Stablecoin transaction worth on Brazil’s native exchanges has surged effectively past Bitcoin, reflecting a pointy rise of their use for B2B cross-border funds.

Brazil‘s stablecoin market is prospering, as Latin America turns into the second-fastest-growing area with a year-over-year development price exceeding 42%, in keeping with knowledge from blockchain analytics agency Chainalysis.

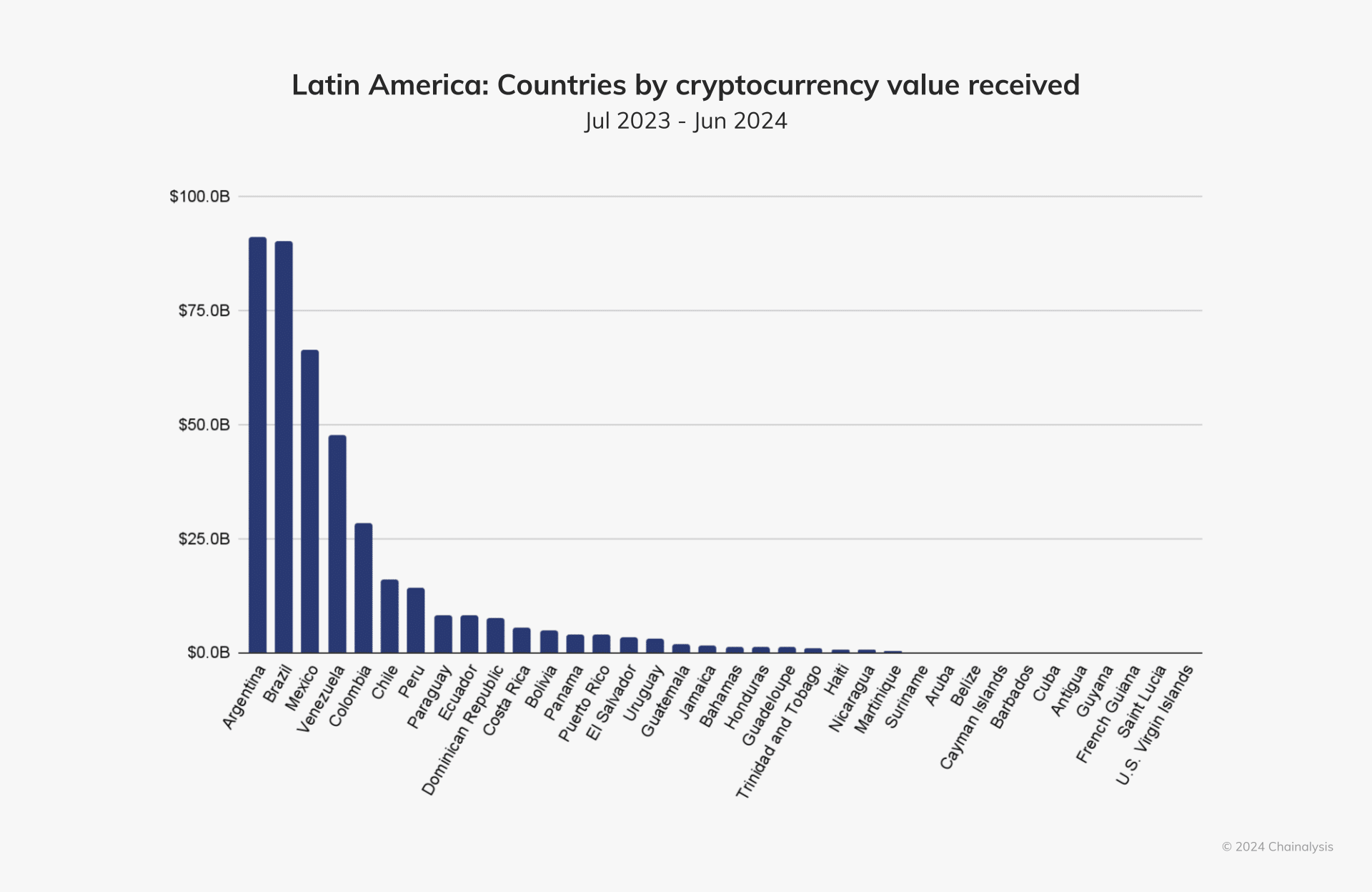

Knowledge from the New York-headquartered agency reveals that between July 2023 and June 2024, Brazil obtained almost $90.3 billion in crypto, trailing carefully behind Argentina. Whereas Bitcoin (BTC) stays fashionable, stablecoins have emerged as a most well-liked possibility on native exchanges, pushed by demand for U.S. greenback publicity amid native forex instability.

Nations by crypto worth obtained | Supply: Chainalysis

Chainalysis notes a year-over-year improve of 207.7% in stablecoin transaction worth on Brazilian exchanges, far outpacing different cryptocurrencies like Ethereum (ETH).

Regardless of financial challenges, reminiscent of a weakening Brazilian actual and slowing development, there are nonetheless “alternatives for crypto development, particularly as regulators open their method to the expertise,” the agency defined. As exchanges like OKX and Coinbase proceed increasing in Brazil, stablecoins are poised to stay a dominant drive within the nation’s evolving crypto panorama, Chainalysis notes.

Nevertheless, Latin America just isn’t the one area witnessing a booming demand for stablecoins amid financial turbulence. As crypto.information reported earlier, stablecoins have emerged as a significant part of Sub-Saharan Africa‘s crypto economic system, accounting for about 43% of the area’s whole transaction quantity.

Ethiopia, Africa’s second-most populous nation, has seen retail-sized stablecoin transfers develop by 180% year-over-year, fueled by a latest 30% devaluation of its native forex, the birr.