At present, benefit from the On the Margin publication on Blockworks.co. Tomorrow, get the information delivered on to your inbox. Subscribe to the On the Margin publication.

Welcome to the On the Margin Publication, delivered to you by Ben Strack, Casey Wagner and Felix Jauvin. Right here’s what you’ll discover in in the present day’s version:

- Felix shares his takeaways from yesterday’s Fed reduce, and the FOMC’s future financial/charge projections.

- A former president walks right into a bar and buys burgers…with bitcoin. Huge deal, or no?

- What analysts and execs are saying in regards to the newest 50bps charge reduce, and a have a look at what to look at for subsequent.

Digging deeper into yesterday’s FOMC assembly

And so concludes probably the most unsure Federal Open Market Committee (FOMC) assembly of the previous decade. Going into the assembly, implied chances have been evenly break up between the Fed going for a reduce of 25 foundation factors and 50bps.

Because it turned out, the Fed went for a 50bps discount with a 10-1 vote. The one dissenting vote, from Governor Michelle Bowman, was the primary governor dissent since 2011. Contemplating Fed president speeches proper earlier than the blackout interval, I’d have anticipated extra dissent, as many have been speaking up going for 25bps.

The one factor we do know, nonetheless, is that Powell will get what he desires and he’s a professional at consensus constructing. So 50bps it’s, for the primary charge reduce since March 2020.

