Spot Ethereum ETFs are anticipated to start out buying and selling this week, a giant occasion since January when the Securities and Trade Fee (SEC) authorized Bitcoin funds.

Individuals in Polymarket’s betting platform have staked $250k, with a likelihood of the itemizing standing at 99%. This is a crucial occasion since Polymarket has been extremely correct on key points up to now few months.

Why spot Ethereum ETF issues

There are indicators that the SEC will approve ETFs by corporations like Blackrock, Invesco, and Franklin Templeton. Most of those issuers have already printed their remaining filings and analysts consider that it’s only a matter of time.

An Ethereum ETF is vital for 3 foremost causes. First, beneath Gary Gensler, the SEC has persistently mentioned that Ether is a safety following the merge occasion in 2022. This merge occasion mixed the earlier Ethereum with the beacon chain, which launched the idea of staking.

Staking is a course of the place traders allocate their cash to delegators after which earn a return, typically month-to-month. Information exhibits that traders have staked tokens value over $116 billion, giving it a staking ratio of 27%. ETH yields about 3.12%.

Different altcoin ETFs

Second, this approval will open the floodgates within the crypto business the place extra corporations will file altcoin funds. VanEck has already filed a spot Solana ETFpapers, a transfer that will likely be replicated by different corporations.

Solana is an apparent selection as a result of it has grown into the most important chain on this planet after Ethereum. Its DEX platforms have gained substantial market share and are dealing with a lot of the quantity within the business.

Equally, Solana meme cash like Ebook of Meme, Popcat, and Dogwifhat have gained substantial market share. Additionally, Solana has turn out to be the most important blockchain for Decentralized Public Infrastructure (DePIN) networks.

Different seemingly blockchains that would see ETF purposes are the likes of Chainlink, Polkadot, Cardano, and BNB.

Ethereum provide is falling

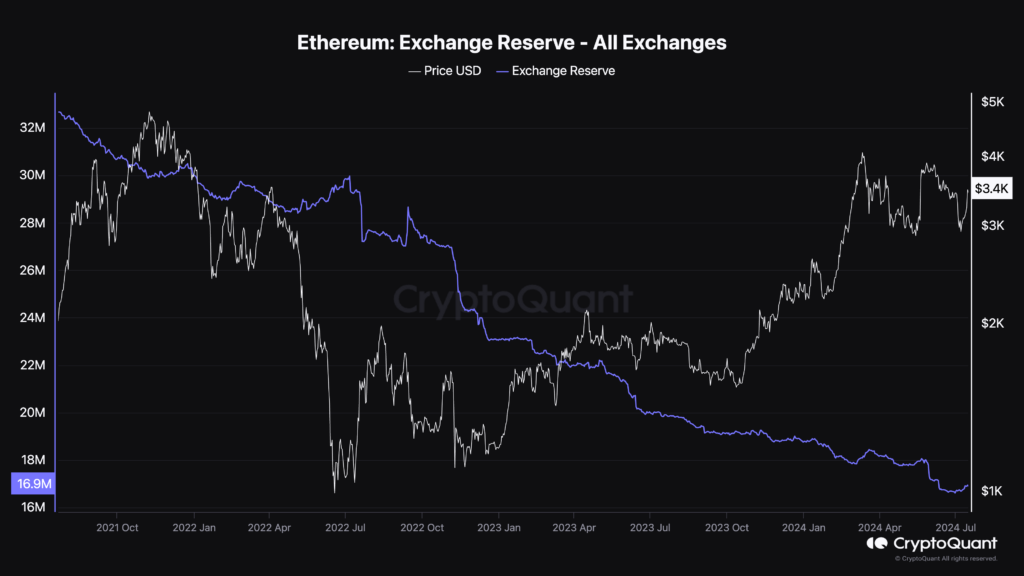

Third, the ETF approval issues due to the continued Ethereum provide dynamics. As proven under, the amount of Ether tokens in exchanges is hovering at a document low. As such, falling provides and excessive demand from ETFs imply that the token’s worth might soar.

A very good instance of that is what occurred with Bitcoin ETFs. Information exhibits that these funds have amassed over $17 billion in inflows up to now few months. As such, analysts consider that Ethereum funds might accumulate Ether ETFs as nicely.

Moreover, Ether has some stable fundamentals. It’s the second-biggest cryptocurrency on this planet, the most important chain in areas like DeFi, and probably the most worthwhile. Information exhibits that Ethereum’s community has revamped $1.8 billion in revenues this 12 months.

