Ethereum (ETH) spot exchange-traded funds (ETFs) grew to become tradeable on July 23. Nevertheless, regardless of preliminary enthusiasm, these funding funds have struggled to take care of investor curiosity.

In current weeks, ETH ETFs have confronted substantial web outflows, with just one week of inflows recorded since their launch.

Ethereum ETFs Document Regular Outflows

In accordance with knowledge from SosoValue, ETH spot ETFs recorded a web outflow of $341.35 million of their first week of buying and selling, marking the biggest outflow to this point. The second week noticed a lowered outflow of $169.35 million, indicating that whereas investor curiosity continued to say no, the tempo of withdrawals slowed barely.

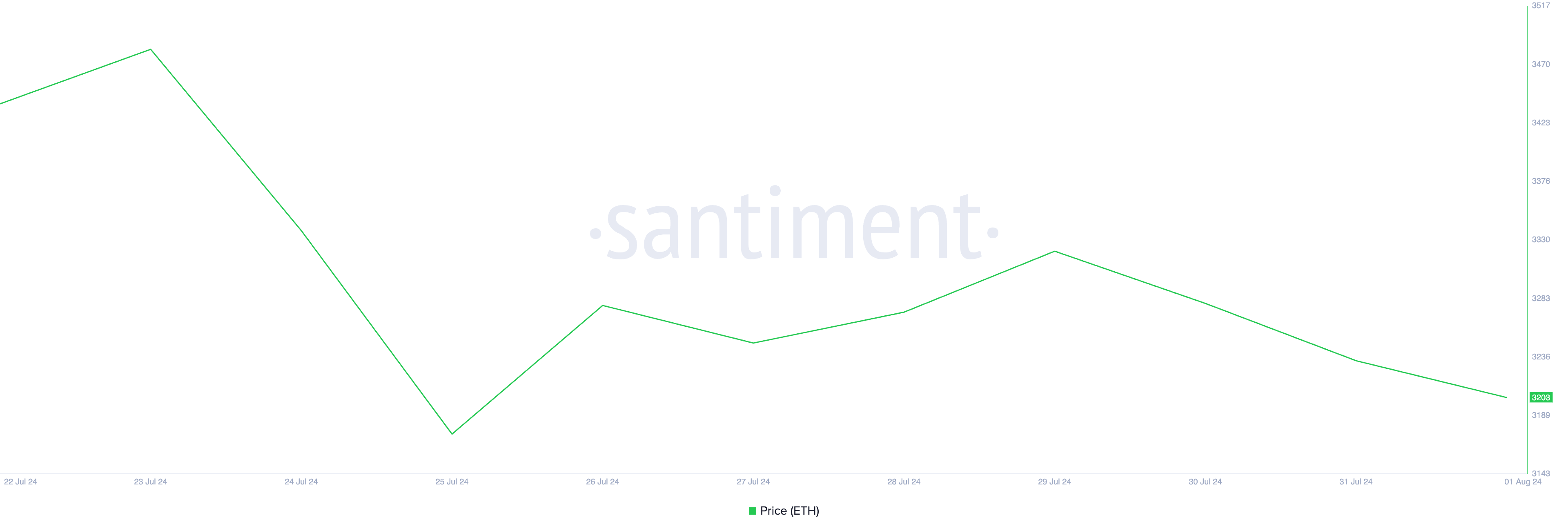

Inside the two weeks, the full web property plummeted from $9.24 billion to $8.33 billion. This decline was as a result of funds withdrawal from these ETFs as ETH worth plugged. Between July 23 and August 8, the worth of the main altcoin dropped by 7%.

Ethereum Value. Supply: Santiment

Though ETH’s worth declined additional within the third week, the ETFs recorded their first and solely inflows, totaling $104.76 million. Apparently, regardless of this constructive influx, the full web property in these funds dropped by one other 13%.

By the tip of that week, the mixed web worth of all property held by US Ethereum spot ETFs stood at $7.28 billion. This stays the one week of web inflows these funds have seen since their launch.

