This text was first printed in July 2022 and up to date in June 2024.

For a few years, the concept publicly traded companies may purchase Bitcoin for his or her reserves was thought of laughable. The highest cryptocurrency was thought of too unstable, too fringe to be embraced by any severe enterprise.

That taboo has been nicely and actually damaged, with plenty of main institutional traders shopping for up Bitcoin lately.

The floodgates first opened when cloud software program firm MicroStrategy purchased $425 million value of Bitcoin in August and September 2020. Others adopted go well with, together with funds processor Block and EV producer Tesla.

Per BitcoinTreasuries, public corporations holding Bitcoin now account for slightly below 1.5% of the whole provide of 21 million BTC.

1. MicroStrategy

MicroStrategy, a distinguished enterprise analytics platform, has adopted Bitcoin as its major reserve asset.

The agency, which produces cell software program and cloud-based companies, has aggressively pursued a Bitcoin shopping for spree, scooping up thousands and thousands of {dollars} value of the cryptocurrency. As of Might 2025, it holds 214,400 BTC in reserve, equal to $14.8 billion—greater than 1% of the whole variety of Bitcoin that can ever be issued.

At one level, MicroStrategy CEO Michael Saylor stated, he was shopping for $1,000 in Bitcoin each second. Within the firm’s Q1 2024 earnings name, Saylor claimed that the corporate’s adoption of a “Bitcoin technique” had enabled it to ship 10x to 30x the efficiency of rival enterprise software program corporations within the enterprise intelligence sector.

In April, @MicroStrategy acquired an extra 122 BTC for $7.8 million and now holds 214,400 BTC. Please be part of us at 5pm ET as we focus on our Q1 2024 monetary outcomes and reply questions concerning the outlook for #BusinessIntelligence and #Bitcoin. $MSTR https://t.co/h40yyrgEb0

— Michael Saylor⚡️ (@saylor) April 29, 2024

In contrast to different CEOs who sometimes draw back from discussing their private investments, Saylor has made it public that he personally holds 17,732 BTC—presently value over $1.2 billion.

Some have requested how a lot #BTC I personal. I personally #hodl 17,732 BTC which I purchased at $9,882 every on common. I knowledgeable MicroStrategy of those holdings earlier than the corporate determined to purchase #bitcoin for itself.

— Michael Saylor⚡️ (@saylor) October 28, 2020

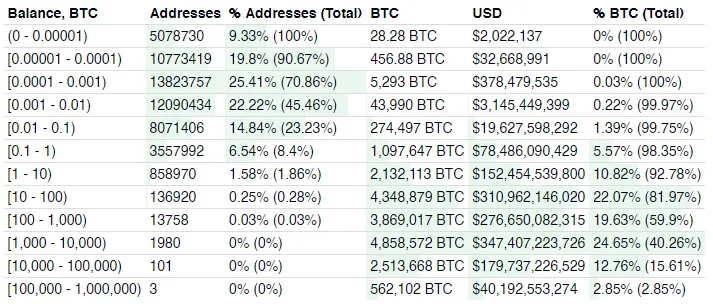

As per information from BitInfoCharts, this positions Saylor among the many prime 101 Bitcoin house owners—assuming his BTC is all held inside a single tackle. It’s one thing of an about-face for the MicroStrategy CEO, who in 2013 claimed that Bitcoin’s days had been numbered.

Bitcoin distribution by variety of addresses. Picture: BitInfoCharts

“We’re at first of the stage of fast institutional adoption of digital property within the type of Bitcoin,” Saylor stated throughout the firm’s Q1 2024 earnings name. He added that in future, Bitcoin gained’t compete in opposition to different crypto belongings, however in opposition to, “gold, artwork, equities, actual property, bonds, and different varieties of store-of-value cash in wealth creation, wealth preservation, and the capital markets.”

2. Marathon Digital Holdings Inc.

Bitcoin mining firm Marathon Digital, unsurprisingly, can be a big holder of Bitcoin, with 17,631 BTC in its company treasury (value round $1.23 billion as of Might 2024). The corporate, which goals to construct “the most important Bitcoin mining operation in North America at one of many lowest vitality prices,” originated as a patent holding agency (and was sometimes called a patent troll) earlier than its pivot into crypto mining.

As of Might 2024, Marathon Digital runs some 240,000 Bitcoin miners able to producing 29.9 EH/s, with a mean operational hash price of 21.1 EH/s.

The agency famous that it’s accelerating its development plans following the 2024 Bitcoin halving, in a bid to “mitigate the influence,” including that it hopes to double the dimensions of its mining operations in 2024.

Nevertheless, the agency missed its Q1 2024 income goal, citing challenges together with “sudden tools failures, transmission line upkeep and better than anticipated weather-related curtailments at Backyard Metropolis and different websites.”

