In anticipation of the upcoming US inflation report, savvy traders have bought 70,000 Bitcoin (BTC), signaling a strategic pivot in the direction of cryptocurrency as a hedge in opposition to potential financial volatility.

This large acquisition follows a major 1 million BTC sell-off on the shut of 2023, underscoring renewed confidence amongst long-term holders in BTC’s worth.

Traders Return to Purchase 70,000 BTC Forward of CPI Report

Current worries about inflation and the reducing value of fiat currencies have sparked renewed curiosity in various shops of worth.

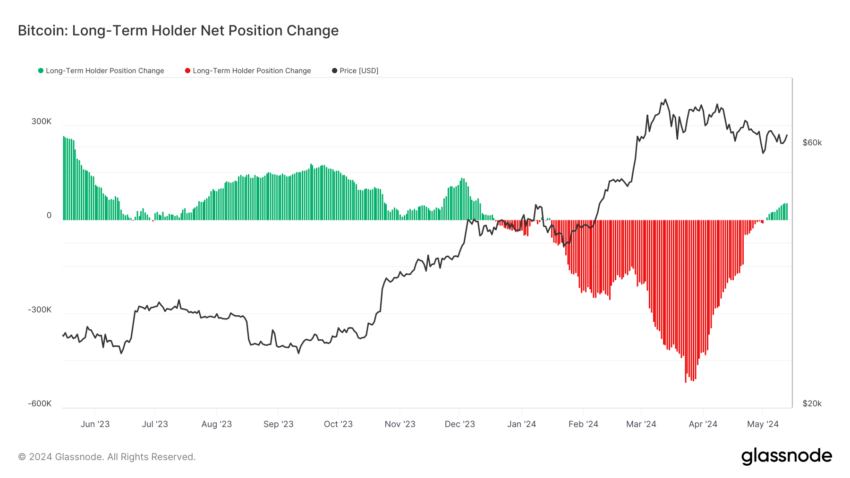

Certainly, on-chain information from Glassnode reveals traders are strategically accumulating extra Bitcoin. Their actions recommend a perception in BTC’s enduring worth, significantly because it stabilizes above $60,000.

Bitcoin Holder Web Place. Supply: Glassnode

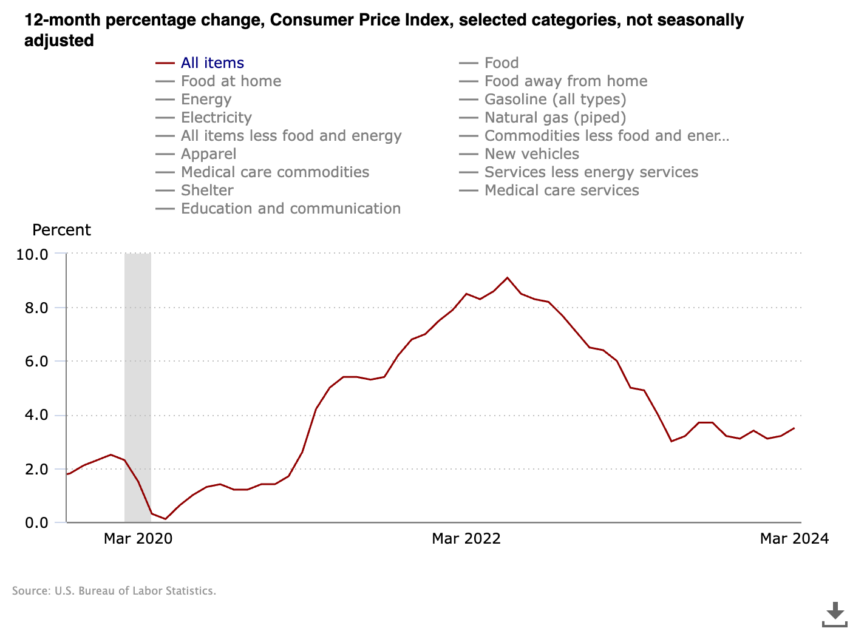

The US Shopper Worth Index (CPI) rose 0.4% in March and reached 3.5% over the previous 12 months. This quantity stays traditionally excessive and has considerably modified the worth of a greenback in comparison with a decade in the past when the inflation fee was simply 0.8%.

The upcoming US inflation report on Might 15 additionally has traders on edge because the Federal Reserve stays unlikely to chop charges this 12 months. For that reason, Neil Bergquist, CEO of Coinme, emphasizes Bitcoin’s enchantment as a retailer of worth.

He factors out that, in contrast to bank-held {dollars}, Bitcoin’s capped provide of 21 million BTC presents an inflation-resistant various.

“There’ll by no means be greater than 21 million bitcoin ever. It has a set provide, in contrast to fiat currencies, and nobody can change that. Nobody can are available in with a brand new coverage, nobody can get elected with a brand new concept and alter that. It’s hard-coded into the bitcoin blockchain,” Bergquist defined.

Learn extra: Bitcoin Worth Prediction 2024 / 2025 / 2030

Shopper Worth Index. Supply: US Bureau of Labor Statistics

Core inflation, which excludes the extra risky prices of meals and gasoline, will possible stay persistently excessive on account of elevated prices of shelter and core companies corresponding to insurance coverage and medical care. In line with Financial institution of America, larger power costs, pushed by elevated gasoline costs, are anticipated to contribute to a “comparatively firmer headline CPI print.”

Because of this, Bitcoin might be able to set up itself as a decentralized useful resource, solidifying its standing as a hedge to conventional monetary methods.

“Should you maintain {dollars} in your checking account over a interval of rising inflation, then your stability has much less buying energy than should you have been to retailer your worth in Bitcoin,” Bergquist concluded.