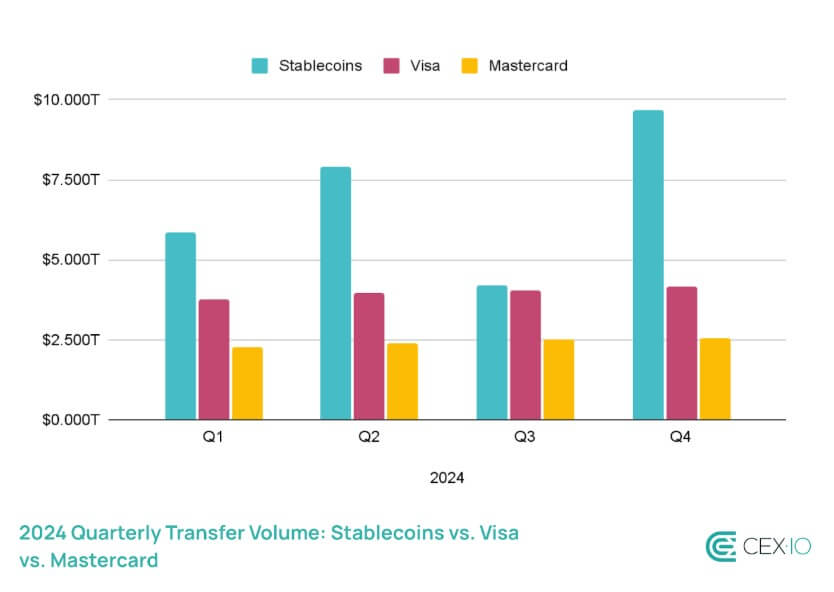

In keeping with a report from crypto change CEX.IO, stablecoin transfers reached $27.6 trillion in 2024, outpacing Visa and Mastercard’s mixed transaction quantity by 7.68%.

The report identified that stablecoins constantly outperformed conventional cost suppliers all year long regardless of a dip in Q3 as a result of broader market slowdowns.

This development alerts a shift in international remittances as legacy suppliers like Western Union and MoneyGram battle to adapt to a rising demand for digital belongings.

The stablecoin provide expanded by 59% throughout this era, exceeding $200 billion. This development pushed stablecoins to signify 1% of the full US greenback provide, a big improve from 0.63% in the beginning of the yr.

USDC leads as Solana features dominance

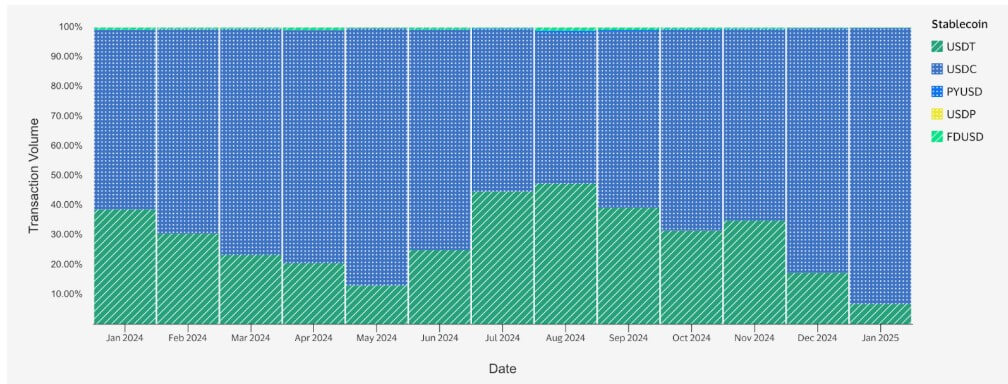

Circle’s USDC emerged because the dominant stablecoin for on-chain transactions, accounting for 70% of whole switch quantity. Nonetheless, its affect weakened barely in Q3 as a result of a short lived decline in DeFi exercise.

Tether’s USDT, the biggest stablecoin by market cap, skilled substantial development, with its whole switch quantity greater than doubling. Regardless of this, its market share declined from 43% to 25% final yr.

Solana grew to become probably the most lively blockchain for stablecoin transfers, overtaking Tron and Ethereum in January 2024. The surge in Solana-based exercise propelled USDC’s market share, with 73% of the community’s stablecoin provide tied to USDC transactions.

