RWAs proceed to expertise progress led by tokenized U.S. Treasuries.

BlackRock’s boasts a market worth of over $500 million.

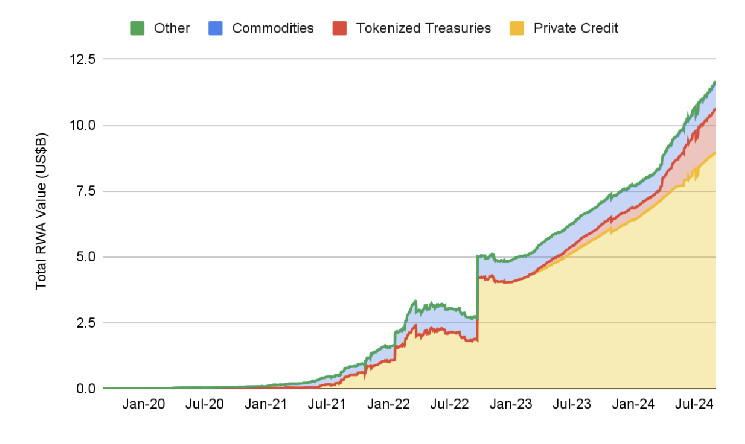

The market worth of on-chain real-world belongings (RWAs), excluding stablecoins, continues to rise, representing continued investor curiosity in blockchain-based tokenization of conventional belongings.

Presently, complete RWAs are value greater than a report $12 billion, based on a report printed by Binance Analysis on Friday. That quantity excludes the $175 billion stablecoin market.

Tokenization of RWAs like actual property, authorities bonds, shares, and intangible belongings like carbon credit makes historically illiquid markets simpler to commerce, permitting traders to buy belongings in fractions whereas facilitating clear information and streamlining the settlement course of.

For over a 12 months, tokenization has been touted as a trillion-dollar alternative, accelerating conventional finance’s transition to blockchain rails. Bigwigs from Wall Avenue, like BlackRock (BLK) and Constancy, have efficiently forayed into RWAs alongside a number of crypto-native initiatives akin to Securitize and Polymath.

Tokenized treasury funds, digital representations of the U.S. Treasury notes, have surpassed $2.2 billion in market worth, with BlackRock’s BUILD boasting almost $520 million. With a market cap of $434 million, Franklin Templeton’s FBOXX is the second-largest tokenized Treasury product.

Elevated rates of interest within the U.S. have catalyzed the speedy progress and management of the tokenized Treasuries market, based on Binance Analysis.

“This progress has possible been impacted by U.S. rates of interest being at a 23-year excessive, with the federal funds goal price having been held regular at 5.25%-5.5% since July 2023. This has made the US government-backed yield of Treasuries a beautiful funding car for a lot of traders,” analysts at Binance Analysis stated within the report.

The Federal Reserve, nonetheless, is predicted to chop charges within the coming months, doubtlessly denting the enchantment of yield-bearing devices, together with tokenized Treasuries. The central financial institution is prone to introduced the primary price reduce subsequent week.

Per Binance Analysis, sizeable price reductions could also be wanted to weaken the demand for tokenized Treasuries materially.

“With charges so excessive for the time being, the scale and regularity of any cuts will probably be essential. As issues stand, the key tokenized Treasury merchandise yield between 4.5%-5.5%, thus it is going to take fairly just a few cuts earlier than these yields grow to be uncompetitive,” analysts famous.

Binance Analysis additionally took inventory of on-chain personal credit score, tokenized commodities and actual property. The report stated the on-chain credit score market is value $9 billion or simply 0.4% of the normal personal credit score market sized at $2.1 trillion in 2023.

Apart from, Determine, a fintech firm offering strains of credit score collateralized by house fairness, accounted for a lot of the market worth of the on-chain personal credit score market. Nevertheless, excluding Determine, the sub-sector has nonetheless skilled progress by way of lively loans, led by Centrifuge, Maple, and Goldfinch.