Latest knowledge reveals the stablecoin sector has grown by an extra $14.429 billion in worth since Jan. 1, signaling renewed momentum in digital asset markets. Main this upward trajectory, the dollar-pegged sky greenback (USDS) skilled a 116% development spurt throughout the identical interval, outpacing its friends within the prime ten pack to assert essentially the most pronounced enlargement amongst main stablecoins.

Stablecoin Sector Hits $217B as Ethereum, Solana, Tron, and Base Drive Recent Issuance

The most recent knowledge illustrates the stablecoin ecosystem has ballooned by a hanging $14.429 billion up to now month, reflecting heightened exercise in crypto markets. Figures from defillama.com element a climb within the fiat-anchored digital asset financial system from $202.867 billion to $217.296 billion as of Feb. 1, 2025.

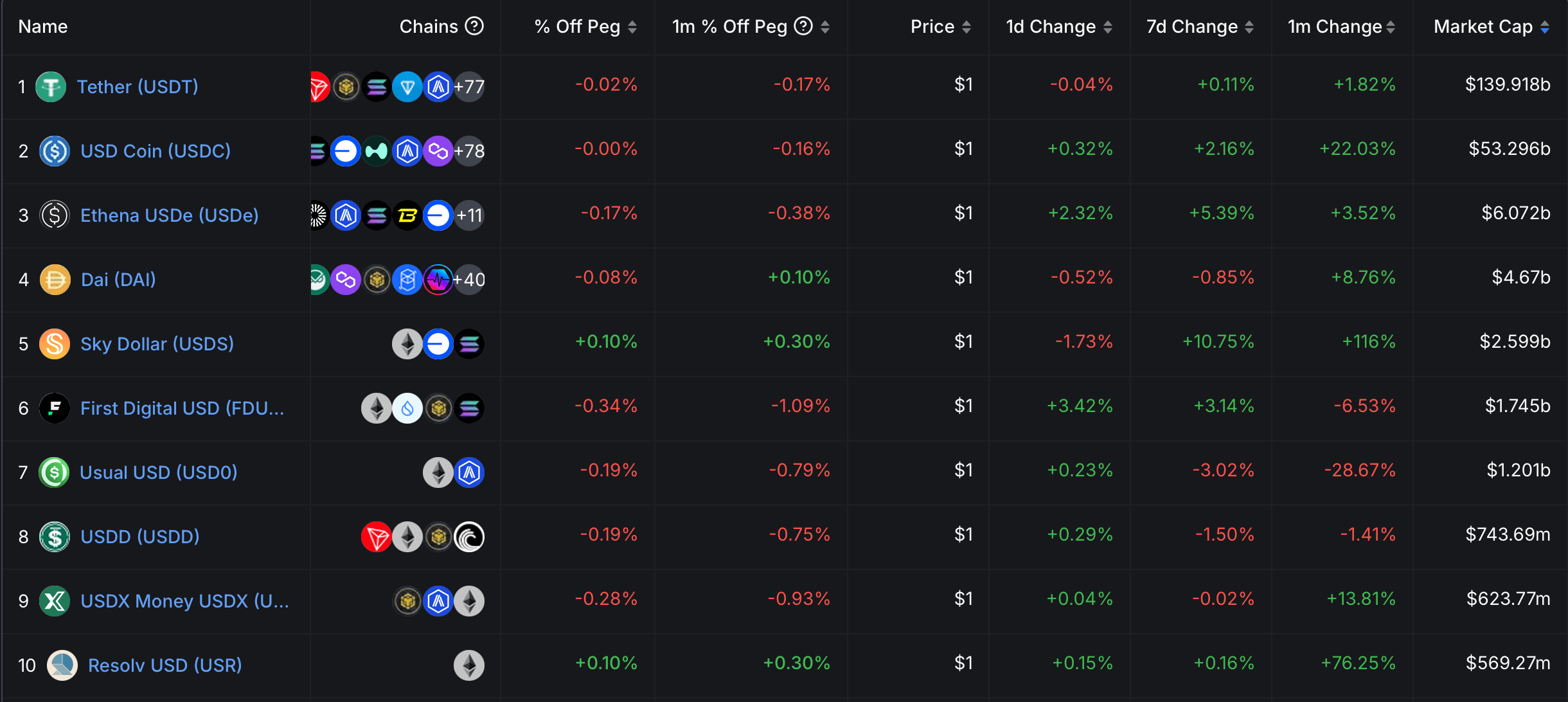

High ten stablecoins by market cap in line with defillama.com.

