The metaverse was meant to herald a brilliant new future for humanity. With none apart from Mark Zuckerberg on the helm, it was alleged to welcome 5 billion customers and develop to $13 trillion, based on researchers at Citi.

Sadly, it seems that these analysts — and Metaverse cheerleaders — have been getting a bit of forward of themselves.

Zuckerberg’s metaverse division at Meta (previously Fb) misplaced $4.5 billion final quarter alone, including to its lifetime, $46 billion-and-counting metaverse losses. His flagship metaverse recreation for adults, Horizon Worlds, is embarrassingly well-liked with youngsters.

Equally, the crypto metaverse business — at the least when measured utilizing the costs of belongings like land parcels, metaverse currencies, and in-world characters — has all of the traits of a dazzlingly popped bubble.

Decimated digital land and asset costs

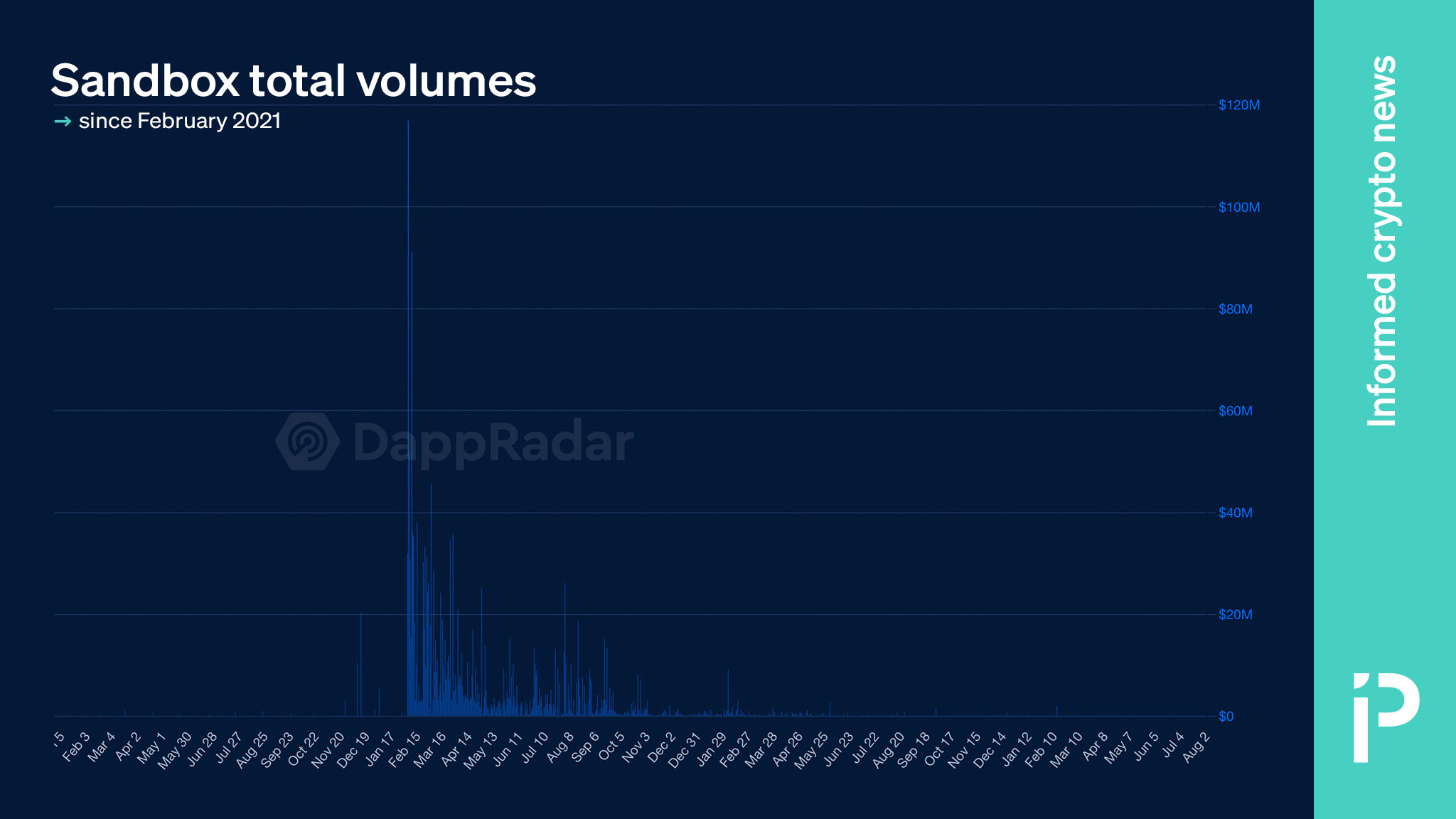

Contemplate The Sandbox, a metaverse as soon as price over $7 billion. As of August 8, its transaction volumes per DappRadar have been down 99.9% from its 2022 highs of $117 million, to lower than $8,000.

Sandbox complete volumes since February 2021.

