At this time, benefit from the Lightspeed publication on Blockworks.co. Tomorrow, get the information delivered on to your inbox. Subscribe to the Lightspeed publication.

Howdy!

I made the error of going to the sixth Avenue Dealer Joe’s proper after work yesterday. I assumed I’d by no means make it out of the crush of enterprise informal or yoga gear-clad consumers.

My neighborhood grocery retailer barely ever will get packed, and also you additionally don’t hear individuals yapping into airpods about closing offers. Because of this Brooklyn is the very best borough. However I digress:

Post-mortem of a Solana NFT market

Yesterday, the longtime Solana NFT market Hyperspace introduced it might be closing up store on Sept. 17. It was the newest salvo in a drawn-out decline for the NFT area, which by no means actually regained its footing after the widespread crypto collapse of 2022.

Hyperspace launched in September 2021 as hype was rising across the nascent Solana blockchain, and SOL neared what continues to be an all-time excessive value. Again then, it was a Solana NFT monitoring software. In February 2022, shortly after NFT market OpenSea hit a $13.3 billion valuation, Hyperspace raised $4.5 million in a spherical led by Dragonfly and Pantera.

Within the time since, Hyperspace operated an NFT market and launchpad and added accessibility for the Sui and Avalanche blockchains. However Hyperspace by no means actually reached hyperspace.

Sources across the business — and Hyperspace’s personal co-founder — advised me that Hyperspace’s demise was attributable to an incapacity to discover a significant area of interest in an NFT market that by no means regained its vaunted 2021 standing.

Hyperspace co-founder Kamil Mafoud advised me he didn’t see the platform rising giant sufficient to justify venture-scale returns. He mentioned Hyperspace tried a number of instances to adapt, and the platform had discovered respectable success by “being scrappy.”

“However no less than for me personally as a founder, I don’t wish to be within the place of preventing the market. It’s a lot better for us to go assault a bigger market and develop that means,” Mafoud mentioned.

After I requested what this bigger market could be, Mafoud mentioned he and his group hadn’t but determined, however acknowledged that “NFTs are a a lot smaller TAM than nearly all different sectors inside crypto.”

That definitely appears to be the case. NFT buying and selling volumes stay a fraction of what they have been in 2021 and 2022. Fashionable NFT market Magic Eden plans to department out past NFTs. Prior to now handful of months, Starbucks, X and GameStop all shut down NFT initiatives whereas lawsuits rained down over ill-fated collections. There’s already a pretty-large graveyard of previous Solana NFT startups. Oh, and the SEC served OpenSea a Wells discover final week.

It makes you surprise how NFT platforms might be worthwhile companies nowadays.

Bangerz, an nameless contributor to NFT platform 3.land, mentioned perhaps NFT platforms must right-size their expectations.

“NFTs getting used as this large means for a mission to lift $$ to do one thing is tremendous tremendous over,” bangerz mentioned. “[A]rt is enjoyable, and tradition is enjoyable…NFTs are enjoyable once they’re not $300 lol.”

Mafoud mentioned one thing comparable once I requested him concerning the success of memecoins relative to NFTs.

“NFTs are a shortage factor,” Mafoud mentioned. “Which did very properly till they didn’t.”

Mafoud added that he might be remaining within the Solana ecosystem together with his subsequent enterprise, and that Hyperspace “misplaced some focus” on Solana whereas branching out to different chains.

— Jack Kubinec

Zero In

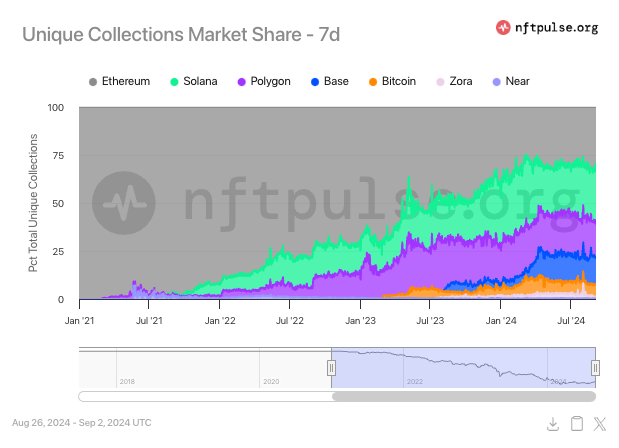

I’ve been NFT Pulse a superb bit these days. It has some actually well-aggregated NFT information.

Right here, you may see how Solana, Polygon and Base have clawed NFT market share away from Ethereum over the previous two years. In early 2021, the NFT market was principally all on Ethereum. At this time, Ethereum holds 33% market share whereas Solana is at 28%.

And regardless of the challenges dealing with NFT marketplaces, some venues are doing alright, notably on Solana. Magic Eden has seen $56 million in buying and selling income over the previous yr, whereas OpenSea and Tensor collected roughly $26 million and $12 million to spherical out the highest three, in response to NFT Pulse.

— Jack Kubinec

One Good DM

A message from Adam Gutierrez, senior developer help engineer at Phantom: