Bitcoin (BTC) and the broader crypto markets are navigating difficult situations, traditionally worsened by September’s seasonality struggles.

In a latest report, Kaiko researchers just lately explored how a possible US fee minimize and different key financial occasions might have an effect on Bitcoin. These 4 charts offered by the analysts clarify what to anticipate from BTC within the coming weeks.

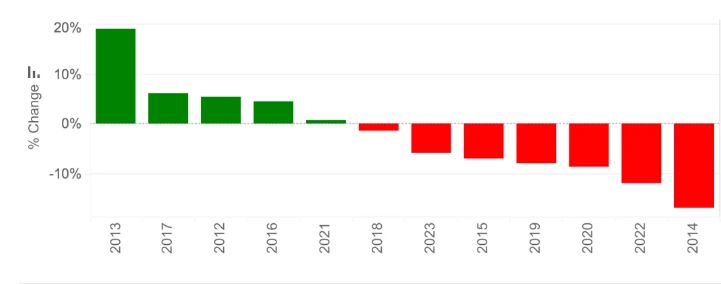

Month-to-month Change in Bitcoin Worth in September

As BeInCrypto reported, the third quarter has traditionally been difficult for Bitcoin and the broader crypto market, with September typically delivering the worst returns. Kaiko highlights that Bitcoin has declined in seven of the final twelve Septembers.

In 2024, this sample continues, with Bitcoin down 7.5% in August and 6.3% up to now in September. As of this writing, Bitcoin is buying and selling over 20% under its latest all-time excessive of almost $73,500, recorded greater than 5 months in the past.

Learn Extra: How To Purchase Bitcoin (BTC) and All the things You Want To Know

Bitcoin Worth September Efficiency Since 2012. Supply: Kaiko

Nevertheless, based on Kaiko Analysis, upcoming US fee cuts might present a lift to danger belongings like Bitcoin. Bitget Pockets COO Alvin Kan shares this stance.

“On the Jackson Gap assembly, Federal Reserve Chairman Jerome Powell hinted that it is likely to be time for coverage changes, resulting in expectations of future rate of interest cuts. The US Greenback Index responded by dropping sharply and is now fluctuating round 100. With a fee minimize in September turning into a consensus expectation, the official begin of fee minimize buying and selling might enhance general market liquidity, offering a lift to crypto belongings,” Kan informed BeInCrypto.

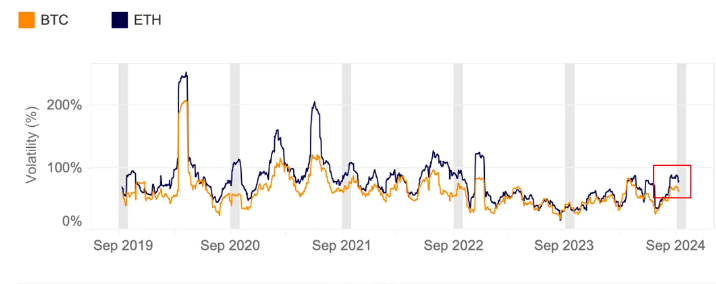

30-day Historic Volatility

In keeping with the report, September is shaping as much as be extremely risky, with Bitcoin’s 30-day historic volatility surging to 70%. This metric measures the fluctuation in an asset’s worth over the previous 30 days, reflecting how dramatically its worth has moved inside that interval.

Bitcoin’s present volatility is sort of double final yr’s ranges and is approaching the height seen in March, when BTC hit an all-time excessive of over $73,000.

Bitcoin and Ethereum 30D Volatility. Supply: Kaiko

Ethereum (ETH) has additionally skilled heightened volatility, surpassing each March’s ranges and Bitcoin’s, pushed by ETH-specific occasions reminiscent of Bounce Buying and selling’s liquidations and the launch of Ethereum ETFs.

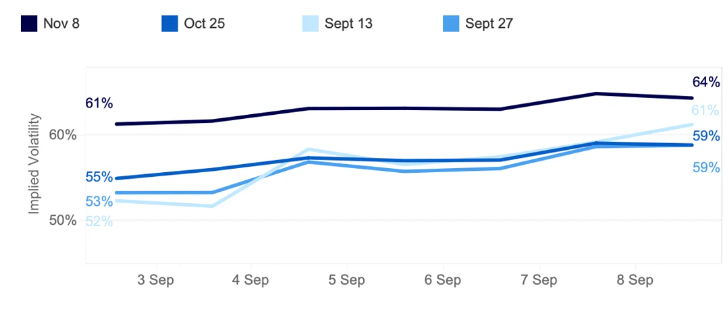

BTC Implied Volatility by Expiry

Because the begin of September, Bitcoin’s implied volatility (IV) has risen after dipping in late August. The IV indicator measures market expectations for future worth fluctuations based mostly on present choices buying and selling exercise. Greater IV means that merchants anticipate bigger worth swings forward, although it doesn’t specify the course of the transfer.

Notably, short-term choices expiries have seen the sharpest enhance, with the September 13 expiry leaping from 52% to 61%, surpassing end-of-month contracts. For the layperson, when short-term implied volatility exceeds longer-term measures, it signifies heightened market stress, known as an “inverted construction.”

Bitcoin Implied Volatility. Supply: Kaiko

Threat managers typically see an inverted construction as a sign of heightened uncertainty or market stress. In consequence, they could interpret this as a warning to de-risk their portfolios by decreasing publicity to risky belongings or hedging in opposition to potential draw back.

“These market expectations align with final week’s US jobs report, which dampened hopes for a 50bps lower. Nevertheless, upcoming US CPI knowledge might nonetheless sway the percentages,” Kaiko researchers notice.

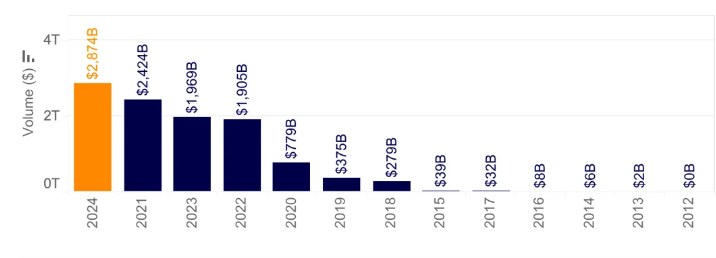

Commerce Quantity

The Bitcoin commerce volumes chart additionally highlights the present market volatility, exhibiting elevated dealer participation. Cumulative commerce quantity is nearing a document $3 trillion, up almost 20% within the first eight months of 2024 after its final peak in 2021.

Learn extra: Bitcoin (BTC) Worth Prediction 2024/2025/2030

Bitcoin Commerce Volums. Supply: Kaiko

Historically, Bitcoin buyers see a fee minimize as a constructive market catalyst. Nevertheless, issues stay about how the market may interpret a larger-than-expected minimize. Markus Thielen, founding father of 10X Analysis, cautions {that a} 50 foundation factors fee minimize could possibly be perceived as an indication of urgency, probably triggering a retreat from danger belongings like Bitcoin.

“Whereas a 50 foundation level minimize by the Fed may sign deeper issues to the markets, the Fed’s major focus might be mitigating financial dangers fairly than managing market reactions,” Thielen stated in a notice to purchasers.

Alongside fee minimize speculations, different elements contributing to crypto market fluctuations embrace the upcoming US elections. As BeInCrypto reported, the Donald Trump versus Kamala Harris debate is predicted to set off motion, significantly in Bitcoin and Ethereum.