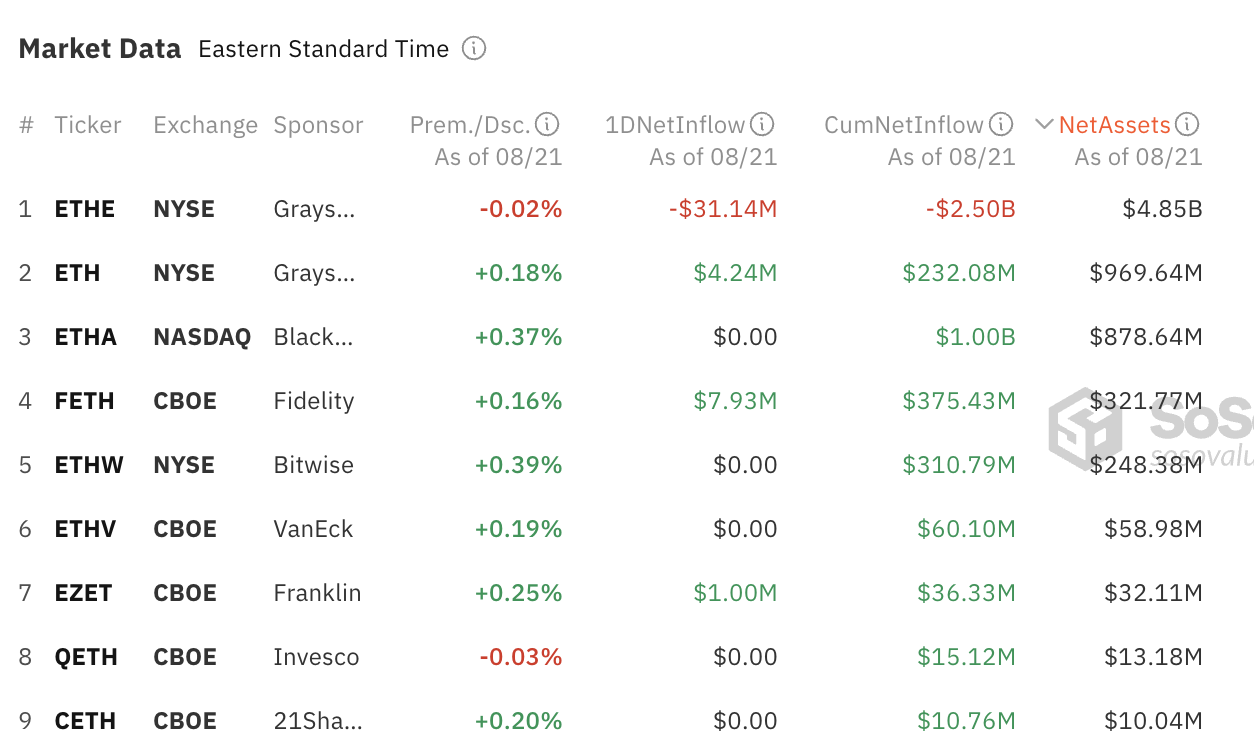

Whole Ethereum Spot ETF Web Influx. Supply: SosoValue

Outflows have amounted to $38 million thus far this week, with complete web property at $7.38 billion. This represents 2.3% of ETH’s market capitalization.

On Wednesday, BlackRock’s iShares Ethereum Belief (ETHA) surpassed $1 billion in cumulative web inflows, making it the one fund to achieve that milestone. In accordance with SoSoValue knowledge, this surpasses the mixed inflows of the following three highest ETFs.

Learn extra: Find out how to Put money into Ethereum ETFs?

Ethereum Spot ETF Market Information. Supply: SosoValue

Nevertheless, ETHA’s web property rank third, behind Grayscale’s mini Ether belief (ETH) and Ethereum belief (ETHE), which have complete property of $4.85 billion and $969.64 million, respectively. ETHA holds complete property of $878.64 million.