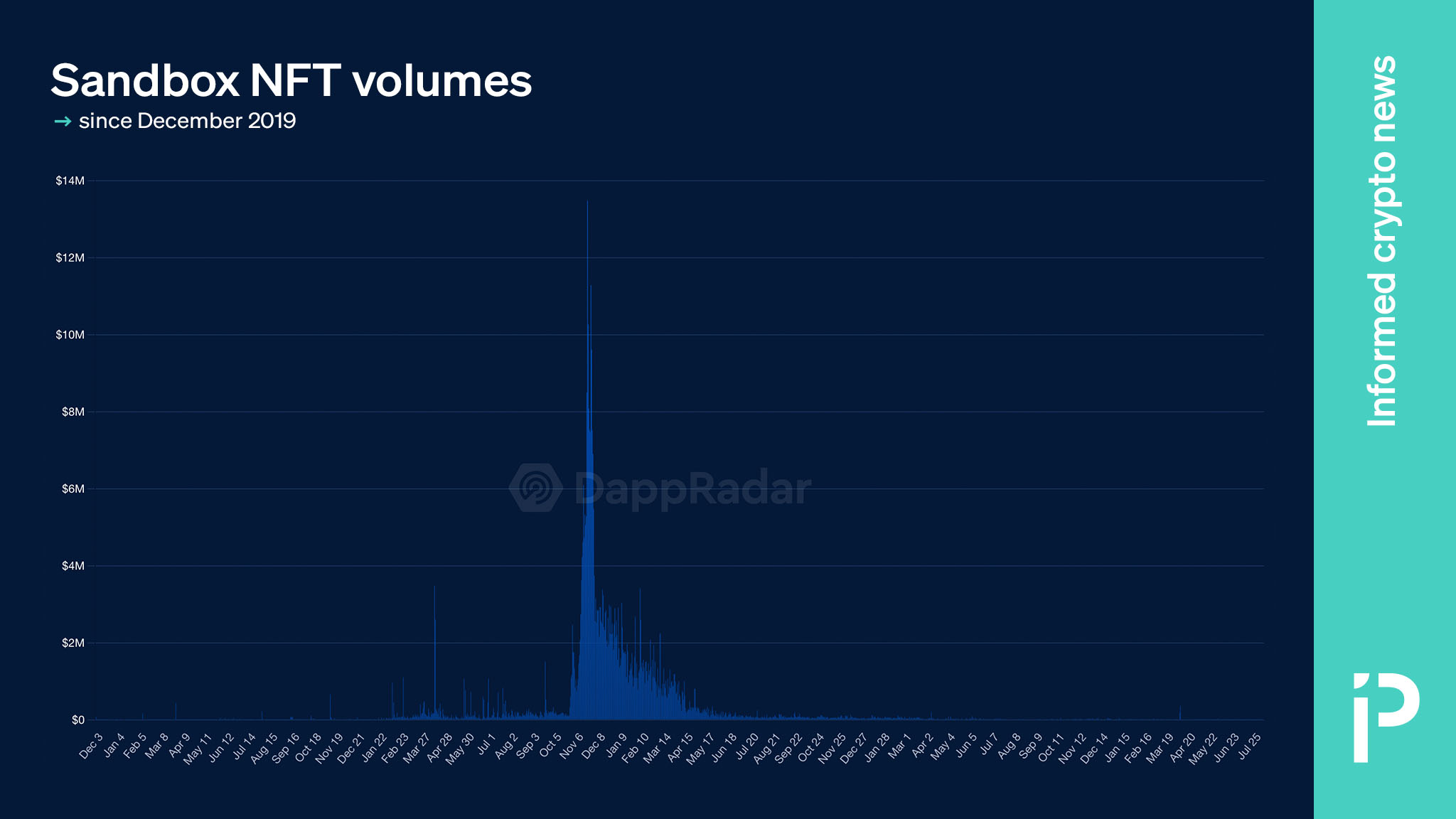

Zooming in on The Sandbox’s non-fungible token (NFT) gross sales doesn’t present any redemption. Its NFTs traded $10.2 million on November 24, 2021 alone. On any common day this August, NFTs from these collections traded lower than $10,000. That’s a decline of over 99.9%.

Sandbox NFT volumes since December 2019.

