A brand new leveraged MicroStrategy ETF is firing on all cylinders as its belongings bounce and its inventory soars to a report excessive.

The T-REX 2X Lengthy MSTR Day by day Goal ETF has added over $82 million in belongings only a week after its launch. Based on Eric Balchunas, Bloomberg’s head of ETFs, these inflows place it within the prime twenty of all 515 funds launched this yr.

The fund, whose ticker is MSTU, has outperformed the Defiance Day by day Goal 1.75X Lengthy MSTR ETF, which launched in August.

That is wild, the 2x $MSTR ETF was launched per week in the past and already has $72m in aum (for context that places in prime 20% of the 515 ETFs launched this yr) regardless of the 1.75x $MSTR ETF having head begin and $357m (prime 8% of recent launches). Each have sturdy liquidity too. I did not… pic.twitter.com/t46B8UIBhm

— Eric Balchunas (@EricBalchunas) September 27, 2024

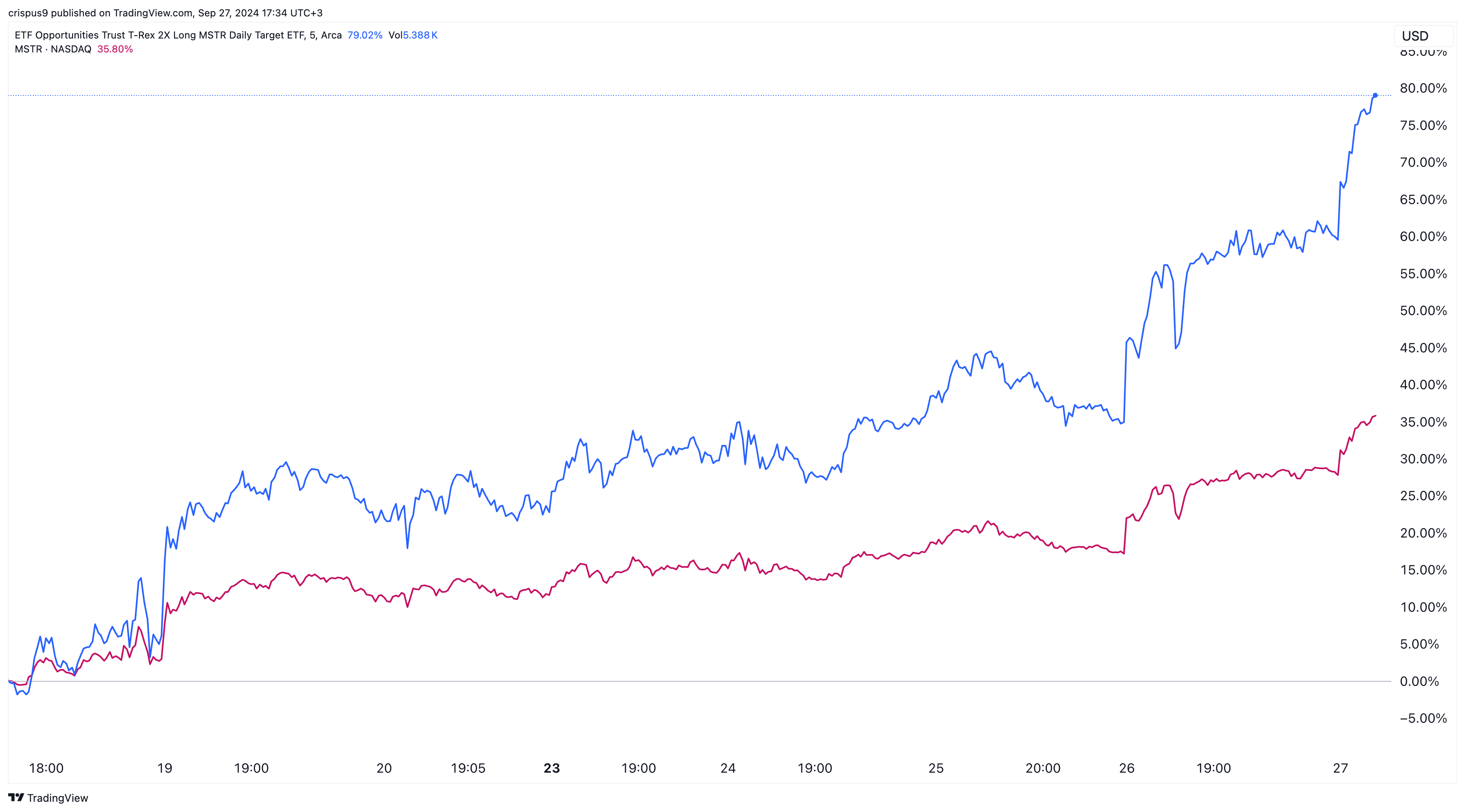

MSTU’s inventory surged to a report excessive of $44 on Friday, Sept. 27, 81% greater than its opening value, making it one in every of Wall Road’s best-performing belongings. It has additionally outperformed MicroStrategy inventory, which has risen by 35% over the identical interval.

MSTU vs MSTX ETF charts | Supply: TradingView

MSTU is a leveraged ETF that goals to realize 200% of the each day efficiency of MicroStrategy inventory. For instance, MicroStrategy shares rose by 6.6% on Friday, whereas the MSTU fund jumped by 13%.

Traditionally, leveraged funds carry out nicely when their underlying asset is in an uptrend and vice versa. As an illustration, the ProShares UltraPro ETF, a leveraged fund that tracks the Nasdaq 100 index, has risen by 373% during the last 5 years, whereas the ProShares UltraPro Quick QQQ has dropped by 98.8% in the identical interval.

You may also like: Michael Saylor reveals $1b in private Bitcoin holdings

Each MSTU and MSTX funds have benefited from MicroStrategy’s rebound amid the continued Bitcoin bull run. Bitcoin (BTC) rose to $66,000 for the primary time in two months, persevering with the surge that started earlier this month.

MicroStrategy shares usually outperform Bitcoin as a result of firm’s substantial holdings. The inventory has risen by 457% during the last 12 months, whereas BTC has jumped by 151% throughout the identical interval.

Final week, the corporate purchased extra cash price over $458 million, bringing its whole holdings to 252,220 price $16.7 billion.

Many analysts imagine Bitcoin will proceed rising, pushed by Federal Reserve rate of interest cuts forward of the upcoming U.S. basic election and Changpeng Zhao’s launch from jail.

Moreover, whales have continued accumulating Bitcoin whereas the exchanges’ balances have slumped to the bottom level this yr. Blackrock has continued accumulating Bitcoins, including 5,894 cash within the final three days.

You may also like: Leverage Shares debuts 3x leveraged MicroStrategy ETPs in Europe