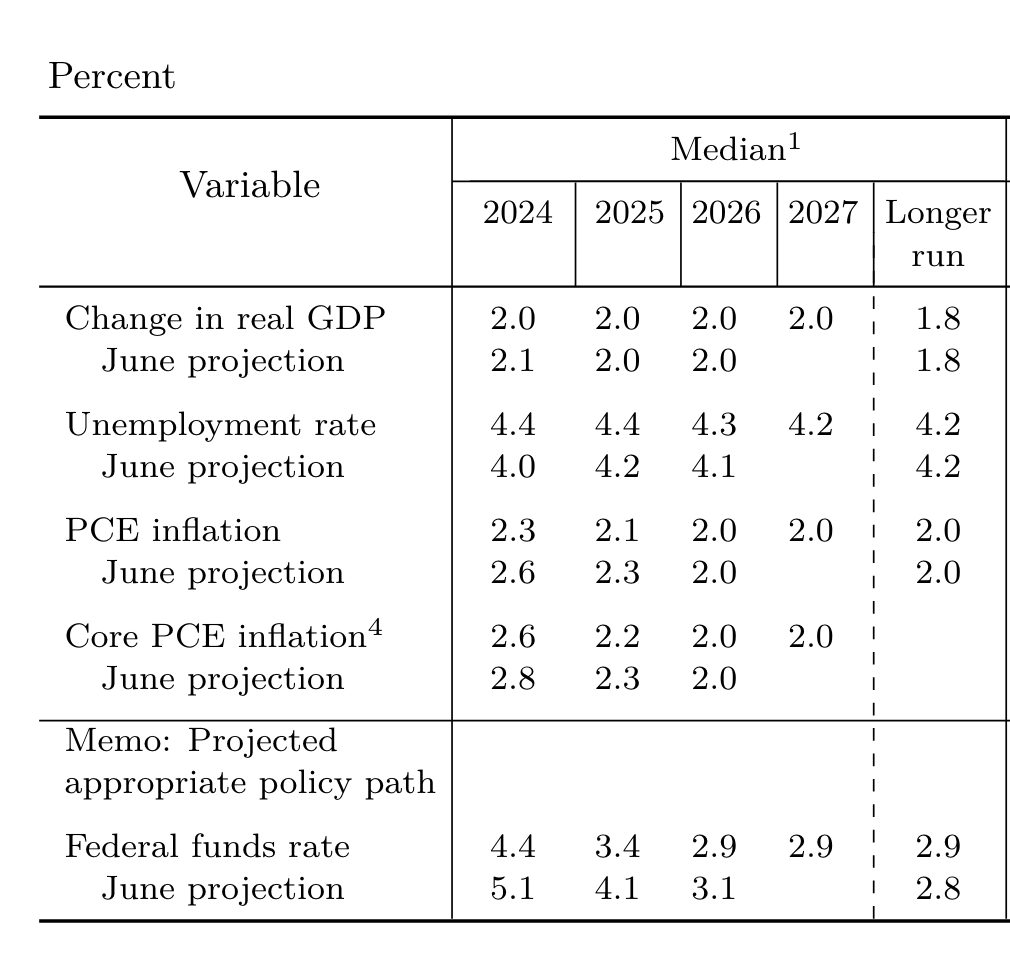

Setting apart the speed determination, we additionally obtained the quarterly replace on the FOMC’s Abstract of Financial Projections (SEP) that features its economist forecasts and projection of the federal funds charge.

Let’s dig into the financial forecast first:

- The FOMC revised its end-of-year forecast for the unemployment charge (UR) from 4% to 4.4%, anticipating it to stay flat in 2025 earlier than lowering in 2026. Contemplating we’re already at 4.2%, and it was at 4.3% only a month in the past, I discover this forecast to be a bit complacent and optimistic. The UR tends to development and has excessive momentum, so when it begins going it tends to proceed larger. To suppose it can simply go up a few foundation factors from right here appears unlikely. However much like the June SEP, throughout which they forecasted 4%, the FOMC may very well be setting itself up for additional easing given the committee has mentioned they don’t welcome additional labor market weak point. This may very well be considered because the strike value of the Fed put, by which any shock uptick within the UR will result in additional ratcheting up of easing.

- I discover the shortage of change on the Fed’s GDP forecast stunning. To suppose we’ll simply sit at 2% for the subsequent 4 years is just ridiculous. I’d view this because the FOMC simply not having a transparent learn on financial progress from right here.