3. Tesla

A Tesla Cybertruck. Picture: Shutterstock.

Electrical automobile producer Tesla joined the ranks of corporations holding Bitcoin in December 2020, with an SEC submitting revealing that the corporate invested “an combination $1.50 billion” in Bitcoin.

Tesla bought 10% of its Bitcoin holdings in Q1 2021; based on CEO Elon Musk, this was “to show liquidity of Bitcoin as an alternative choice to holding money on stability sheet.”

The corporate’s Bitcoin play adopted months of hypothesis, after CEO Elon Musk took to Twitter to debate the cryptocurrency. In late 2020, MicroStrategy’s Saylor supplied to share his “playbook” for Bitcoin investing with Musk, after arguing {that a} transfer into Bitcoin can be doing Tesla shareholders a “$100 billion favor.”

Nevertheless, Musk and Tesla have had an on-off relationship with Bitcoin. After asserting that Tesla would settle for funds in Bitcoin for its services and products in March 2021, simply two months later the CEO abruptly introduced that the corporate would now not settle for the cryptocurrency for funds.

Tesla & Bitcoin pic.twitter.com/YSswJmVZhP

— Elon Musk (@elonmusk) Might 12, 2021

Citing the “quickly growing use of fossil fuels for Bitcoin mining and transactions”, Musk revealed that the corporate would not be promoting any of its Bitcoin holdings, and would think about using it for transactions once more as soon as mining “transitions to extra sustainable vitality.” He later clarified that the corporate would resume utilizing Bitcoin for transactions as soon as miners are utilizing 50% clear vitality.

In July 2022, the corporate revealed that it had bought “roughly 75%” of its Bitcoin in its Q2 2022 quarterly replace, with its stability sheet displaying gross sales from digital belongings amounting to $936 million. In a name with analysts, Musk acknowledged that the agency did so as a way to shore up its money place within the face of uncertainty round COVID lockdowns. On the time, he added that the corporate is, “open to growing our Bitcoin holdings in future, so this shouldn’t be taken as some verdict on Bitcoin.”

As of Might 2024, the corporate holds 9,720 BTC in its portfolio (value round $677 million at present costs), per bitcointreasuries.org. The agency has maintained its Bitcoin place, with its Q1 2024 stability sheet displaying an estimated $184 million for each Q3 2023 and Q1 2024.

Musk has additionally emerged as a eager advocate of Dogecoin, with Tesla enabling Dogecoin purchases for some merchandise.

4. Hut 8 Mining Corp

Bitcoin mining agency Hut 8 holds 9,109 BTC, value round $644 million at present costs.

In June 2021, the corporate was listed on the Nasdaq World Choose Market underneath the HUT ticker, with the corporate’s SEC submitting noting that it is “dedicated to rising shareholder worth by growing the quantity and worth of our bitcoin holdings.”

The corporate additionally defined that it generates fiat revenue by leveraging its reserve of self-mined and held Bitcoin, “by way of yield account preparations with main digital asset prime brokerages.”

In November 2023, the agency merged with fellow Bitcoin mining firm US Bitcoin, with the post-merger agency billing itself as an “vitality infrastructure firm focusing on bitcoin mining and information facilities.” These mining facilities are based mostly at six websites in Alberta, Texas and New York, with a reported 7.5 EH/s of put in self-mining capability.

In its Q1 2024 outcomes, the agency reported income of $51.7 million for the quarter, a rise of 231% year-on-year.

This morning, Hut 8 introduced outcomes for the primary quarter of 2024. Income grew to $51.7 million, Web Revenue attributable to Hut 8 grew to $250.9 million, and Adjusted EBITDA grew to $297.0 million. We held 9,102 self-mined Bitcoin on our stability sheet as of the tip of the…

— Hut 8 (@Hut8Corp) Might 15, 2024

5. Riot Platforms, Inc.

One other crypto mining outfit, U.S.-based Riot Blockchain holds 9,084 BTC, value $643 million at at present’s costs.

With its valuation surging from beneath $200 million in 2020 to highs of over $6 billion in 2021, the Nasdaq-listed firm went on an aggressive growth drive. In April 2021, it spent $650 million on a one-gigawatt Bitcoin mining facility in Rockdale, Texas; describing the acquisition as a “transformative occasion” that might make the corporate the “largest publicly-traded Bitcoin mining and internet hosting firm in North America, as measured by complete developed capability.”

In April 2022, Riot revealed additional plans to broaden in Texas, with the announcement of an additional one-gigawatt mining facility in Navarro County. Following the 2022 crypto crash, CEO Jason Les advised Yahoo Finance that Bitcoin mining will “proceed to flourish in america,” and that “despite the fact that Bitcoin mining economics have gone down, there’s nonetheless large alternative right here.”

