- Ethereum’s adverse common returns in September may see the highest altcoin document one other month of losses.

- US merchandise spark one other week of internet outflows for Ethereum ETFs.

- Ethereum value wants to maneuver outdoors a key rectangle to find out its subsequent development.

Ethereum (ETH) is up 2% on Monday regardless of adverse sentiment round ETH’s historic weak value motion in September. In the meantime, ETH ETFs proceed their weak development, recording one other week of internet outflows.

Each day digest market movers: Ethereum weak September returns, ETH ETF outflows

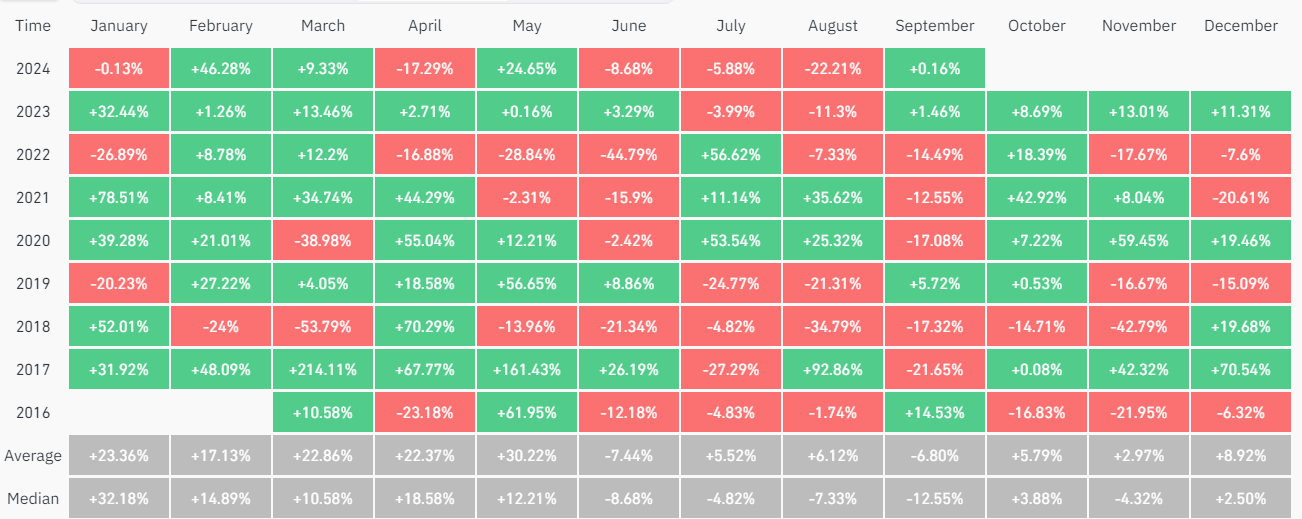

A number of market contributors are anticipating that Ethereum may even see additional declines in September resulting from its historic adverse common return within the month. For the reason that ICO increase of 2017, ETH solely recorded a median constructive September return in 2019, per Coinglass knowledge.

With a median and median return of -6.8% and -12.6%, respectively, investor sentiment going into the month is barely adverse. This additionally follows ETH ending August with a median lack of 22%.

Ethereum Month-to-month Returns (%)

Then again, some traders are anticipating {that a} potential charge reduce by the Federal Reserve (Fed) will assist ETH stage a rally in September.

In the meantime, CoinShares reported that world Ethereum exchange-traded funds (ETFs) posted internet outflows of $5.7 million final week, indicating risk-averse sentiment amongst traders resulting from uneven value motion. Notably, the adverse flows had been sparked by US spot Ethereum ETFs, which recorded a complete internet outflow of $12.4 million, following zero flows throughout the 9 issuers, together with BlackRock’s ETHA and Grayscale’s ETHE.

Regardless of the weak flows, three Ethereum ETFs characteristic among the many high 25 ETF launches in 2024: BlackRock’s ETHA, Constancy’s FETH and Bitwise ETHW.

*13* of high 25 ETF launches this yr are both bitcoin or ether associated…

Out of approx 400 new ETFs.

Prime 4 ETFs all spot btc. pic.twitter.com/gIkAiIM1jZ

— Nate Geraci (@NateGeraci) September 2, 2024

ETH technical evaluation: Ethereum maintains consolidation inside key rectangle

Ethereum is buying and selling round $2,520 on Monday, up greater than 2% on the day. Prior to now 24 hours, ETH has seen $38.49 million in liquidations, with lengthy and quick liquidations accounting for $27.59 million and $10.9 million, respectively.

On the four-hour chart, ETH is consolidating inside a key rectangle with resistance at $2,817 and assist at $2,400. ETH bounced off the assist degree on Sunday, stretching its time inside the rectangle to 25 days.

ETH/USDT 4-hour chart

The following indication of ETH’s value development will probably be a transfer outdoors the rectangle. A breakout above the $2,817 resistance will flip it right into a assist and assist ETH rally towards the $3,237 degree. It is necessary to notice that the $2,817 degree held as a assist for practically 4 months — April to July 2024. The 200-day, 100-day and 50-day Easy Transferring Averages (SMA) additionally stand as potential resistance on the best way up.

Nevertheless, a transfer beneath the $2,400 degree may spark bearish momentum and ship ETH towards the assist degree round $2,111.

The Relative Power Index (RSI) is trying a transfer above its midline after crossing above its transferring common line on the 4-hour chart. The %Ok line of the Stochastic Oscillator (Stoch) has entered the oversold area, indicating costs may even see a downward correction.

A day by day candlestick shut beneath $2,111 might sign the top of the present bull cycle.

Within the quick time period, ETH may decline to $2,416 to clean liquidation leverage price over $32.47 million.