After subsequent periods of sideways buying and selling, Bitcoin (BTC) bears look like gaining momentum over the maiden cryptocurrency.

As of press time, Bitcoin had misplaced the $67,000 help zone within the final 24 hours, dropping as little as $65,000. Consideration is now targeted on the following value motion, with Bitcoin analyst CryptoCon noting in an X put up on June 14 that traders ought to anticipate additional corrections within the coming days.

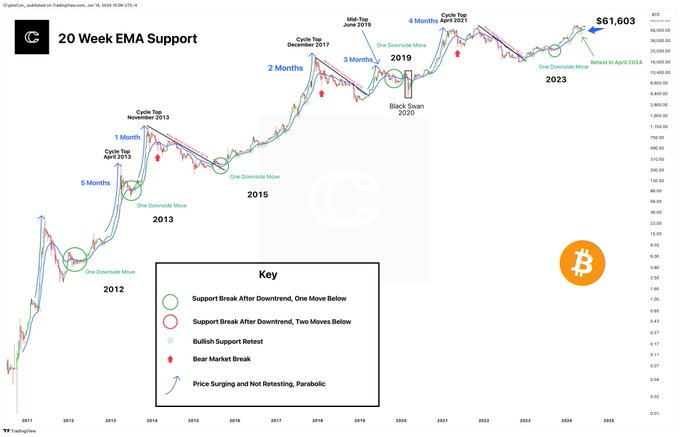

In keeping with CryptoCon’s evaluation, a crucial help degree that might closely affect market path has emerged on the 20-week exponential transferring common (EMA), presently at $61,603. The analyst highlighted that the state of affairs is now a ‘ready recreation’ to watch Bitcoin’s subsequent transfer.

“The quantity to observe: $61,603 in line with probably the most dependable wholesome help, the 20-week EMA. <…> It’s only a ready recreation,” the professional stated.

Historic impression of 20-week EMA

The 20-week EMA has traditionally been a dependable help degree throughout varied market cycles. For instance, Bitcoin noticed fast progress through the early bull run of 2012-2013, utilizing the 20-week EMA as a launching pad for increased costs. A notable retest of the EMA in April 2013 preceded one other substantial value surge.

Conversely, bear market phases equivalent to these in 2014-2015 and 2018-2019 witnessed Bitcoin breaking beneath the 20-week EMA, signaling extended downturns. For example, in late 2018, Bitcoin’s decline beneath the EMA led to an prolonged bearish interval till it regained help in early 2019.

In distinction, the sudden market crash triggered by the COVID-19 pandemic in 2020 briefly pushed Bitcoin beneath the EMA.

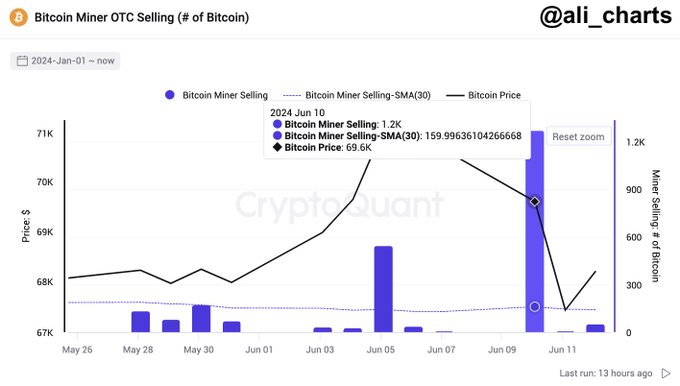

Breaking down Bitcoin’s sudden drop

Elsewhere, a number of theories have been proposed to elucidate the sharp drop in Bitcoin, which plummeted to as little as $65,000. For example, cryptocurrency analyst Ali Martinez steered in a put up on June 15 that current actions by miners could have contributed to the decline. Martizenz famous that miners bought over 1,200 Bitcoins, valued at greater than $79.20 million, which added to the downward stress.

Alternatively, crypto buying and selling professional Michaël van de Poppe identified that Bitcoin and the broader crypto market have been affected by a mix of hawkish indicators from the Federal Reserve, a robust greenback, and regulatory uncertainties.

The #Crypto markets proceed to drop, why?

This week was full of macroeconomic knowledge, which all turned out to be dangerous. Nevertheless, the Greenback continued its energy the earlier week, whereas Gold was sturdy too.#Bitcoin’s value motion was horrible, by which altcoins have…

— Michaël van de Poppe (@CryptoMichNL) June 14, 2024

Regardless of present value consolidation, general sentiment seems cautious but optimistic. That is supported by knowledge from Martinez indicating that traders are shopping for through the dip. Particularly, on the HTX crypto change, the Bitcoin Taker Purchase Promote Ratio spiked to 545, signaling bullish sentiment towards the main cryptocurrency.

In the meantime, Bitcoin is striving to maintain its value above $66,000 and goal $67,000. As of press time, Bitcoin was buying and selling at $66,210, reflecting a 24-hour correction of over 1%. On the weekly chart, it stays within the purple with a virtually 5% loss.

Disclaimer:The content material on this website shouldn’t be thought of funding recommendation. Investing is speculative. When investing, your capital is in danger.