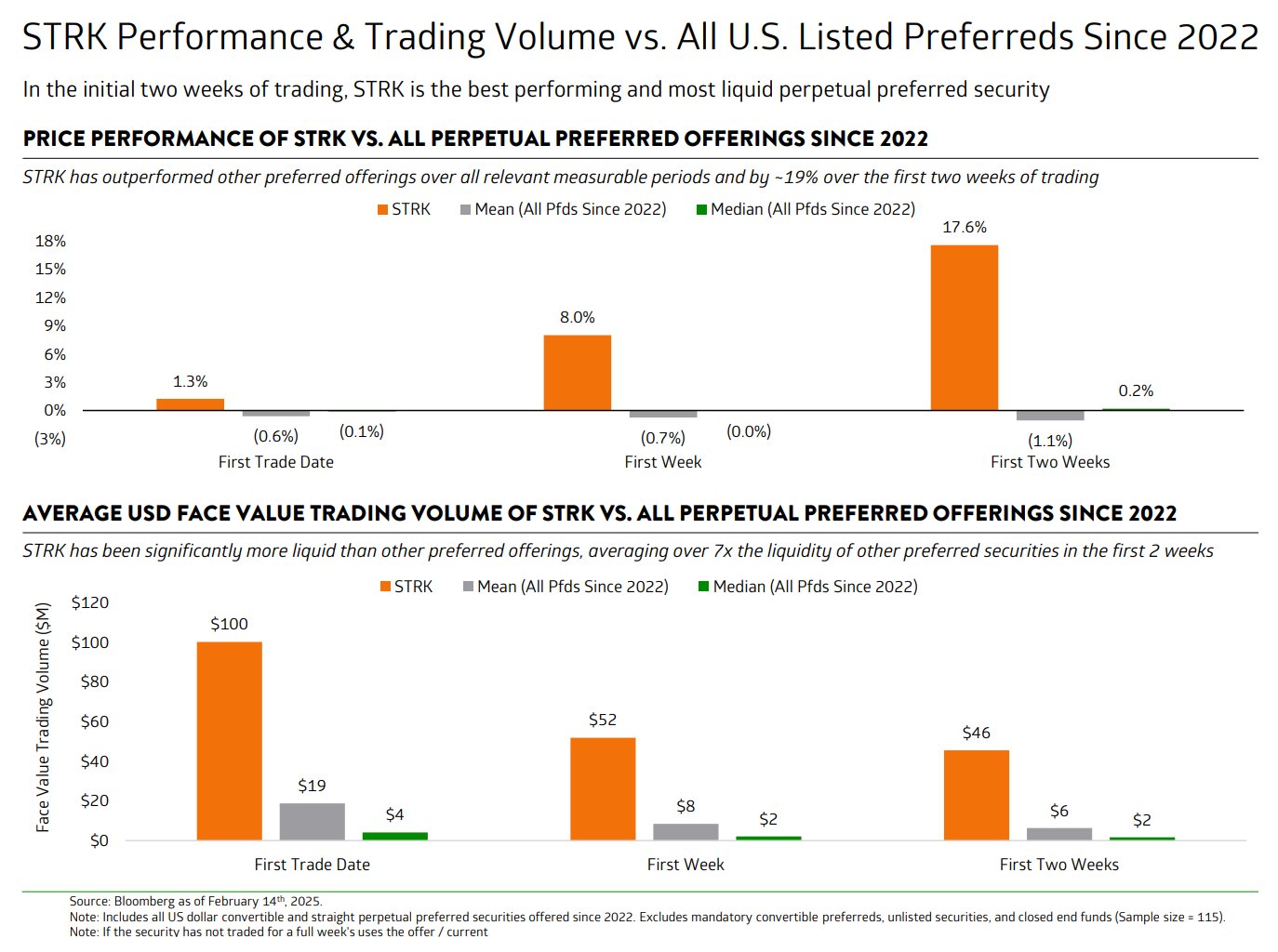

Technique (previously MicroStrategy) most popular inventory, STRK, had a record-breaking efficiency in its first two weeks. In line with the corporate, STRK is now the best-performing out of 115 most popular shares listed within the US since 2022.

Per info shared on X, STRK is first in worth efficiency with 19% extra good points than the typical most popular inventory. It has additionally attracted extra curiosity from buyers, with a buying and selling quantity that’s 7x the typical.

The corporate founder, Michael Saylor, additionally famous the inventory’s sturdy efficiency, saying:

“Within the preliminary two weeks of buying and selling, $STRK is one of the best performing and most liquid perpetual most popular safety.”

The efficiency highlights how effectively buyers have taken to STRK regardless of earlier speculations from some analysts that it may fail to fulfill expectations. Barron’s analyst Andrew Bary had stated in January that Technique may need to chop the worth of the inventory providing by 8%.

With STRK now doing higher than anticipated, Coindesk senior analyst James Van Straten stated he had contacted Barry about probably updating his article. One other market professional famous that Barron’s take is no surprise as a result of Wall Avenue underwriters often need issuers to underprice offers in order that they will seem as a giant success in hindsight.

STRK is Technique’s Sequence A Perpetual Strike Most popular Inventory, a convertible most popular inventory via which Technique seeks to boost $250 million that shall be spent on shopping for Bitcoin. The inventory has a liquidation choice of $100 and might be transformed into Class A standard inventory below sure circumstances.

Technique continues optimistic efficiency regardless of BTC decline

The efficiency of STRK highlights how Technique has been performing positively this yr regardless of Bitcoin itself struggling. The enterprise intelligence turned Bitcoin firm has seen a powerful efficiency, with its fill up 16.61% yr so far.

By comparability, Bitcoin is barely up 3.42% YTD, with the flagship asset caught under $100,000 for nearly two weeks. BTC’s struggles are as a result of a number of causes, together with macroeconomic components resembling inflation and tariffs, however Technique, which positions itself as a Bitcoin firm, has not seen a lot unfavorable impression.

Regardless of Technique’s final two Bitcoin acquisitions costing greater than BTC’s present worth, buyers appear to have a powerful optimistic sentiment about Technique’s place, which additionally spreads to STRK.

There are not any clear causes for this, however the firm has made a number of strikes because the begin of this yr that present its give attention to Bitcoin acquisition with out diluting shareholder worth. It’s also anticipated to start out making use of the FASB accounting guidelines by 2025 Q1, which may increase its financials.

Curiously, the optimistic sentiments are usually not restricted to Technique however embrace different Bitcoin institutional funding merchandise. Spot Bitcoin Change-traded funds (ETF) proceed to see huge curiosity from institutional buyers regardless of BTC’s present worth struggles, exhibiting how this group of buyers understand them.

For example, Abu Dhabi sovereign wealth fund Mubadala Funding Firm is BlackRock IBIT’s seventh largest identified holder, with $461.23 million. Tudor Funding, the agency of legendary investor Paul Tudor James, additionally owns $426.9 million value of IBIT shares.

IBIT’s efficiency has stood out, significantly from different Bitcoin ETFs. Since Donald Trump turned president, IBIT has solely had two outflows, all value a mixed $50 million.