Often, the halving of Bitcoin creates the circumstances for a major improve within the value of the cryptocurrency, however this time every thing could possibly be completely different.

The truth is, in comparison with the primary 3 halvings within the historical past of crypto property, on this newest block reward halving occasion, issues didn’t go as anticipated.

Bitcoin has up to date its all-time excessive even earlier than the four-year replace, whereas 4 months later it sees a bear value efficiency..

What can we anticipate now? Let’s see every thing intimately beneath.

The fourth halving within the historical past of Bitcoin

On April 19, 2024 the umpteenth Bitcoin halving aired, an occasion recognized par excellence as one of the best catalyst for the value improve of the criptovaluta.

That is the fourth halving of the block reward within the historical past of the crypto asset.

Each 4 years in actual fact, or slightly each 210,000 blocks, the Bitcoin community performs an replace that reduces new coin emissions by 50%.

This time the halving has lowered the presence of latest circulating from the canonical 6.25 BTC per block (roughly each 10 minutes) to three.125 BTC.

We’re speaking a few lower of 450 BTC per day, equal to a worth of 26.3 million {dollars}. In a 12 months, this quantities to over 9.5 billion {dollars} of potential promoting strain faraway from the crypto market.

Now the subsequent halving is anticipated in 2028, when the block reward will drop to 1.5625 BTC, additional contributing to creating the digital asset more and more useful and tough to mine.

The 4th #Bitcoin halving is full!

Block rewards are actually 3.125 #BTC

The countdown has been reset – see you in 2028 🫡 pic.twitter.com/s0Wcl19A8p

— Binance (@binance) April 20, 2024

As talked about, usually the Bitcoin halving is related to a bull motion within the value of the coin. It’s because, in a context the place quotations transfer based on the demand/provide ratio, a discount in provide definitely has a optimistic influence.

This doesn’t imply, nonetheless, that essentially each lower in provide (not the circulating one, however the “new” provide) has corresponded to a rise in costs.

The truth is, in parallel to this situation, there should even be a rise in demand to successfully help the rise within the markets.

We remind you that Bitcoin just isn’t a deflationary asset, as it’s mistakenly described: slightly, it’s an asset with a restricted provide, with a programmed linear discount inflation.

The value of cryptocurrency after the primary months post-halving

If within the first 3 halvings within the historical past of Bitcoin, (2012, 2016, 2020), the halving of the block reward triggered a considerable improve within the value of the crypto, this time it could possibly be utterly completely different.

The halving of 2024 certainly represents a singular occasion of its type, not a lot on the software program replace facet however slightly in relation to the context of the quotations.

A posteriori possiamo osservare come già prima della fatidica knowledge del 19 aprile 2024, Bitcoin had already up to date its all-time excessive to 74,000 {dollars}.

Within the earlier 3 dates, the cryptocurrency had as a substitute set a brand new value document after just a few months (not earlier than).

This time the cryptocurrency has skilled a robust rally within the months main as much as the halving, anticipating one of the vital “discounted” actions out there.

It’s because in all probability the merchants, realizing the historic value pattern at the side of the halving, have chosen to purchase upfront.

Nonetheless, there are those that consider that we’re nonetheless early within the bull market of the present market cycle. Typically, Bitcoin reaches a brand new excessive 530 days after the halving.

It has been 119 days for the reason that 2024 #Bitcoin halving. Within the final two cycles, $BTC hit a market high round 530 days post-halving.

If historical past repeats, we’re nonetheless within the early levels of this cycle! pic.twitter.com/Yxxo7DLfsg

— Ali (@ali_charts) August 19, 2024

On the earth of finance, the phrases “bull” and “bear” are sometimes used to explain market tendencies. A “bull” market is characterised by rising costs, whereas a “bear” market is marked by falling costs. Understanding these ideas is essential for traders.

4 months after the halving, nonetheless, Bitcoin costs are down by about 10%, highlighting a totally “off” timing in comparison with the asset’s historic efficiency.

Since April, the pattern of the whole cryptocurrency sector has been bearish, properly beneath customers’ expectations.

It isn’t sure that one other bull section will happen within the coming months, simply as it isn’t sure that there will probably be a brand new all-time excessive AFTER the final halving.

Bitcoin halving bull run :pic.twitter.com/VWoyFNQQHQ

— naiive (@naiivememe) August 19, 2024

What to anticipate now? The macro knowledge and future value forecasts of Bitcoin

Positively the halving of this cycle represents essentially the most tough to research, each for the impact on the value of Bitcoin and for the macroeconomic context of the monetary markets.

Within the earlier three halving occasions, there was in actual fact a macro-level state of affairs utterly completely different from the present one.