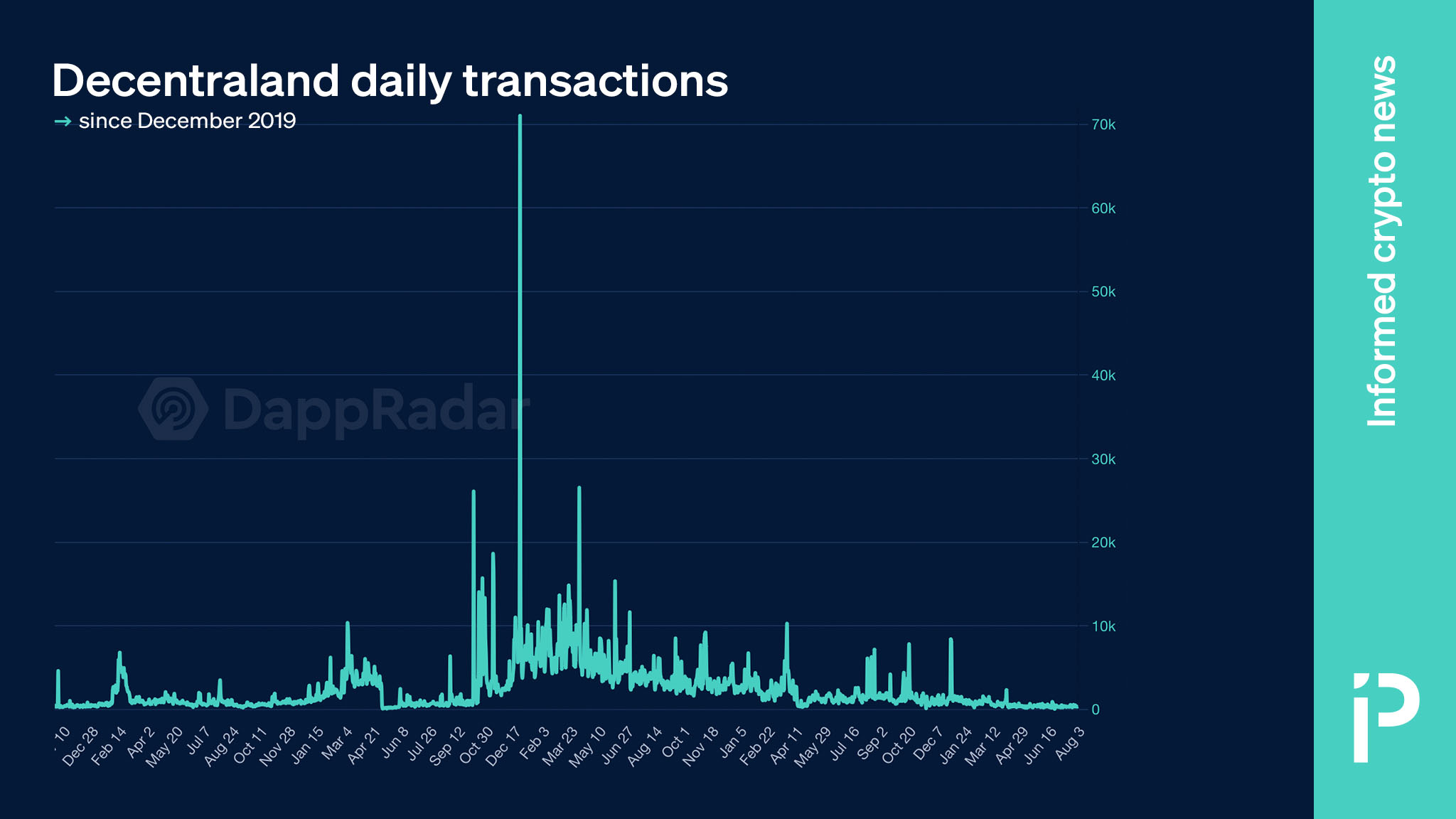

Then there’s, Decentraland, one of many oldest crypto metaverses. Its each day transactions have declined 99.9% from $2.5 million on November 29, 2021, to lower than $5,000 on a mean day this month.

Decentraland each day transactions since December 2019.

Different metaverse lands have suffered comparable humiliation. Axie Infinity buying and selling volumes are down 99% from practically $1 billion on September 30, 2021, to lower than $2 million in the present day. Metaverse transactions are down 99% from 672 on April 6, 2022, to lower than 5 on common this month. League of Kingdoms transactions are one thing of an outlier, down a ‘mere’ 90% from their March 19, 2022, all-time highs.

By virtually any measure, whether or not by distinctive lively wallets, NFT ground value, land parcel resales, pores and skin values, or in-game actions, crypto metaverses are much less well-liked virtually with out exception than in 2021 and 2022.

Learn extra: The NFT market bubble has popped and we’ve bought the charts to show it

