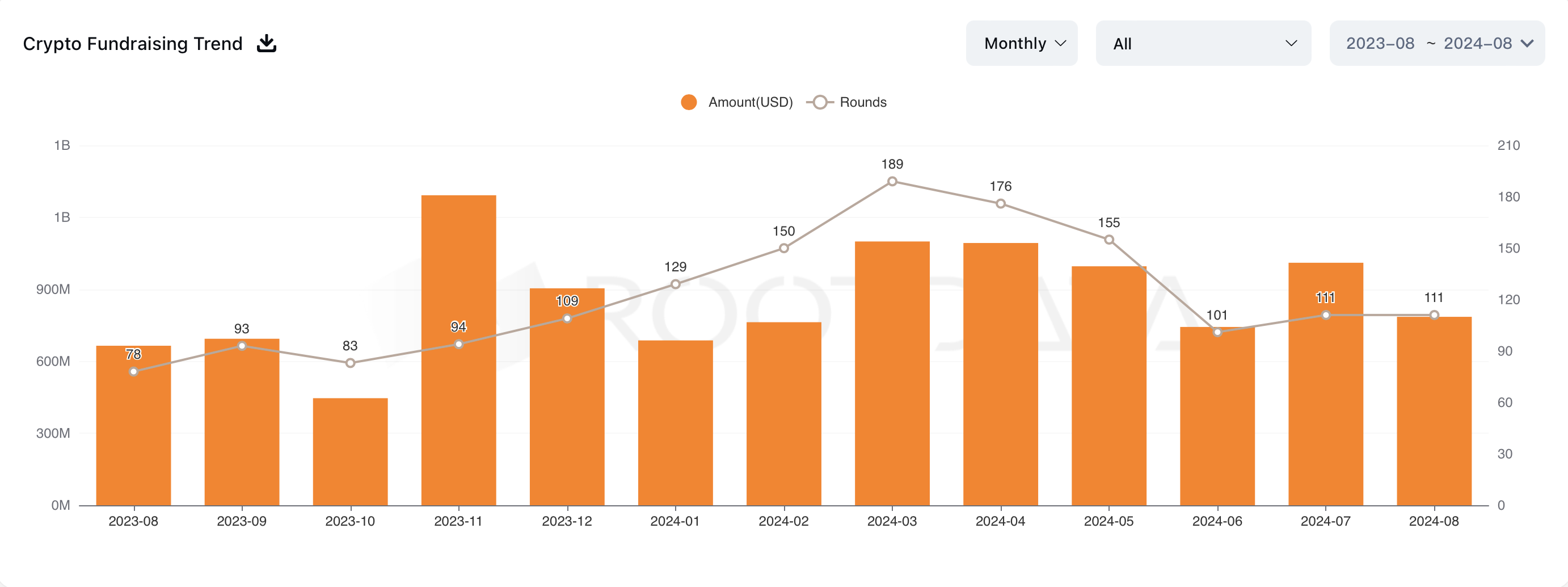

In accordance with RootData statistics, 111 publicly disclosed crypto VC funding tasks came about in August, matching the whole from July 2024. This represents a 41% enhance in comparison with August 2023, when 78 tasks have been recorded.

The overall fundraising quantity in August reached $785 million, marking a 22% lower from the $1.01 billion raised in July.

Crypto VC Investments Stay Regular in August

Enterprise capital exercise is a key indicator of main traders’ curiosity within the crypto market. Whereas the variety of publicly disclosed crypto VC tasks in August remained unchanged from July, each months now rank because the third-highest for crypto funding rounds in 2024, behind March and Could, which noticed 190 and 155 rounds, respectively.

Though the whole fundraising quantity in August dropped by 22% from July’s $1.01 billion, it nonetheless represents a 20% enhance over the $660 million raised in August 2023.

Learn extra: Finest Funding Apps in 2024

Crypto Fundraising Development. Supply: RootData

The regular funding quantity displays robust confidence within the crypto sector, even amidst financial uncertainties. Moreover, the distribution of funds throughout varied sectors factors to shifting priorities and rising tendencies within the trade.

In August, decentralized finance (DeFi) accounted for almost 25% of whole investments, adopted by synthetic intelligence (AI) at 15%. Instruments and wallets noticed the smallest share, with solely 2.2% of the whole.

You will need to be aware that these figures don’t embrace merger and acquisition offers.

