Think about you personal an funding property: a worthwhile asset that’s simply sitting there.

Someday you checklist your property on Airbnb, so you may earn further earnings. You continue to personal the property, however now it’s working for you, incomes cash whilst you sleep – by giving visitors a spot to sleep.

Coinbase Wrapped Bitcoin (cbBTC) is like that funding property.

For those who’ve already invested in bitcoin (your long-term “funding property”), you may convert it to a type that’s appropriate with Ethereum (like changing to a rental property). This allows you to use your bitcoin in new methods to earn further earnings.

On this information, you’ll discover ways to convert your BTC to cbBTC, how you can use it to earn cash whilst you sleep, and the most important funding alternative unlocked by cbBTC.

How one can Purchase cbBTC

You don’t “purchase” it within the conventional sense: you exchange bitcoin you already personal into cbBTC. Right here’s how.

Step 1: Personal Bitcoin on Coinbase. To start out utilizing cbBTC, you have to maintain bitcoin in your Coinbase account. (See our information right here.) For those who don’t have bitcoin but, you may simply buy it on Coinbase by way of the app or web site.

Step 2: Convert BTC to cbBTC. After getting bitcoin in your Coinbase pockets, you switch your bitcoin to an handle on both the Ethereum or Base community. This switch mechanically converts your bitcoin to cbBTC at a 1:1 ratio, which helps you to use it with many DeFi purposes.

Observe: You continue to personal the bitcoin! It’s like changing an funding property right into a rental property.

Step 3: Retailer and Handle cbBTC. Your cbBTC will be saved in any Ethereum-compatible pockets, together with Coinbase Pockets. It’s also possible to handle and commerce cbBTC on decentralized exchanges (DEXs) like Uniswap, Aerodrome, and Curve.

Observe: For those who promote the cbBTC, or commerce it for an additional token, that is like promoting your rental property. You promote the underlying BTC, and obtain money (or one other token) in return. You additionally pay taxes on the transaction.

How one can Earn Revenue with cbBTC

You may’t earn cash simply by holding cbBTC, as a result of 1 BTC = 1 cbBTC. As a substitute, you earn cash by making your BTC extra helpful.

With cbBTC, you’re changing your bitcoin to an Ethereum-compatible ERC-20 token, which suggests you may put your bitcoin to work on DeFi web sites. Listed here are the three hottest methods to earn:

1. Lending cbBTC (Aave, Compound)

1. Lending cbBTC (Aave, Compound)

Lending cbBTC is like depositing your cash in a financial savings account at a financial institution. The financial institution lends out your cash, and pays you curiosity in return.

While you ship bitcoin to platforms like Aave or Compound, you’re depositing your cbBTC right into a lending pool. This pool is on the market for different customers to borrow from, by offering their very own crypto as collateral. In return, you earn curiosity, which is paid by the debtors.

Right here’s the way it works:

Deposit your cbBTC into the lending pool. From Coinbase, you ship your bitcoin to a sensible contract on Aave, Compound, or related platforms. This contract holds your cbBTC together with different customers’ deposits, making a pool of belongings that may be borrowed. In return, you obtain a “receipt token.”

Earn curiosity in your deposit. As debtors take out loans from the pool, they pay curiosity. That curiosity is distributed proportionally amongst all of the lenders within the pool, together with you. The speed of curiosity can fluctuate based mostly on the provision and demand for cbBTC loans at any given time.

Withdraw at any time. You may withdraw your bitcoin from the pool at any time, together with any curiosity you’ve earned, by sending your receipt token again to the unique good contract handle.

Profit: Aave and Compound allow you to earn curiosity earnings in your cbBTC with out promoting it. They’re each trusted platforms which can be usually secure to make use of.

Dangers: The rates of interest fluctuate based mostly on market situations. Moreover, whereas the platforms are decentralized, there are nonetheless small dangers of good contract bugs or vulnerabilities.

2. Offering Liquidity with cbBTC (Uniswap, Curve)

2. Offering Liquidity with cbBTC (Uniswap, Curve)

Think about proudly owning a small foreign money alternate sales space the place you revenue from individuals swapping currencies.

By offering cbBTC (together with one other token) to liquidity swimming pools on decentralized exchanges like Uniswap or Curve, you allow others to commerce. In return, you earn a portion of the buying and selling charges.

Right here’s the way it works:

Deposit cbBTC and one other asset right into a liquidity pool. You have to provide two belongings in equal worth—for instance, BTC and ETH—right into a single good contract handle on Uniswap or Curve. This pool holds each belongings, and facilitates trades between them for different customers on the platform.

Obtain Liquidity Supplier (LP) Tokens. In alternate for offering liquidity, you obtain LP “receipt” tokens that symbolize your share of the pool. You may redeem them at any time to get again your authentic deposit, plus any charges earned, by sending them again to the unique good contract handle.

Earn charges on each commerce. Every time somebody makes use of the pool to swap between cbBTC and the opposite asset (e.g., ETH), they pay a small charge. This charge is distributed proportionally to all of the liquidity suppliers (LPs) within the pool, together with you. The extra they commerce, the extra you earn.

Profit: You earn a share of buying and selling charges within the pool, supplying you with a gentle supply of earnings so long as individuals commerce.

Threat: There’s a danger of impermanent loss, the place the worth of the belongings you’ve deposited modifications in comparison with whenever you initially added them to the pool. (See our information right here.) Moreover, there’s a small danger of good contract bugs or vulnerabilities, although Uniswap and Curve are usually secure.