Which would be the greatest Ethereum ETFs?

As I’ve written earlier than, I’d not advocate investing in any Ethereum ETF for a easy cause. These funds, as now we have seen with Bitcoin, will observe the value of BTC in the long run.

Spot Ethereum ETFs will observe Ethereum as nicely, that means that investing in ETH will result in higher returns than these funds.

As an ETF investor, you will have to pay an annual payment to the issuer. The latest filings present that almost all funds may have a waiver, the place customers won’t be charged. These charges will then apply after a number of months.

In the long run, nevertheless, these charges are unavoidable. The most costly ETF would be the Grayscale Ethereum Belief (ETHE), which can cost 2.50%. That is an exorbitant excessive payment for any ETF.

After the waiver, the most cost effective Ethereum ETF would be the Franklin Ethereum ETF (EZET), which may have a payment of 0.129%. Will probably be adopted by the VanEck (ETHV) and Bitwise (ETHW) Ethereum ETFs, which can cost 0.20%.

The opposite funds from Constancy (FETH), Blackrock (ETHA), Grayscale Mini Belief (ETH), and Invesco Galaxy ETF (QETH) will cost 0.25%.

Okay everybody. Listed here are the small print for the #Ethereum ETFs that we anticipate to launch subsequent week. We’re solely lacking particulars for Proshares’s ETF. 7 of the ten funds have payment waivers. pic.twitter.com/5v3QnHOeub

— James Seyffart (@JSeyff) July 17, 2024

Investing in these ETFs additionally implies that customers won’t profit from the staking rewards. Information by StakingRewards exhibits that the token has a yield of three.30%. This reward implies that a $100,000 funding will generate an annual reward of $330. In a decade, this reward will likely be over $3,300, which ETF traders will forego.

Subsequently, altogether, you possibly can lose over 3.35% when it comes to charges and staking rewards by simply investing in Ethereum ETFs.

Ethereum worth forecast

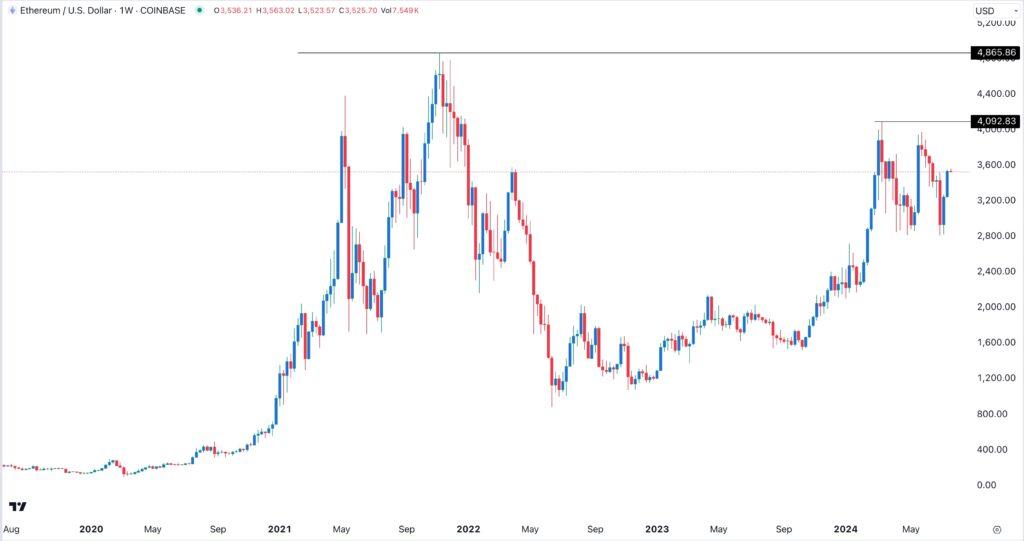

The approval of spot Ethereum ETFs may have a constructive affect on the token’s worth, which explains why it has jumped by over 24% from its lowest level this month. It has additionally moved to its highest level since June twenty second.

In principle, Ethereum worth ought to rise after the spot Ethereum ETF approval due to the excessive demand and diminishing provides. On this case, the token might rise to about $3,800. Nevertheless, in actuality, the token might drop as traders promote the information. Moreover, the ETF approval has been already priced in by market members.

The put up Spot Ethereum ETFs to start out buying and selling by July twenty sixth – Polymarket predicts appeared first on Invezz