Establishments that use Fireblocks for crypto key administration workflows will work seamlessly with M^0’s stablecoin-minting and validation software program.

The protocol goals to fill the hole between current stablecoin methods, the place all of the yield goes to both the token issuers or the token holders.

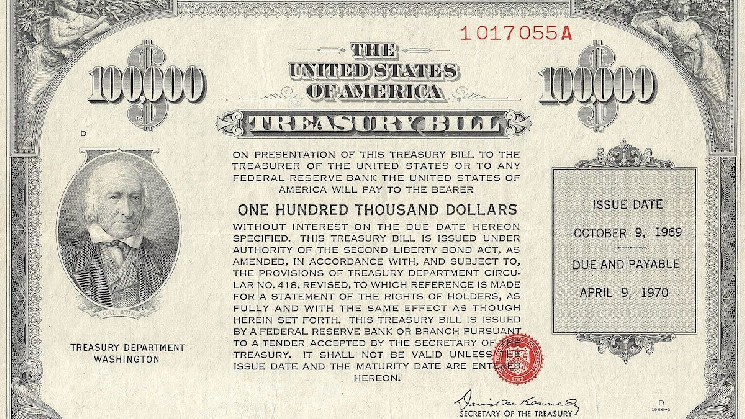

M^0 (pronounced “M Zero”), a protocol that permits establishments to mint their very own stablecoins backed by U.S. Treasury payments, reached an settlement for Fireblocks to supply cryptocurrency custody companies to its issuers.

Corporations utilizing M^0 to mint cryptodollars use personal keys to switch them, replace collateral balances, retrieve and burn tokens and work together with different members within the ecosystem resembling validators for checking reserves. These keys now work seamlessly with Fireblocks’ key-management system, the businesses mentioned.

“We’re creating these minter modules and validator modules to be as institutional prepared as doable,” M^0 Labs CEO Luca Prosperi mentioned in an interview. “So when a celebration like a big market maker or buying and selling desk, for instance, comes and says they wish to develop into a minter, however have their key administration system on Fireblocks, then you possibly can combine it in a seamless manner with them. We’re doing this as a result of we predict nobody is as nicely outfitted as Fireblocks to do such subtle workflow and key administration methods for crypto property.”

M^0 Labs develops the software program for the protocol, which is ruled by the decentralized M^0 Basis.

The group additionally highlights what it says is a novel function of its enterprise mannequin: income sharing

The success of stablecoin issuers like Tether, whose USDT is the most important by market cap, and Circle, producer of the No. 2, USDC, have targeted consideration on the business and seeded a brand new crop of dollar-pegged tokens. These tokens are typically backed by yield-generating reserves, usually U.S. Treasury payments.

In current fashions both the issuer, resembling Tether or Circle, retains all yield, or the curiosity cost accrues to the token holder. There’s a necessity for extra versatile system, Prosperi mentioned.

M^0 permits protocol customers to wrap stablecoins such that they’ll decide to maintain the yield in its entirety or they’ll do extra difficult issues like share a proportion with sure folks based mostly on what they do, he mentioned.

“Between these two dumb options, the place issuers both hold 100% of the yield, or the opposite excessive the place holders hold 100% of the yield – even when they need not – there is no such thing as a house to incentivize distribution until by cumbersome paper-based advertising and marketing contracts,” Prosperi mentioned. “This expertise permits issuers or holders of M to create arbitrarily advanced logic to handle the yield with the intention to incentivize their very own ecosystem. And this opens up a variety of totally on-chain alternatives and enterprise fashions.”

M^0 has to this point gathered a float of round $30 million that’s already over collateralized, with reserves independently validated on-chain each 30 hours, Prosperi mentioned. The service shouldn’t be out there to customers within the U.S.