Metaverse currencies and governance tokens down 90%

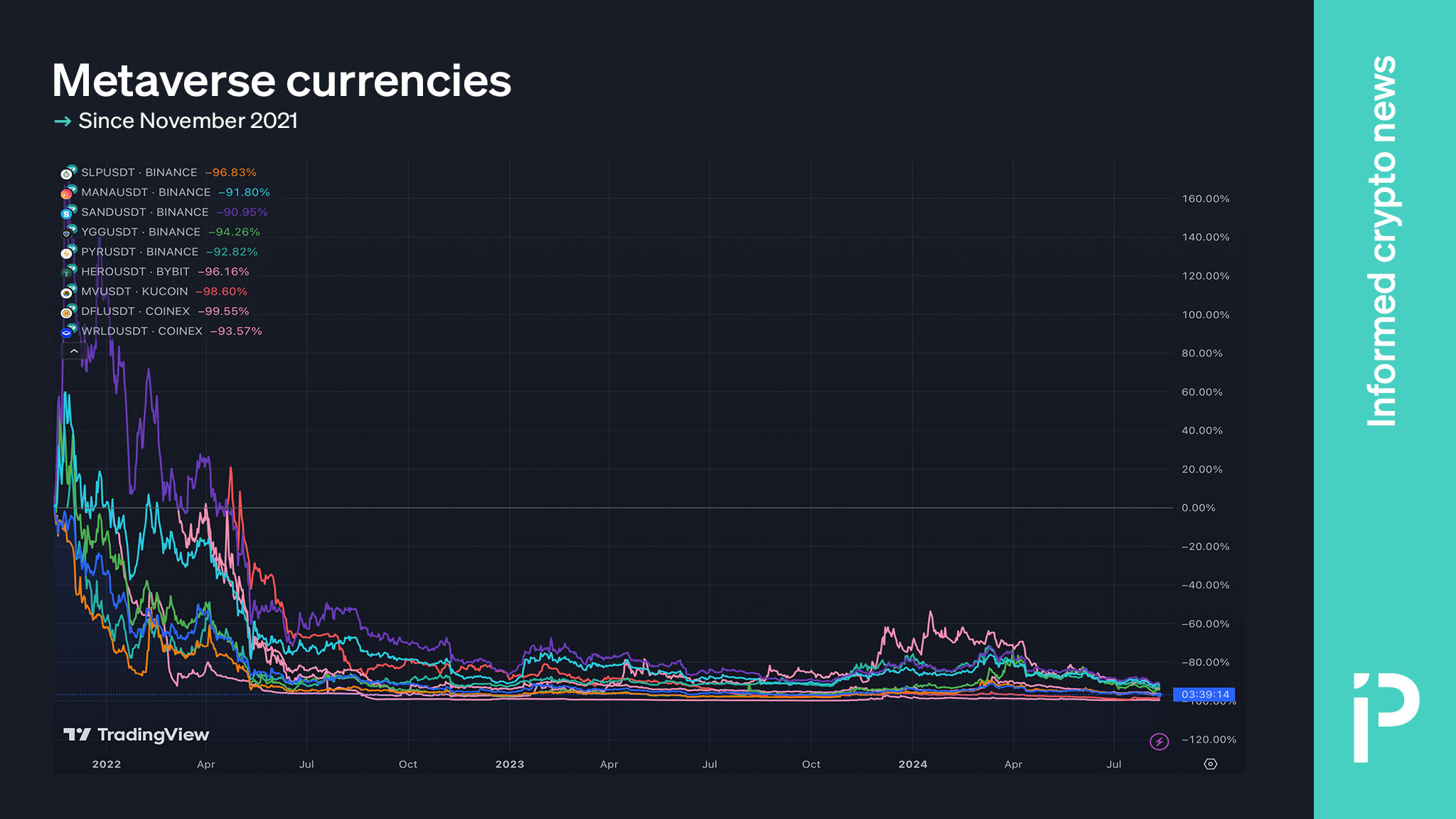

Following the ICO mannequin that started with MasterCoin and NextCoin in 2013, many crypto metaverses bought a proprietary token to function an in-game forex and governance token. Nearly all of those metaverse tokens are, like person engagement statistics inside digital worlds, down at the least 90% from their highs.

A chart of varied metaverse currencies from mid-November 2021 to in the present day reveals declines exceeding 90%. Decentraland’s MANA, Axie Infinity’s AXS and SLP, The Sandbox’s SAND, Yield Guild Video games’ YGG, Vulcan Cast’s PYR, Metahero’s HERO, GensoKishi Metaverse’s MV, DeFi Land’s DFL, and NFT World’s WRLD have all declined over 90% since mid-November 2021.

Metaverse currencies since November 2021.

Regardless of two years of decay, there are nonetheless believers within the metaverse — particularly Bloomberg’s #3 ranked billionaire, Mark Zuckerberg. With 10X extra wealth personally than the mixed market capitalization of all CoinMarketCap-categorized metaverse tokens, Zuckerberg and his Actuality Labs division at Meta are seemingly undeterred of their dedication to creating Horizon Worlds a hit.

As with every bubble-popped business, there will probably be uncommon survivors. Even eBay and Amazon emerged from the dot-com bubble as victors. Usually talking, the mixed market capitalization of over 100 CoinMarketCap-categorized metaverse belongings has declined from $50 billion on November 25, 2021, to $16 billion.

If this crypto sector is to stage a comeback, it should definitely be an extended journey.