Vyper, Ethereum’s Python-inspired sensible contract language for the Ethereum Digital Machine (EVM), not too long ago marked an anniversary. Nevertheless, chatter out of Devcon suggests its improvement staff is combating underfunding.

Conceived by Ethereum co-founder Vitalik Buterin in November 2016, Vyper got down to present an easier, safer various to Solidity.

Vyper’s clear, Python-inspired syntax prioritizes readability and restricts complicated options to attenuate vulnerabilities — a boon for builders targeted on writing safe and sturdy sensible contracts.

Curve Finance was a excessive profile utility of the language, and founder Michael Egorov took to his Telegram channel over the weekend to reminisce.

“I began utilizing Vyper in 2019 after I began creating Curve. Identical to in 2005 I fell in love with Python, identical occurred with Vyper,” Egorov wrote, noting that it’s “in all probability the easiest way to put in writing protected sensible contracts for [the] Ethereum ecosystem.”

Safety has all the time been a cornerstone of Vyper’s philosophy. It has usually loved a robust monitor report, although a 2023 high-profile exploit within the Vyper compiler triggered a whole lot of harm to Curve.

Learn extra: How DeFi customers are navigating post-Curve exploit panorama

Right now, Egorov famous, Vyper boasts a well-documented historical past of audits, with all reviews obtainable publicly on its GitHub repository. Vyper builders have additionally applied processes for managing vulnerabilities, as highlighted in its safety advisories.

The emphasis on transparency and public evaluations aligns with Ethereum’s broader ethos of decentralization and group belief.

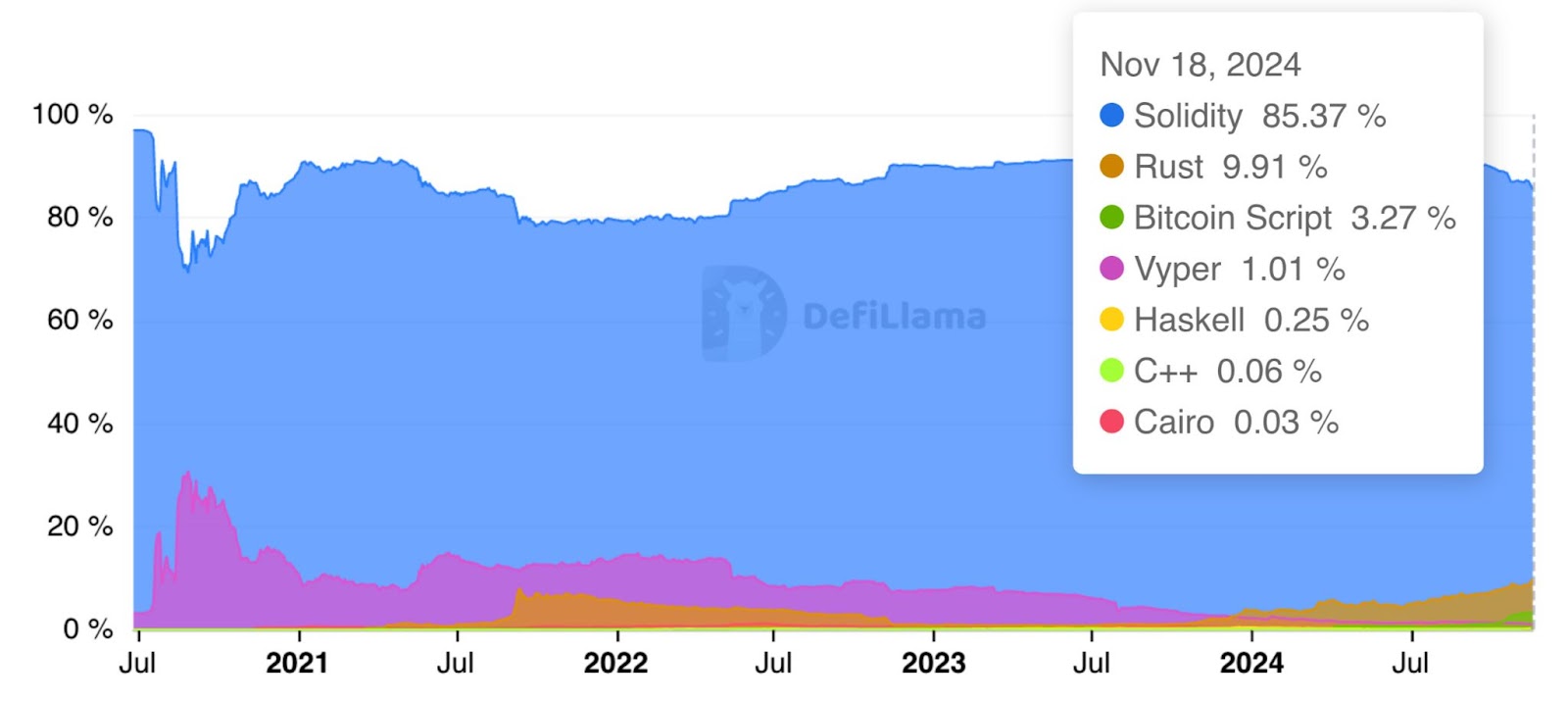

Vyper’s affect within the Ethereum ecosystem has seen a gradual decline over the previous few years. As soon as commanding a notable share of the full worth locked (TVL) in DeFi, Vyper peaked at 30% in August 2020.

DeFi TVL dominance by sensible contract language |Supply: Defillama

Its share has steadily eroded since, falling to 13.8% by early 2022, 7.6% by the beginning of 2023, and simply 2.2% in the beginning of 2024. As of this month, Vyper accounts for less than about 1% of DeFi TVL, illustrating how the language has struggled to keep up momentum in opposition to Solidity’s dominance.

Vyper and Solidity differ considerably in design philosophy and options. In distinction, Solidity’s JavaScript-like syntax is extra complicated however permits for better flexibility, catering to builders with expertise in conventional programming languages.

Solidity advantages from a mature and intensive ecosystem, with a variety of instruments, libraries and group assist, making it the usual for the overwhelming majority of Ethereum tasks.

This expansive tooling and the Web3 developer thoughts share round Solidity have probably contributed to this shift, though it should be famous Vyper’s decline mirrors the rise and fall of TVL inside Curve itself.

Regardless of its shrinking share, Vyper stays a invaluable possibility for security-focused tasks, at the same time as its affect in shaping Ethereum sensible contract improvement has waned over time.

Maybe it’s time for a reversal?

In response to Egorov, historical past affords an fascinating parallel: In 2005, Python was additionally a distinct segment language overshadowed by PHP and Java. Over time, Python’s readability and flexibility propelled it to dominate industries like AI and information science. Equally, Vyper’s deal with safety and readability may spark a renaissance as a future-proof language for the subsequent wave of dapps.

There are a ton of Python builders on the planet, a undeniable fact that Algorand is banking on to usher in a contemporary class of builders following the adoption earlier this 12 months of Python as its canonical language.

For Ethereum builders, Vyper might now serve a distinct segment viewers — these prioritizing safety and ease over intensive options. But, for tasks needing concise and safe sensible contracts, it stays a compelling possibility.