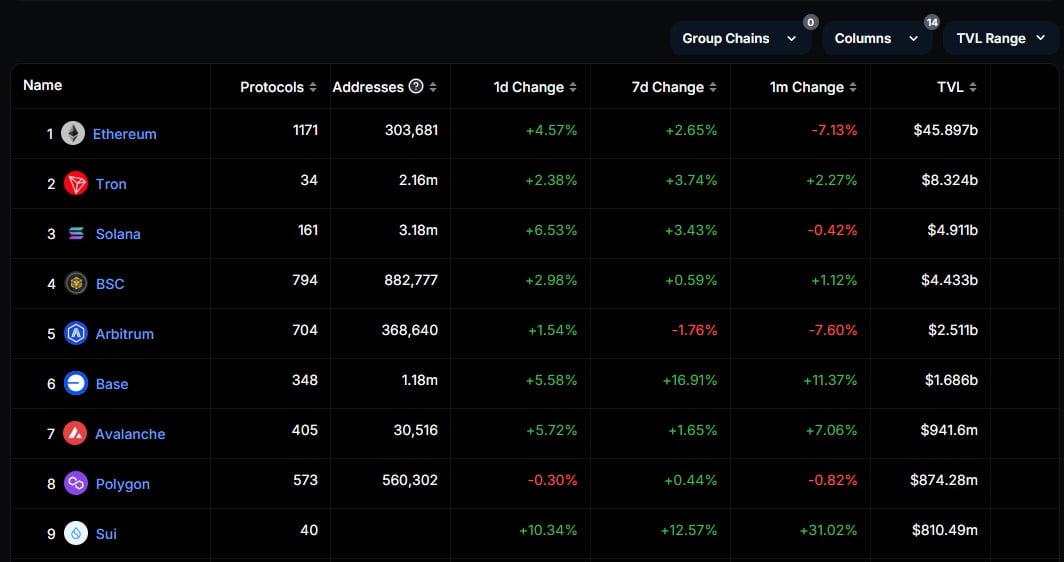

The full worth locked (TVL) on the Sui Community surged to a file of $810.5 million on September 19, in accordance with information from DefiLlama. The SUI token additionally reported main good points, rising over 30% within the final seven days, CoinGecko’s information reveals.

The expansion comes regardless of earlier TVL fluctuations throughout broader market corrections, with a year-to-date improve of roughly 283% from about $211 million.

TVL, indicative of the quantity deposited into DeFi protocols for actions corresponding to lending and derivatives, highlights rising curiosity in Sui’s choices.

All three main DeFi protocols on the Sui blockchain have seen good points over the previous week. The TVL of the NAVI Protocol, a lending protocol on the Sui Community, elevated by 16.5% to $310 million.

The Scallop Lend lending protocol achieved a TVL of $140.5 million, representing a rise of roughly 19.5% weekly, whereas Suilend noticed a weekly improve of 14.5% with over $134 million in TVL.

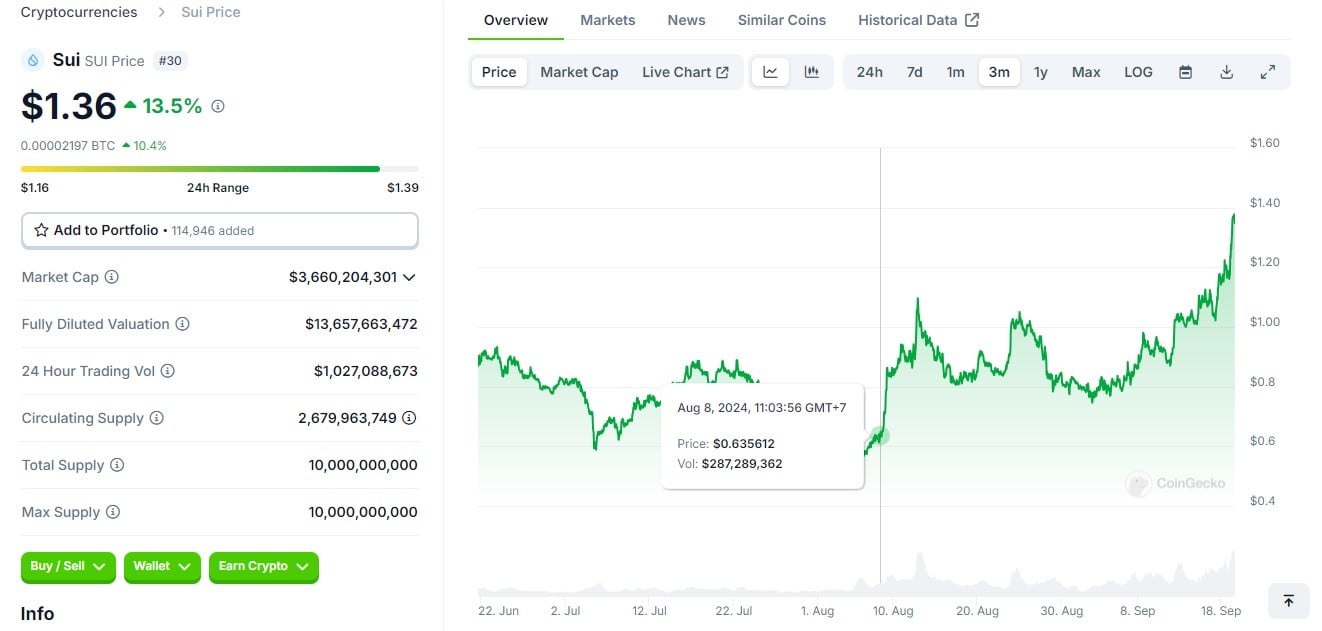

Along with the TVL file, Sui has notched one other achievement as its SUI token has been among the many top-performing crypto belongings within the final seven days. It has outperformed widespread memecoins like PEPE and Aptos (APT) when it comes to market capitalization and buying and selling exercise.

The SUI token climbed from $0.6 to $1.04 following the launch of the Grayscale Sui Belief. The constructive momentum was later fueled by the announcement of Circle’s upcoming integration of USDC into the Sui Community, which despatched the worth hovering to a brand new excessive of $1.18.

SUI is now buying and selling at $1.3, up over 13% up to now 24 hours.