DeFi and AI Take the Highlight

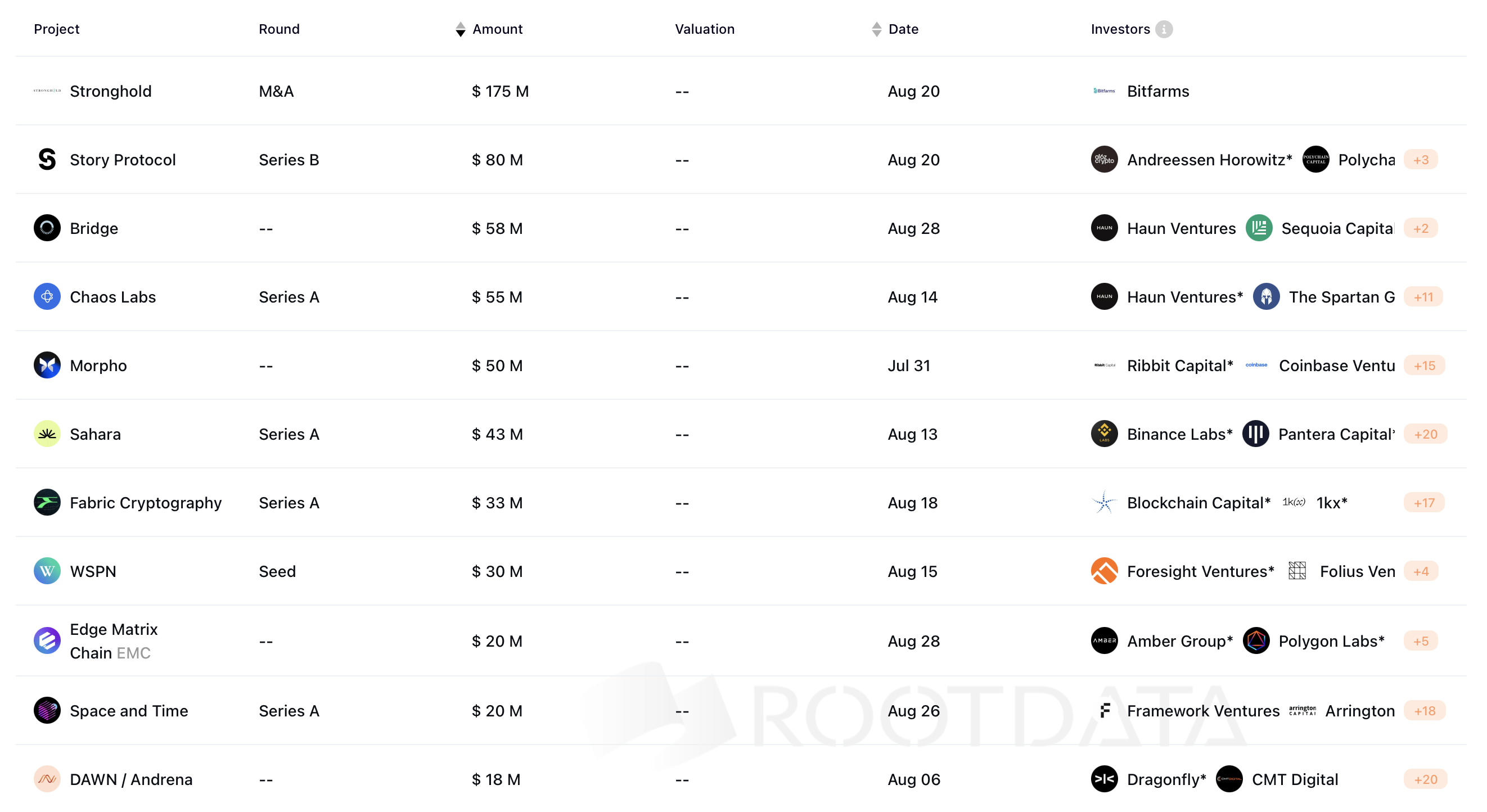

The most important occasion in August as soon as once more concerned Bitcoin mining corporations: Bitfarms introduced its acquisition of competitor Stronghold Digital for $175 million in inventory and debt, including to the current development of mining M&As. Bitfarms will trade 2.52 shares for every Stronghold share, a 71% premium over the 90-day volume-weighted common worth of Stronghold on Nasdaq as of August 16.

“After three years of ongoing discussions, I’m proud to announce this transformative acquisition. With this transaction, we count on to develop and rebalance our power portfolio to 950 MW with almost 50% within the US by the tip of 2025 and have visibility on multi-year growth capability as much as 1.6 GW with roughly 66% within the US, up from roughly 6% right now,” Bitfarms CEO Ben Gagnon mentioned.

IP-focused Story Protocol secured $80 million in a Collection B funding spherical led by Andreessen Horowitz, with participation from Polychain and different traders. Based in 2022, Story has now raised a complete of $140 million, with the newest spherical reportedly valuing the corporate at $2.25 billion.

Most Funded Crypto Tasks of August 2024. Supply: RootData

Story’s blockchain platform permits mental property (IP) homeowners to retailer their IP on the community, embedding utilization phrases—reminiscent of licensing charges — into good contracts. This ensures that homeowners are compensated every time their IP is used.

“Huge Tech is stealing IP with out consent and capturing all of the revenue. First, they are going to gobble up your IP for his or her AI fashions with none compensation. The present state of AI utterly destroys the motivation to create unique IP for all of us,” Story co-founder S.Y. Lee said.

The third-largest funding, totaling $58 million, was secured by Bridge, a stablecoin community based by former Coinbase and Sq. executives. Bridge goals to problem conventional monetary programs like Swift and bank card infrastructures by providing a extra efficien various.

Different notable funding rounds in August included Chaos Labs, which raised $55 million for DeFi danger administration, and Morpho, securing $50 million to combine DeFi into the web’s infrastructure. Sahara AI raised $43 million to boost AI sovereignty, whereas Cloth Cryptography secured $33 million to develop cryptographic {hardware}.

Learn extra: Prime 12 Crypto Corporations to Watch in 2024

One smaller funding spherical stood out as a result of present hype round meme coin launchpads. Parlay Labs, the primary multichain, no-code platform for launching meme cash, secured a $2 million spherical led by DNA.fund. Notable particular person traders included Jon Najarian of Market Riot and Rick Schlesinger, Co-Founding father of EOS New York.

“The deal with meme cash was predicated on present market demand. Parlay wished to enter the market with a product that creators and customers wished to make use of, not one thing that we thought they need to use. At the moment Parlay provides creation and buying and selling throughout the EVM spectrum. Plans are to develop throughout much more chains throughout this primary quarter of launch, and let creators who favor different protocols take pleasure in the identical device’s presently provided by Parlay on EVM,” Parlay workforce informed BeInCrypto.