By January 2023, the agency had rebranded to Riot Platforms in a bid to diversify its enterprise mannequin, because the crypto mining trade struggled with an ongoing crypto winter and elevated vitality costs.

In early 2024, the agency warned shareholders that there was “no assure” the approaching Bitcoin halving would positively influence on its profitability. In June, the corporate was focused by quick vendor agency Kerrisdale, which argued that “Bitcoin mining is without doubt one of the stupidest enterprise fashions we have come throughout in our time quick promoting over the previous 15 years,” however its inventory worth rapidly recovered after initially dipping on publication of the report.

6. Coinbase World, Inc.

Arguably the best-known crypto agency on this listing, crypto change Coinbase went public in a landmark direct itemizing on the Nasdaq in April 2021.

Forward of its itemizing, in February 2021, Coinbase revealed that it held $230 million in Bitcoin on its stability sheet. By June 2024, it held 9,000 BTC in its treasury, value slightly below $642 million.

7. Galaxy Digital Holdings

Crypto-focused service provider financial institution Galaxy Digital Holdings holds 8,100 BTC. That’s down from the 16,400 BTC it held in July 2022, although the rise within the worth of Bitcoin since then signifies that the greenback worth of its holdings in June 2024 is simply shy of $578 million, versus the $357 million its stash was value two years earlier.

Based by Michael Novogratz in January 2018, the corporate has partnered with crypto companies together with Block.one and BlockFi. Novogratz is, unsurprisingly, a eager advocate for Bitcoin, arguing in March 2024 that the cryptocurrency would by no means dip beneath $50,000 once more, and months later predicting that it could soar to $100,000 by the tip of the yr.

Galaxy Digital is one among plenty of companies managing a U.S. spot Bitcoin ETF, following their landmark approval by the SEC in January 2024.

8. Block, Inc.

Alongside Tesla, Block, lit the fuse for institutional funding in Bitcoin with its October 2020 funding of $50 million within the cryptocurrency.

By June 2024, the agency held 8,027 BTC, value round $573 million. It’s, maybe, unsurprising, contemplating that CEO Jack Dorsey is an enthusiastic advocate for Bitcoin (even working his personal Bitcoin node).

Extra essential than Sq. investing $50mm in #Bitcoin is sharing how we did it (so others can do the identical): https://t.co/35ABYHuz4f

— jack (@jack) October 8, 2020

On the time of its preliminary funding, the corporate described it as “a part of Sq.’s ongoing dedication to bitcoin,” noting that “the corporate plans to evaluate its combination funding in Bitcoin relative to its different investments on an ongoing foundation.”

The agency has invested in Bitcoin expertise, launching its personal Bitcoin pockets and growing a Bitcoin mining ASIC chip. In April 2024, its cost companies subsidiary Sq. introduced that it could allow companies utilizing its Money App product to routinely convert a portion of day by day gross sales into Bitcoin.

In Might 2024, the agency introduced that it could reinvest 10% of its earnings from Bitcoin-related services and products into BTC, in a greenback value common (DCA) buy programme.

The corporate modified its identify from Sq. to Block in December 2021, in an obvious reference to the blockchain expertise that underpins Bitcoin. The rebrand adopted Dorsey’s announcement every week earlier that he was stepping down as Twitter CEO to give attention to the funds firm.

9. CleanSpark

U.S. Bitcoin mining agency CleanSpark holds 6,154 BTC, value round $439 million as of June 2024.

Forward of the 2024 Bitcoin halving, the agency expanded its operations, snapping up three Bitcoin mining amenities in Mississippi for $19.8 million, including as much as 2.4 EH/s to its mining capability. The corporate additionally added a 3rd facility in Dalton, Georgia to its line-up, including an extra 0.8 EH/s.

In June 2024, CleanSpark revealed that it had mined 417 BTC within the month of Might, claiming to have “outperformed trade expectations” in its first full month of manufacturing following the halving. The corporate added that it plans to additional broaden to a web site in Wyoming “within the coming days.”

10. Bitcoin Group SE

Germany-based enterprise capital agency Bitcoin Group SE brings up the rear of the listing, with comparatively modest holdings of three,830, value $275 million at present costs.

Its investments embrace crypto change Bitcoin.de and Futurum financial institution, which merged in October 2020 to type “Germany’s first crypto financial institution.”

The transfer adopted the German parliament’s determination to allow banks to promote and retailer cryptocurrencies, with Bitcoin Group SE managing director Marco Bodewein highlighting the chance to introduce the financial institution’s institutional traders to crypto’s “excessive returns and security options.”