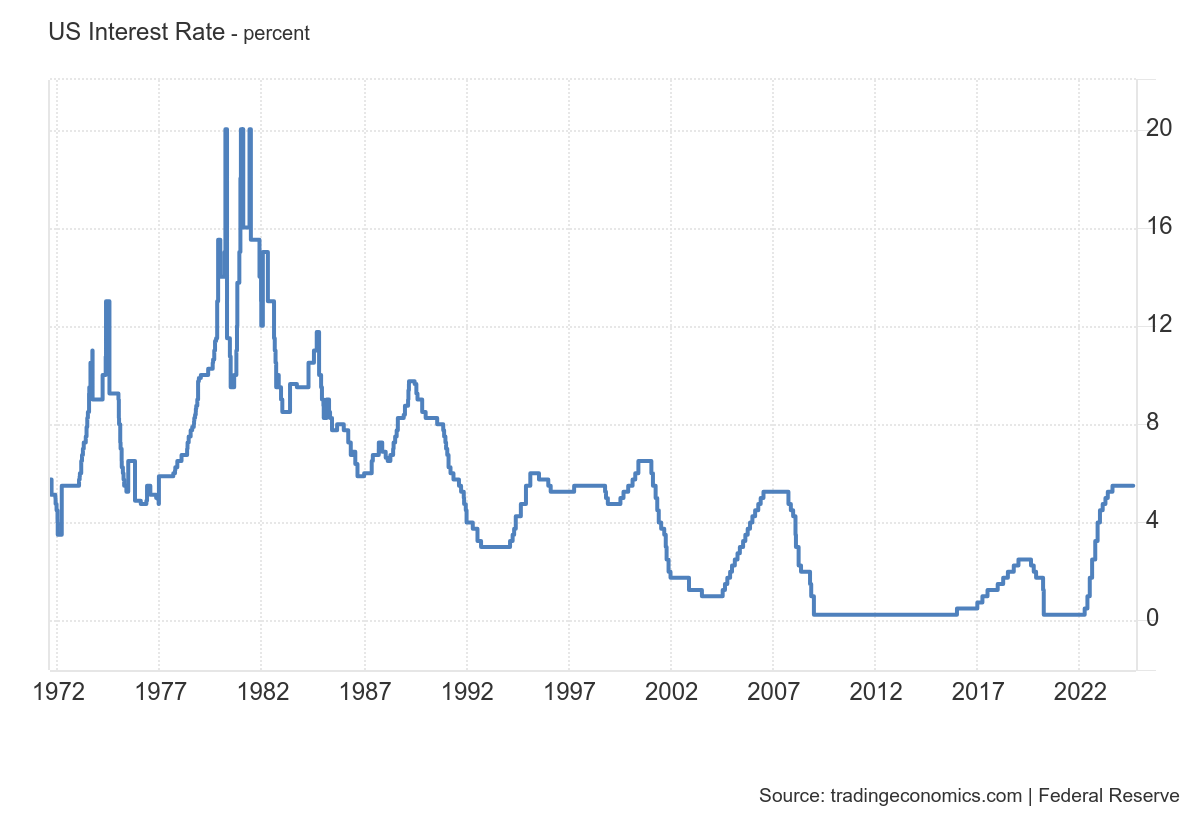

To start with, within the years 2012, 2016, and 2020, the rate of interest of Authorities Bonds within the USA has all the time fluctuated between 0.25% and 0.50%, with a short rise throughout 2019.

In April 2024, nonetheless, the so-called “FED Fund Fee” have been as excessive as 5.5 share factors, indicating one of the vital restrictive financial insurance policies of the final 20 years.

Moreover, geopolitical tensions with open wars in Center East and in Ukraine additional complicate the image, making it much more tough to match the most recent halving with the earlier ones.

What to anticipate now? By having a look on the projections of rate of interest cuts within the USA, we will estimate an increase within the crypto market as early as subsequent month.

In September, in actual fact, traders anticipate a reduce of no less than 50 foundation factors, adopted by a possible additional reduce of 25 factors within the subsequent FOMC.

Along with this reversal from a “tightening easing” pattern to a “quantitative easing” pattern, inflation in the US is steadily diminishing.

Up to now few days, the index of the rise in shopper items costs has certainly fallen beneath 3% for the primary time in a number of months.

In anticipation, we will subsequently anticipate an increase within the value of Bitcoin all through This autumn 2024. Indicatively, in these 3 months, the cryptocurrency might replace its all-time excessive, bringing the cyclical impact of the halving again to regular.

Consideration in any case to attainable black swans from right here to the approaching months, with potential postponement of the value improve in Q1 2025.

The primary post-halving goal is that of 100,000 {dollars}, with attainable spikes even above this document determine.

#BTC

Bitcoin is ~125 days after the Halving

Bitcoin tends to breakout into the Parabolic Part of the cycle some ~160 days after the Halving

If historical past repeats, Bitcoin could possibly be simply over a month away from breakout

That is late September$BTC #Crypto #Bitcoin pic.twitter.com/iy7xmDjuso

— Rekt Capital (@rektcapital) August 18, 2024