disaster, The New Yorker article warns of the potential penalties of deregulating crypto property. It cites the Commodity Futures Modernization Act of 2000, which exempted sure monetary derivatives from regulation, resulting in the explosive progress of mortgage derivatives that performed a vital function within the monetary meltdown.

Integration with Mainstream Finance

The New Yorker expresses critical concern in regards to the potential integration of largely unregulated crypto property into the mainstream monetary system. The article quotes Dennis Kelleher, president of Higher Markets, who warns of the hazards if a crypto crash have been to happen in an atmosphere the place crypto is “totally built-in and interconnected with the banking system.”

Political Affect of Crypto Cash

The article in The New Yorker additionally illuminates the crypto trade’s important political donations. It cites Bloomberg information exhibiting that three crypto tremendous PACs have raised $170 million from donors, together with Coinbase, Ripple, and enterprise capital agency Andreessen Horowitz. The New Yorker means that this inflow of cash could possibly be used to affect coverage choices favorable to the trade.

Trump’s Private Pursuits

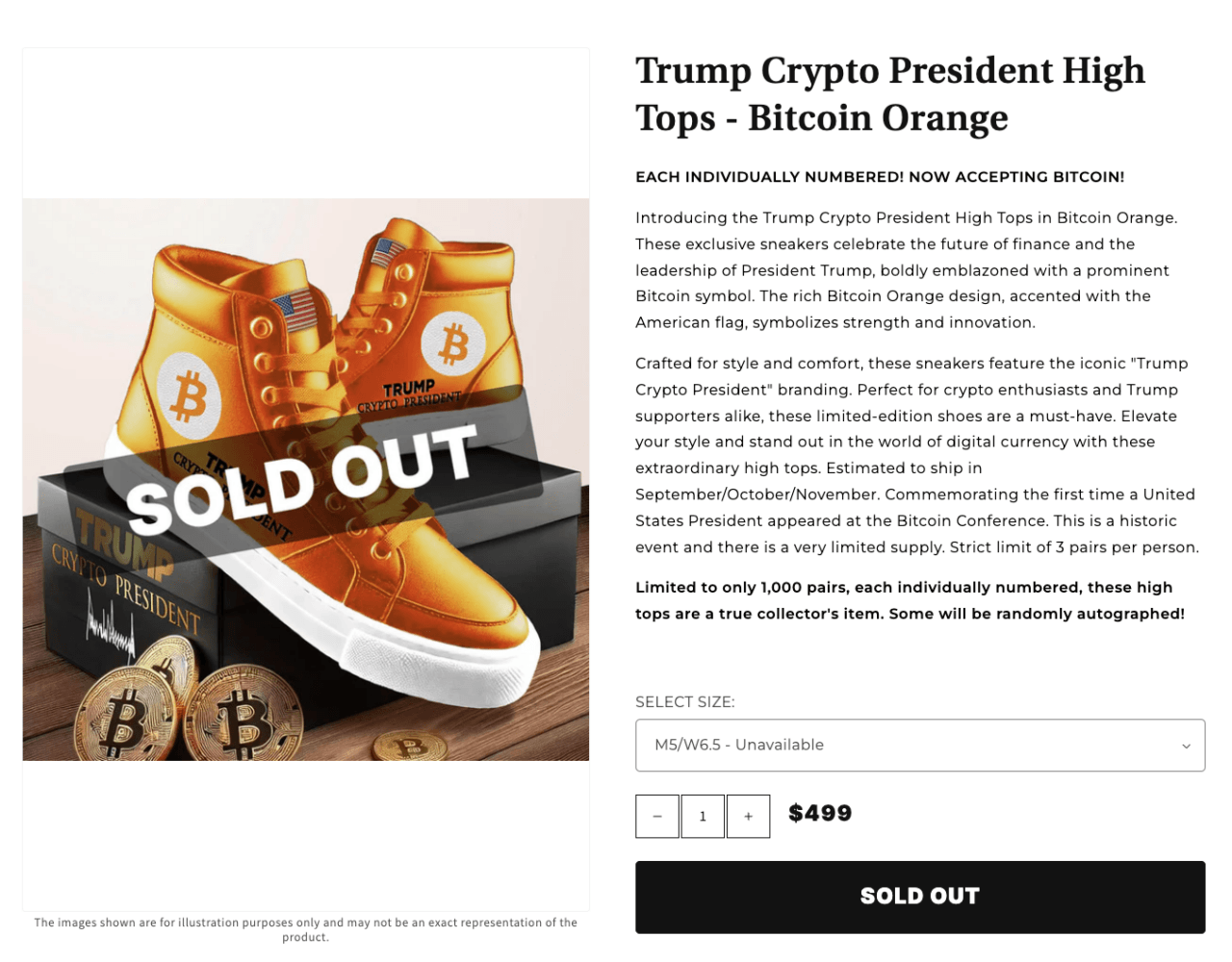

The New Yorker factors out that Trump’s embrace of crypto seems to increase past coverage proposals. The article studies that Trump’s firm has launched a line of Bitcoin-themed sneakers, suggesting a private monetary curiosity within the cryptocurrency’s success. This raises questions on potential conflicts of curiosity, ought to Trump return to the White Home.

Lack of Clear Social Goal

A closing concern raised by The New Yorker is the obvious lack of a transparent social function for cryptocurrencies. The article contrasts this with previous monetary improvements, resembling mortgage securities, which not less than presupposed to serve a bigger social purpose of increasing homeownership. The absence of such a function for crypto, The New Yorker suggests, makes the dangers related to gentle regulation more durable to justify.

Featured Picture through Pixabay