In keeping with CEX.IO:

“This improve aligned with Solana’s general ecosystem development, as stablecoins on the community have been predominantly used for DeFi and different dApp actions.”

Bots gas stablecoin quantity

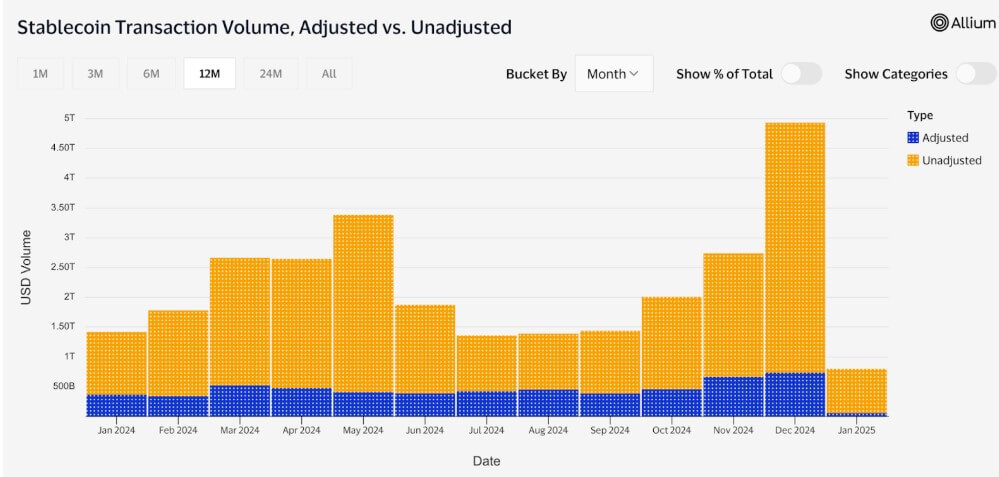

CEX.IO identified that Bot-driven buying and selling performed a big position in stablecoin transactions final yr, with automated techniques answerable for 70% of whole quantity.

In keeping with the corporate’s analysis, bot-driven trades have been significantly dominant on Ethereum, Base, and Solana.

The crypto change reported that unadjusted transaction volumes—primarily reflecting bot exercise—represented 77% of all stablecoin transfers in 2024. This marked a fourfold improve from 2023, with Base even overtaking Ethereum in This fall stablecoin quantity because of the rise of automated buying and selling.

It continued that unadjusted transactions comprised over 98% of whole stablecoin exercise in networks the place USDC dominates, equivalent to Solana and Base.

This surge was fueled by these networks’ excessive transaction speeds, low prices, booming DeFi ecosystem, and fast proliferation of meme tokens. In December alone, memecoins accounted for 56% of Solana’s decentralized change (DEX) buying and selling quantity.

Regardless of considerations over bots manipulating markets by means of frontrunning and sandwich assaults, CEX.IO famous that in addition they enhance effectivity. These automated techniques facilitate arbitrage, execute recurring sensible contract transactions, and assist cowl customers’ gasoline charges.

CEX.IO added:

“In consequence, bot dominance in stablecoin transactions might additionally signify the maturation of sure networks.”

What subsequent for stablecoins?

The change mentioned stablecoins cemented their position as important liquidity sources in DeFi, buying and selling, and cross-border funds in 2024. This development is anticipated to persist in 2025, significantly in post-halving cycles, which traditionally set off elevated buying and selling quantity and capital flows.

Provide enlargement can also be more likely to proceed. The corporate famous that earlier market cycles confirmed stablecoin development extends past bullish phases, usually persisting even in early downturns. For example, in 2022, stablecoin provide saved rising till March—5 months after the market’s peak. This implies that demand might stay regular even when broader market circumstances weaken.

One other key growth might contain a shift past USDT-dominated networks like Tron. The report famous that USDT faces rising competitors and elevated regulatory scrutiny, which might erode its market share and impression Tron’s dominance in stablecoin transactions.

In the meantime, Ethereum’s upcoming Pectra replace, anticipated in March 2025, might strengthen the community’s enchantment as a stablecoin hub. The improve goals to enhance scalability, cut back gasoline charges, and improve consumer expertise throughout Ethereum Layer 1 and Layer 2 networks.