ETH Value Prediction: Coin Flashes Purchase Sign

At press time, ETH is buying and selling at $2,627, reflecting a 1% value improve over the previous 24 hours, whereas its buying and selling quantity has surged by 9%.

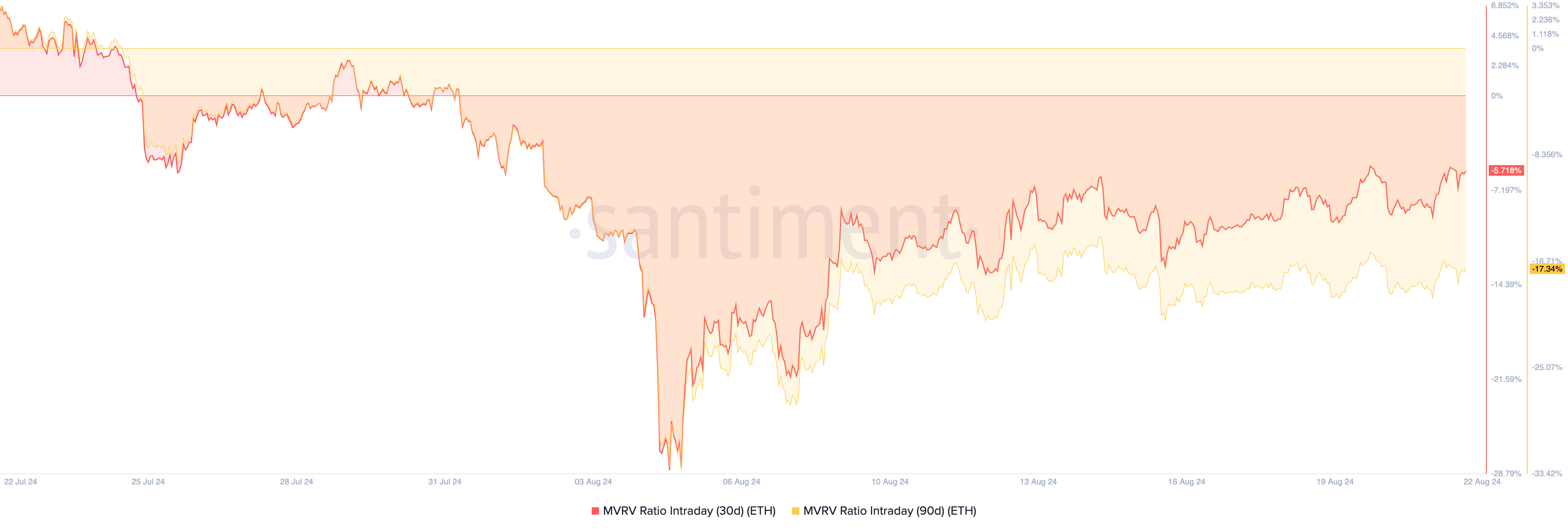

ETH’s battle to stabilize above the $3,000 mark presents a possible shopping for alternative, indicated by its damaging market worth to realized worth (MVRV) ratio. In accordance with Santiment, the token’s 30-day and 90-day MVRV ratios stand at -5.71% and -17.34%, respectively, suggesting the asset could also be undervalued.

ETH MVRV Ratio. Supply: Santiment

The MVRV ratio measures whether or not an asset is overvalued, undervalued, or pretty valued. When the ratio is under one, it signifies the asset’s market worth is lower than its realized worth, suggesting it might be undervalued. This creates a shopping for alternative for merchants trying to capitalize on the “dip.”

If ETH begins an uptrend, consumers who enter on the present market worth might understand features as the worth climbs towards $2,868.

Learn extra: Ethereum (ETH) Value Prediction 2024/2025/2030

Ethereum Value Evaluation. Supply: TradingView

Nevertheless, they danger being put “below the cash” if a downtrend happens and the worth drops to $2,579. An investor is “below the cash” when the asset’s market worth falls under the acquisition value, resulting in potential losses.