Seven of the highest ten stablecoins recorded provide expansions, with business titan tether (USDT) inching upward by a modest 1.82%. Dominating the expansion charts, Sky’s USDS catapulted 116% in January to $2.599 billion, seizing the highlight as this month’s unequalled victor when it comes to stablecoin development.

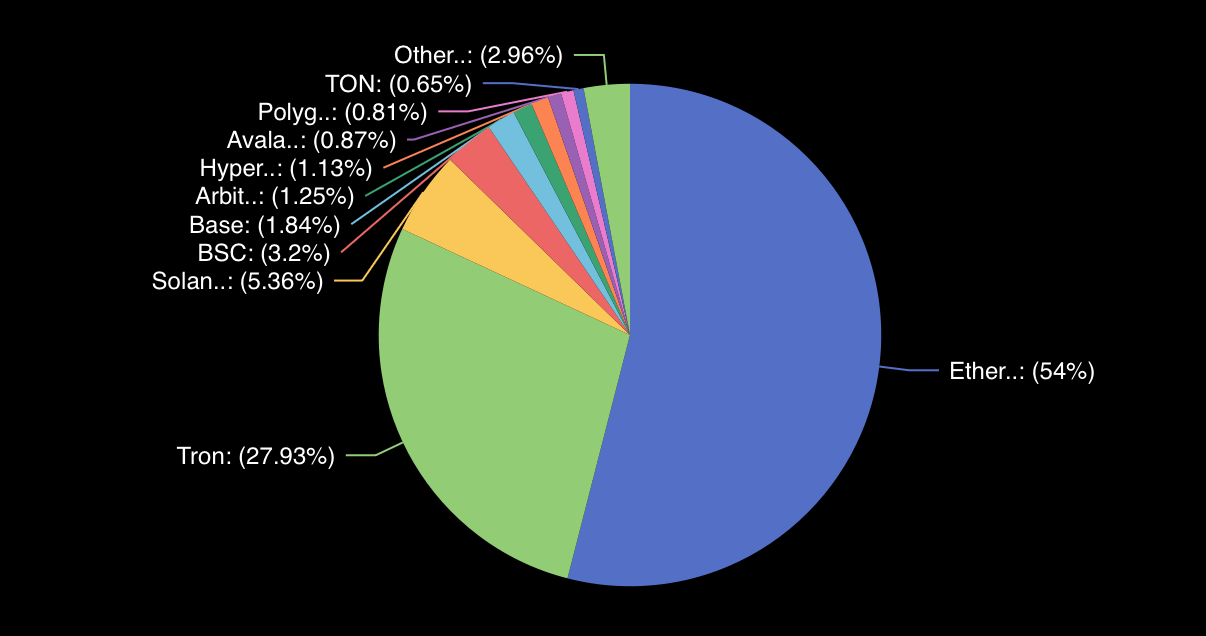

Stablecoin distribution when it comes to blockchains through defillama.com knowledge.

Trailing carefully, resolv usd (USR)—a protocol collateralized by ethereum (ETH) and hedged by perpetual futures performs—boosted its provide by 76.25%, now totaling $569.27 million. Circle’s USDC claimed third place with a 22.03% uptick since Jan. 1, solidifying its standing because the sector’s second-largest asset at $53.296 billion.

Further notables within the prime ten embrace USDE (+3.52%), DAI (+8.76%), and USDX (+13.81%). As of this weekend, Ethereum anchors $117.327 billion of the full $217.296 billion in circulation, whereas Tron hosts $60.682 billion.

Solana secures third with $11.654 billion on Feb. 1, adopted by Binance Sensible Chain (BSC) at $6.961 billion and Base with $3.994 billion. Solana and Base emerged as February’s standout platforms when it comes to stablecoin issuance.

January’s enlargement indicators a maturing digital asset enviornment, the place Ethereum, Tron, and Solana preserve strategic footholds, whereas Base demonstrates agility in capturing rising demand. Whereas everybody’s buzzing about how far this bull market would possibly run, of us are additionally questioning: Simply how large might the stablecoin financial system get on the experience up?