T-Rex Group has filed for brand new ETFs that take a leveraged lengthy or quick place in Microstrategy (MSTR).

MSTR is thought for its volatility given its heavy publicity to bitcoin.

T-Rex Group, the exchange-traded funds (ETFs) issuer, has filed for an ETF that may take a 2x lengthy place in bitcoin (BTC)-heavy Microstrategy (MSTR).

In accordance with a submitting revealed on the Securities and Change Fee’s EDGAR platform, the T-Rex 2X Lengthy MSTR Each day Goal ETF goals to realize 200% of MicroStrategy’s each day efficiency.

T-Rex additionally filed for an ETF that may take a 2x inverted place in MSTR. Successfully, each of those listed merchandise can be a leveraged lengthy or quick on bitcoin.

MSTR, with its heavy publicity to bitcoin, is thought for its volatility because it tracks the world’s largest digital asset. The inventory’s present implied volatility is excessive at 85.6, however trending decrease than its current common, as bitcoin’s worth stays secure.

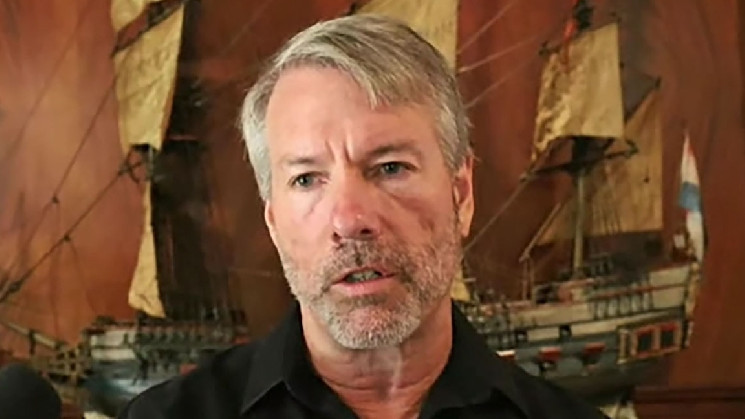

Not too long ago its CEO, Michael Saylor, introduced the agency would provide $500 million in convertible notes to spice up its bitcoin holdings.

Bloomberg ETF analyst Eric Balchunas wrote on X that these ETFs can be a “near-lock to be probably the most unstable ETFs ever seen within the U.S, with 20x the volatility of the SPX.”

They would be the “ghost pepper of ETF sizzling sauce”, he mentioned.

ETF issuers Defiance and GraniteShares have additionally listed merchandise that take a brief place in MSTR.

T-Rex additionally filed for six leveraged inverse bitcoin ETFs in March, with positions starting from 1.5x-2x.