3. Incomes Yield with cbBTC (Mellow, Veda)

3. Incomes Yield with cbBTC (Mellow, Veda)

Utilizing yield vaults is like placing your cash in an funding fund. The fund managers (on this case, automated algorithms) transfer your cash between totally different alternatives to get you the best potential return, with no need to handle it your self.

Yield vaults like Mellow and Veda are DeFi platforms that transfer your cbBTC between varied lending platforms, liquidity swimming pools, and different methods, optimizing for the best yield. Basically, they do the arduous work of discovering the perfect methods to earn earnings in your cbBTC, so that you don’t must.

Right here’s the way it works:

Deposit your cbBTC right into a yield vault. You begin by sending your bitcoin from Coinbase right into a yield vault’s good contract. You’ll obtain vault tokens: a “receipt” that can be utilized to trace the worth of your deposit because it grows over time.

Earn yield in your cbBTC. As your cbBTC is deployed throughout totally different DeFi methods, you earn yield within the type of curiosity, buying and selling charges, or rewards. The vault reinvests these earnings, compounding your returns over time.

Withdraw at any time. You may withdraw your cbBTC and the earned yield by redeeming your vault tokens (e.g., sending them again to the unique good contract). The worth of your withdrawal will embrace the unique bitcoin you deposited, plus any income the vault has generated.

Profit: Yield vaults present a hands-off solution to maximize your returns, permitting you to earn the best potential yield with out actively managing your cbBTC.

Threat: Greater returns usually include increased dangers. Yield vault methods can contain risky DeFi protocols, and there’s all the time a danger of good contract vulnerabilities or sudden market modifications impacting your returns.

Keep in mind, whereas these strategies can probably generate earnings, in addition they include dangers. At all times analysis completely and solely make investments what you may afford to lose. Moreover, remember that you just’ll have to pay taxes on any further earnings you earn (e.g., whenever you convert cbBTC again to BTC).

Wrapped Bitcoin (wBTC) vs. Coinbase Wrapped Bitcoin (cbBTC)

Each Wrapped Bitcoin (WBTC) and Coinbase Wrapped BTC (cbBTC) enable bitcoin holders to make use of their BTC in Ethereum-compatible DeFi apps. Nonetheless, there are necessary variations between the 2.

Custody and Belief: WBTC is managed by a consortium, led by BitGo, whereas cbBTC is absolutely backed and managed by Coinbase. WBTC has confronted issues over governance modifications, whereas cbBTC advantages from Coinbase’s established fame because the main “bitcoin financial institution.”

Conversion Course of: WBTC conversion requires third-party retailers to wrap and unwrap bitcoin, which may take longer. In distinction, cbBTC gives a direct, seamless conversion built-in with Coinbase, making the method a lot quicker and easier.

Blockchain Assist: WBTC is primarily used on Ethereum, whereas cbBTC is on the market on each Ethereum and Base (Coinbase’s layer-2 community), with plans to increase to extra chains sooner or later. This implies cbBTC can be cheaper and simpler to make use of.

Adoption and Use Circumstances: WBTC has been extensively adopted in DeFi since 2019 and is built-in with many platforms. cbBTC is newer, however supported by main DeFi apps from day one and is anticipated to develop shortly as a result of Coinbase’s massive consumer base.

The Greatest Investing Alternative

Maybe the perfect funding of all is just shopping for Coinbase inventory ($COIN).

The corporate is excess of a crypto alternate: it’s the main “bitcoin financial institution,” holding almost 1 million bitcoin (at the moment valued at over $57 billion). It’s the largest custodian for bitcoin ETF suppliers, and the corporate has over 100 million customers worldwide.

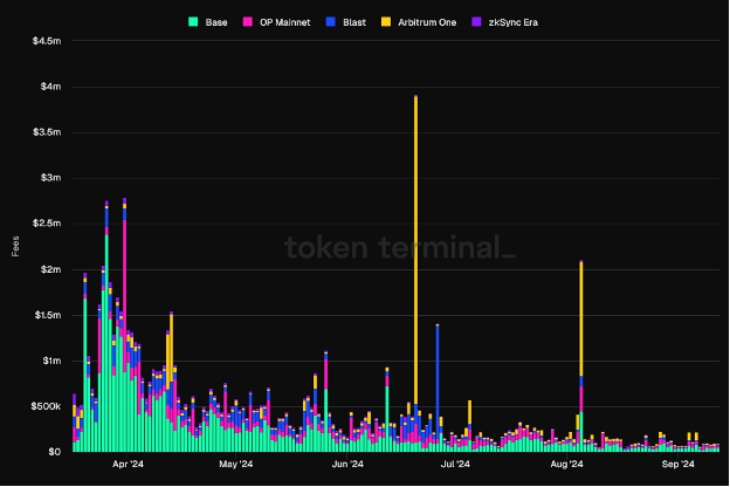

With cbBTC, Coinbase is constructing the infrastructure to permit prospects to earn earnings with their bitcoin. It’s more likely to turn into the most important “wrapped bitcoin” resolution available on the market, simply as Coinbase’s layer-2 expertise Base has turn into the highest layer-2 by charges and income:

Coinbase has over a decade of expertise in securely managing billions in bitcoin. And as a publicly-traded firm, Coinbase gives transparency and regulatory compliance.

It’s now simpler to transform your funding property (BTC) right into a rental property (cbBTC), and earn further earnings whilst you sleep. However don’t neglect the financial institution that’s underwriting your mortgage (Coinbase). Shopping for $COIN inventory is an funding alternative in itself.