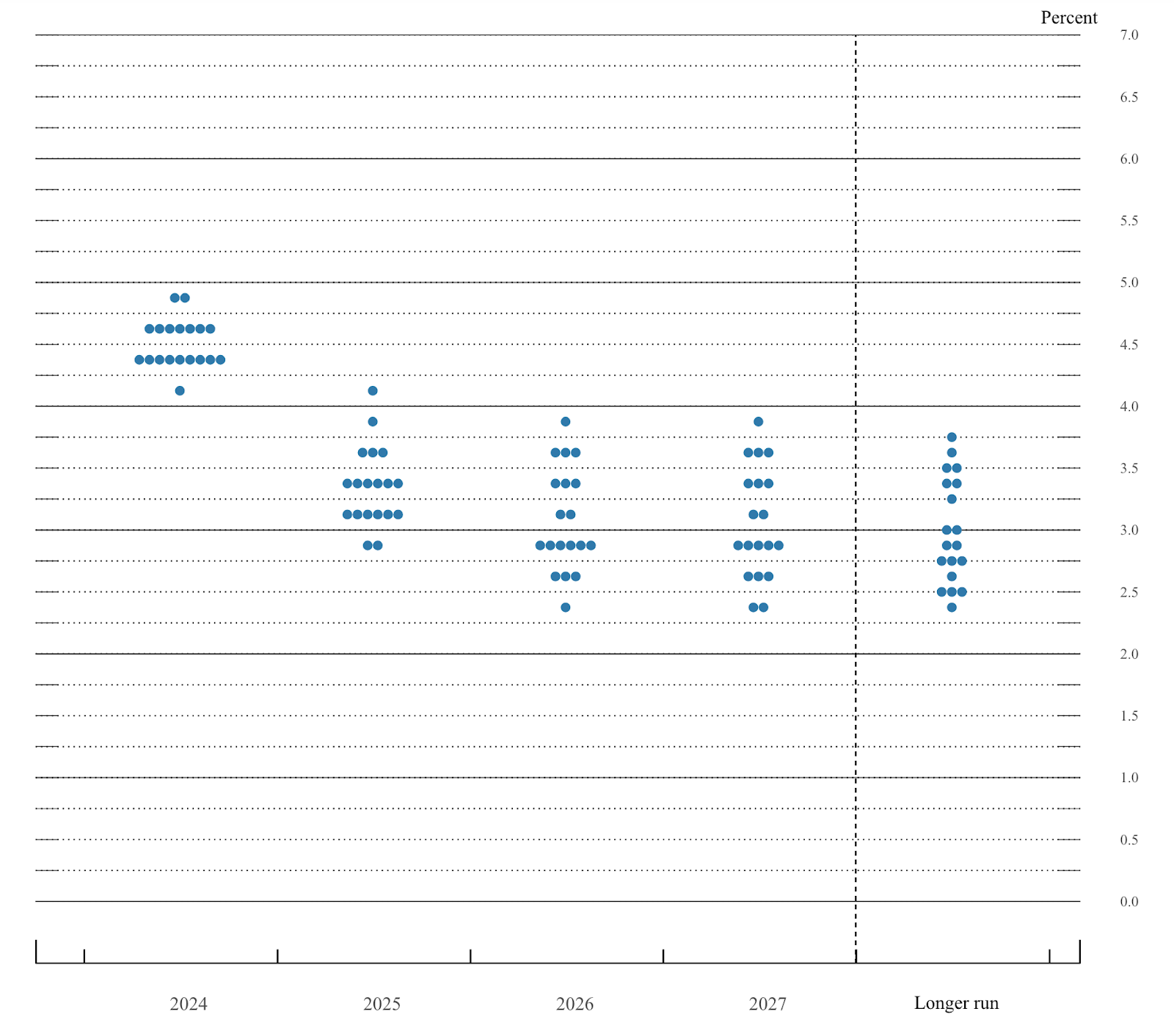

That uncertainty across the path from right here on out can be mirrored within the FOMC’s dot plot forecast of future rates of interest:

The dispersion in views of the place the federal funds charge shall be is large, and that dispersion will get wider as we get additional into the long run.

Some FOMC members see the funds charge netting out round 3% in 2025 — what many see because the post-pandemic impartial charge. Nonetheless, others truly view us to be under that impartial charge, which might indicate an accommodative financial coverage.

Into the extra distant future, the FOMC expects us to settle someplace between a spread of two.5% and three.75%.

General, yesterday’s assembly emphasizes a couple of issues:

- The FOMC doesn’t welcome any additional weak point within the labor market. Contemplating the place inflation stands, it’s prepared and keen to go massive on easing if want be to make sure this happens.

- The committee is very unsure in regards to the medium-term outlook, and there’s a giant dispersion in economist forecasts with respect to the place the financial system goes from right here.

- The FOMC’s trajectory of cuts is much less aggressive than what the market has priced in, though not by as a lot as some had thought.

— Felix Jauvin

49

The variety of days till the subsequent FOMC assembly, set for Nov. 7.

Sure, the 50bps discount occurred simply 24 hours in the past. However it’s all the time good to maintain wanting forward, proper? The countdown is particularly related given the Fed is predicted to chop rates of interest once more this 12 months.

Committee member projections printed Wednesday present the median rate of interest goal by the tip of 2024 falling within the 4.25%-4.5% vary — 50bps decrease than the present degree.

The BTC transaction heard ’around the world (or at the least Crypto Twitter)

Stopping into an NYC bar on a Thursday evening is hardly groundbreaking. However Republican presidential nominee Donald Trump turned it right into a historic occasion when he made a purchase order utilizing bitcoin at crypto hotspot PubKey.

PubKey — a so-called “bitcoin-themed bar” in Greenwich Village (they’ve a reside ticker displaying BTC’s value and an indication proclaiming “central financial institution digital currencies enslave”) — obtained the primary cost made in bitcoin by a former US president (and his aides).

Trump paid roughly $950 in bitcoin for a spherical of burgers and eating regimen cokes. The transaction was largely hands-off for Trump, as in he didn’t seem like the one holding his gadgets. See right here for a video.

