5 weeks in the past, Tether, probably the most worthwhile firm within the crypto trade partnered with its subsidiaries Moon Gold and Moon Gold El Salvador to launch a brand new token, Alloy (aUSDT).

The stablecoin large, which manages over $114 billion in belongings and posted an annualized revenue of $18 billion, says it “goals to redefine stability within the digital house” with aUSDT.

It additionally claims that its “modern strategy supplies constant worth and stability between the reference asset and its tethered counterpart.”

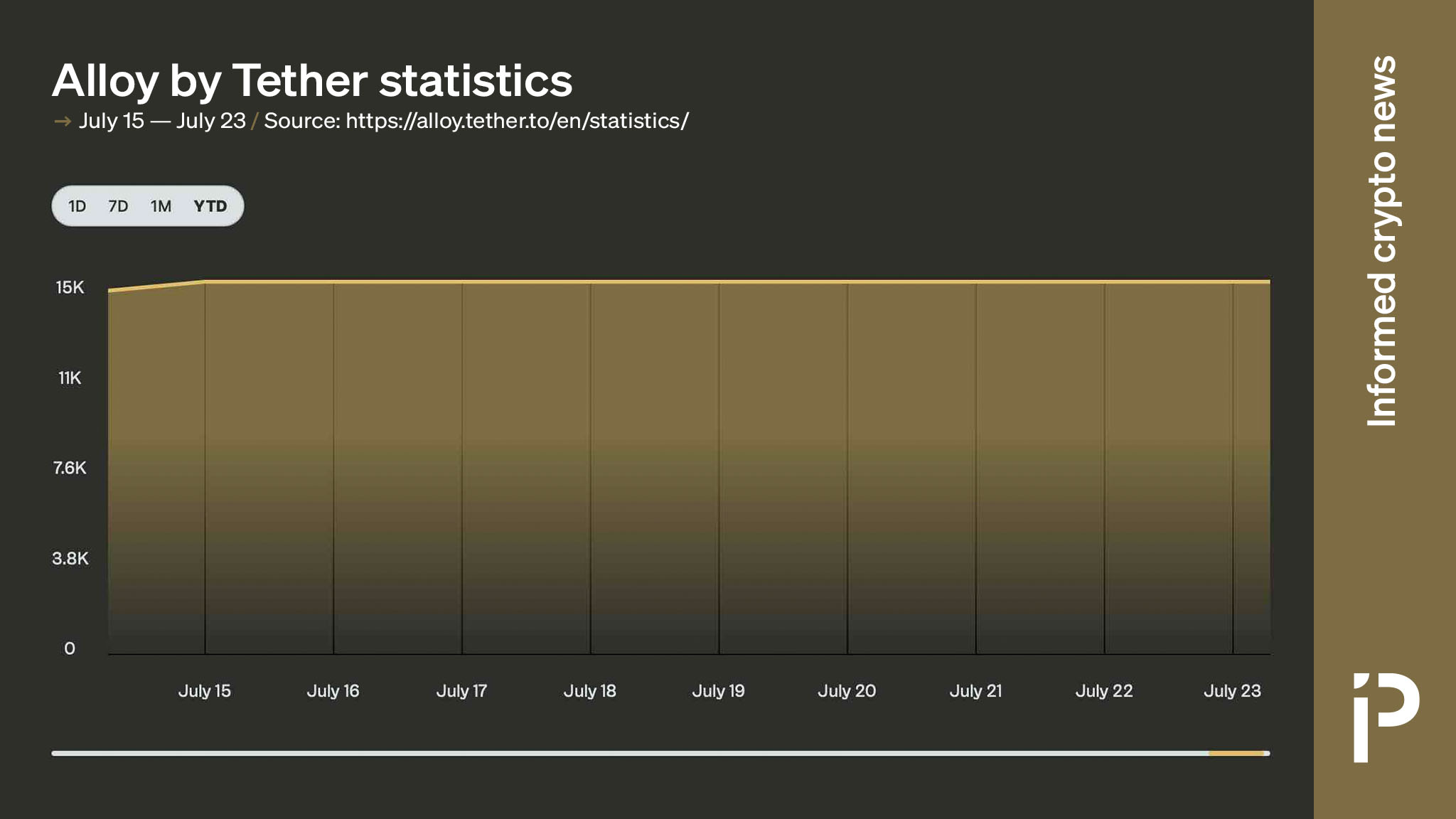

Nevertheless, in keeping with present statistics, simply 5 wallets have opened aUSDT positions and solely 32 wallets maintain the token.

And the embarrassing statistics don’t finish there. Regardless of its declare of a “very helpful and modern mixture for customers who need to have interaction in digital transactions, funds, and remittances with a foreign money that feels as acquainted because the US greenback,” CoinGecko and CoinMarketCap agree that over the past 24 hours, a mere $34 of aUSDT has transacted.

Simply 5 wallets have opened aUSDT place to this point and solely 32 wallets maintain it.

Learn extra: Tether’s new asset at present backed by 0kg of gold

Tether launches gold-backed USDT to crickets

Tether claimed that aUSDT would permit crypto customers to carry a dollar-like Ethereum token backed by gold in Swiss vaults. For clarification, XAUT is the tether truly backed by gold whereas aUSDT is the over-collateralized stablecoin at present collateralized by XAUT.

With oversight by El Salvador’s Comisión Nacional de Activos Digitales (CNAD), Moon Gold and its El Salvadoran division helped to arrange and coordinate the flowery sequence of occasions and possession transfers wanted to maintain aUSDT backed by bodily gold.

As with most digital belongings provided by Tether — USDT, XAUT, LEO, RSR, EURT, CNHT, AUSDT — any proof of reserves is usually primarily based on statements from company executives. Until somebody is excited about arranging for supply or bodily inspection of their allocation of gold in Switzerland, they have to belief Tether’s assurances and paperwork relating to the backing of Alloy by Tether.

Maybe because of this — the belief in a centralized middleman that’s embedded into all Tether tokens — lower than just a few dozen individuals have cared to undertake its newest model of a ‘gold-backed’ stablecoin.

Learn extra: Let’s speak about Tether’s investments

Promoters of gold stablecoins have been making an attempt to push tokens onto the crypto neighborhood for six years or extra. Regardless of their efforts, nevertheless, there are roughly $1 billion value of gold-backed stablecoins at the moment. This compares to $157 billion value of USD stablecoins.