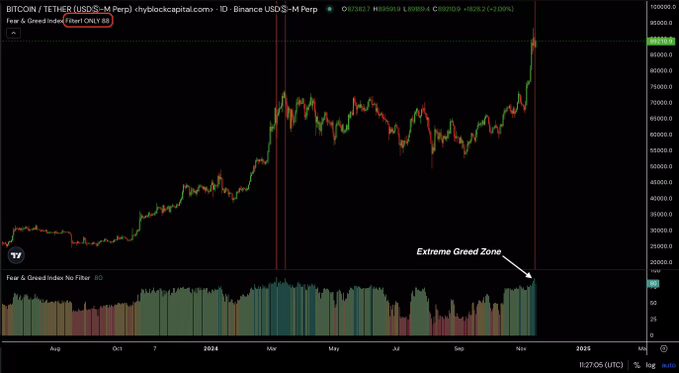

Bitcoin just lately entered what many discuss with because the “Excessive Greed” zone, as noticed on the Worry and Greed Index.

Traditionally, this zone alerts a heightened degree of investor optimism, typically pushed by expectations of continued upward worth motion.

Within the final week, the index hit starkly excessive ranges, marked by dark-green column bars, indicating an intense accumulation part.

Bitcoin costs responded by surging to new highs, flirting with worth factors beforehand seen as lofty aspirations.

Bitcoin Worry & Greed Index | Supply: Hyblock Capital

The climactic rise stirred hypothesis amongst merchants and analysts about an impending correction.

This sample isn’t new; related spikes within the index have sometimes led to pullbacks as merchants take earnings and the market re-calibrates.

With the index peaking, the neighborhood is on edge, anticipating whether or not Bitcoin will maintain its bullish momentum or succumb to a sell-off, triggered by profit-taking and market jitters.

A take a look at developments of Bitcoin Miners and Lengthy-Time period Holders

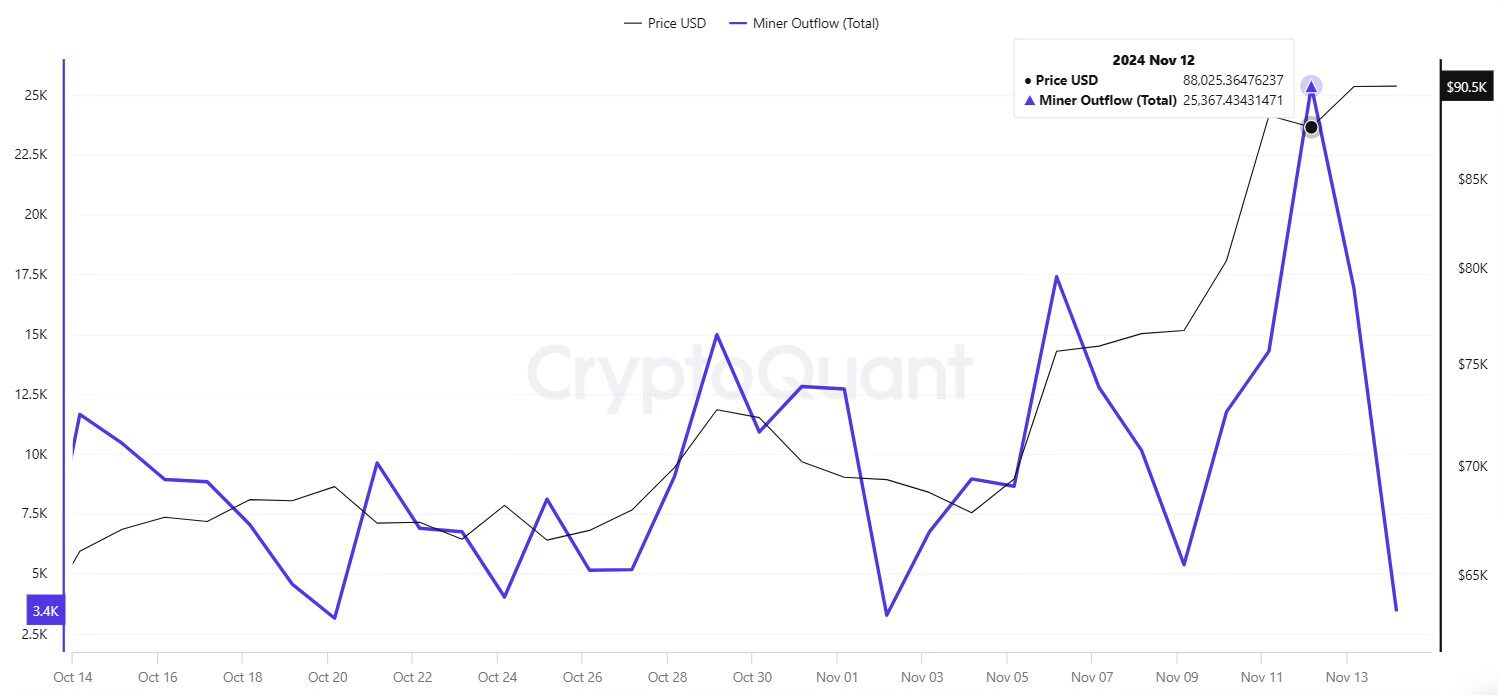

Moreover, Bitcoin miners who seem like promoting off their holdings as Bitcoin’s worth stays sturdy.

Prior to now week alone, miner outflows spiked considerably, coinciding with Bitcoin’s worth reaching $88K, marking a transparent sign that miners are taking earnings forward of potential Bitcoin peak.

Traditionally, such gross sales typically prelude vital market actions, suggesting we might be nearing a market high.

BTC Miner Outflow chart | Supply: CryptoQuant

Regardless of this sell-off, the broader sentiment within the Bitcoin market stays bullish. Lengthy-term holders of Bitcoin, seen because the spine of market stability, have offloaded round 300,000 BTC.

This determine is considerably decrease than the sell-offs witnessed in March 2024, which noticed practically one million BTC being bought.

The decreased scale of this promoting means that whereas the market is experiencing some strain from sellers, the depth is way much less extreme than in earlier cycles.

This might point out continued bullishness, because the promoting strain isn’t as overwhelming regardless of rising costs.

The present dynamics recommend a cautious optimism, with an undercurrent of strategic profit-taking by miners tempered by a powerful holding sample amongst long-term buyers.

Extra On-Chain Shopping for of BTC

Nonetheless on-chain Bitcoin holders have been accumulating, with a major variety of addresses displaying intense shopping for exercise across the $89.2K worth degree.

Based on IntoTheBlock, over 307,000 addresses purchased Bitcoin at this worth, suggesting a sturdy demand zone.

As Bitcoin’s worth at the moment teeters slightly below this crucial threshold, this degree may doubtlessly function a pivotal help or resistance level within the close to future.

The information additional confirmed that there was additionally appreciable accumulation at lower cost ranges, which could act as foundational help if the worth dips.

In/Out of the Cash Round Worth for BTC

Nonetheless, the massive cluster of shopping for at $89.2K advised that many buyers are anticipating larger costs, positioning this degree as a battleground between bears and bulls available in the market dynamics.

The curiosity at these ranges not solely displays investor sentiment but additionally hints at potential strategic strikes available in the market.

If this zone will certainly flip into resistance, potential decline, in any other case, if a breakthrough happens, it would propel it to new highs, pushed by optimistic investor sentiment and strategic large-scale buys.