There was some confusion as to why the transaction appeared to take longer than regular. The delay was brought on by the numerous digital camera flashes making a glare on the display screen, plus the bill having been left open for some time in preparation for Trump’s arrival, based on Will Cole, head of product at bitcoin funds firm Zaprite.

No matter whether or not or not Trump truly knew the best way to pay in bitcoin (or if he even cared in regards to the transaction within the first place) appeared irrelevant to his bitcoin-maxi followers. Final evening’s occasion was largely hailed on Crypto Twitter as an enormous success and turning level for an trade that has felt misunderstood and focused by the federal government and public.

We’re 47 days out from the election, so we should see if Trump releases a proper crypto coverage plan or shares plans to nominate crypto-focused cupboard members.

— Casey Wagner

Analysts, execs digest the Fed charge reduce

We wrote in regards to the Fed charge reduce moments after it occurred yesterday, and Felix gave precious further perception above.

However how are trade analysts and executives digesting the transfer? The consensus appears to be: We should control what has to date been a tailwind for crypto, as the long term financial outlook stays unsure.

Bitcoin has jumped about 6% for the reason that FOMC revealed the 50bps reduce — going from about $60,000 at 2 pm ET yesterday to roughly $63,600 simply 24 hours later.

As Bybit’s Chris Aruliah identified: Decrease rates of interest typically drive extra funding into riskier belongings like crypto, due partly to the diminished returns from conventional funding automobiles.

“Nonetheless, the broader world financial slowdown stipulated by softer financial indicators and geopolitical complexities is tempering investor sentiment,” he mentioned in an announcement.

Whereas the speed reduce provided a “short-term enhance” to crypto markets, Aruliah added, “it’s essential to stay vigilant relating to the potential challenges posed by financial uncertainty and market fluctuations.”

Ruslan Lienkha, chief of markets at YouHodler, gave an analogous warning.

The reduce is favorable for fairness markets and provides a “risk-on sign” for merchants within the quick time period, he defined. It might even push BTC nearer to its all-time excessive (above $73,000, reached in March).

However the transfer, as some indicated prior, may very well be seen as an “emergency measure” that implies the Fed “misjudged the optimum timing for relieving,” Lienkha added.

“Over the subsequent three months, it can turn out to be clearer whether or not the Fed can information the financial system towards a smooth touchdown and keep away from a recession on this cycle.”

To that time, yesterday was doubtless simply the primary of a number of anticipated cuts.

Fed Chair Jerome Powell mentioned at yesterday’s presser that the Fed is “not on any pre-set course,” including that charge choices can be made assembly by assembly based mostly on evolving financial knowledge.

The US central financial institution “has quite a bit going for it” by way of averting a deep recession, mentioned FalconX analysis head David Lawant.

“This cooldown commences from a relatively elevated rate of interest baseline, family steadiness sheets seem comparatively strong, and inflation typically appears to be trending in the best course,” Lawant added. “However, unexpected shocks ought to by no means be dominated out.”

There’s a presidential election developing too, after all, slated for a similar week as the subsequent FOMC assembly. That ought to make for an enchanting few days for journalists like us and readers such as you.

— Ben Strack

Bulletin Board

- BMO Capital Markets raised its 2024 year-end forecast for the S&P 500 to six,100 on Thursday. Brian Belski, the agency’s chief funding strategist, famously was one of many few analysts to accurately predict the 2023 inventory market rally.

- Two vital central financial institution conferences have been scheduled for Thursday. The Financial institution of England met this morning and opted to carry rates of interest, which was anticipated. And later this night, we’ll hear from the Financial institution of Japan. Analysts doubt the BOJ will elevate charges in the present day, however are eyeing a rise in December.

- In yet one more occasion of a historic crypto cost, the state of Louisiana accepted its first cost over the Bitcoin Lightning community. It was a fantastic paid to the Louisiana Division of Wildlife and Fisheries.