Current rumors swirling on X wrongly accused presidential candidate Kamala Harris’ of endorsing President Biden’s 2025 proposal for a 25% tax that features unrealized capital good points. What’s the reality behind the headlines and what induced the confusion?

Earlier this week, hundreds of crypto buyers discovered themselves caught up in a whirlwind of misinformation, with many distinguished accounts reporting that U.S. presidential candidate Kamala Harris had endorsed a brand new tax on unrealized good points, initially proposed by President Joe Biden for 2025.

Social media, particularly X, buzzed with outrage as individuals retweeted and reacted to evidently misinterpreted headlines, satisfied that Harris needed to tax unrealized capital good points at 25% subsequent 12 months. The mass disapproval expressed on X appeared to suggest that members of the crypto group thought this proposed tax could be all U.S. buyers, no matter their internet price.

Unrealized good points discuss with the quantity an asset has gained in worth (let’s say in USD) earlier than you promote the asset and take the revenue. So when you purchased Bitcoin at $50,000 and now you’re seeing your BTC has grown greater than 22% at in the present day’s costs, you don’t really notice these good points till you promote your BTC.

BREAKING: Kamala Harris endorses elevating long-term capital good points tax to 44.6%, additionally backing a 25% tax on unrealized capital good points of rich people.

— The Spectator Index (@spectatorindex) August 20, 2024

The outcry was evidently fueled by a misunderstanding after Harris’ marketing campaign staff final week launched her financial plan, in addition to acknowledged on Monday that, if elected, she would elevate the company tax fee — a proposal beforehand put ahead by the Biden administration.

Many had been fast to imagine that Harris’ staff had formally endorsed the present administration’s complete tax coverage proposal for 2025, which mentions unrealized good points as a part of a brand new minimal tax on the extremely rich.

However as occurs with quickly spreading rumors, this simply wasn’t true.

As identified by crypto investor, professor and well-known analyst on X, Harris’ staff didn’t endorse, touch upon or in any other case reference the 256-page doc entitled “Basic Explanations

of the Administration’s Fiscal Yr 2025 Income Proposals,” which was printed in March of this 12 months.

So that you fuckwits did it once more and ran up the rumor mill.

Harris didn’t endorse an “unrealized achieve” tax.

-Harris’ marketing campaign endorsed the *will increase* in tax fee on company tax and private tax fee over $400k on this plan.

-They didn’t touch upon introducing new taxes like… https://t.co/Jvv8JoYfJG

— Adam Cochran (adamscochran.eth) (@adamscochran) August 20, 2024

Nevertheless, somebody on X had learn not less than a part of the intensive proposal from Biden-Harris administration. Included within the doc is a brand new minimal tax of 25% on complete earnings (together with unrealized capital good points) for individuals with greater than $100 million in wealth:

“The proposal would impose a minimal tax of 25 % on complete earnings, usually inclusive of

unrealized capital good points, for all taxpayers with wealth (that’s, the distinction obtained by

subtracting liabilities from belongings) larger than $100 million.”Biden’s tax proposal for 2025

Taken out of context — each that it is a proposal from the present administration and it is just relevant to a really restricted group of extremely rich people, and likewise that Harris and her staff didn’t even endorse this proposal — the rumors took on a lifetime of their very own and unfold throughout the crypto group.

Let’s break down what we do find out about Harris’ proposed tax coverage, the way it would possibly impression the crypto market, and what consultants should say about it.

Decoding Harris’ taxation proposal and its impression on crypto

Final week, Harris did in truth reveal a part of her proposed financial agenda, which included a collection of tax proposals. Whereas the small print are nonetheless rising, let’s break down what we all know up to now.

First, as famous above, Harris has expressed help for elevating the company earnings tax fee from 21% to twenty-eight%. This transfer is anticipated to generate vital income for the federal authorities, probably rising tax receipts by as much as $1.4 trillion over the subsequent decade.

This proposed enhance within the company tax fee might impression crypto corporations, particularly bigger entities like exchanges or mining operations.

Larger taxes might result in decreased funding in new initiatives or elevated charges for customers as corporations search to cowl their rising tax obligations.

One other key facet of Harris’s financial agenda is targeted on making housing extra inexpensive. She’s proposing a number of tax incentives to encourage the development of latest properties, notably for first-time patrons and renters.

As an illustration, she plans to supply tax breaks to corporations that construct inexpensive housing and supply as much as $25,000 in down-payment help for brand spanking new owners to handle the rising prices of housing within the U.S.

Whereas the query of tokenized actual property might come into play right here, it’s not clear that the housing-related coverage proposals have an effect on crypto holders in any explicit manner.

What’s Biden’s proposal for capital good points tax?

Once more, the confusion surrounding Harris’ rumored (however really faux information) endorsement of Biden’s proposed tax on unrealized capital good points stems from a few misunderstandings. However though Harris didn’t endorse the plan, it’s not unreasonable to recommend she would possibly achieve this sooner or later. So let’s check out what Biden’s plan for 2025 tax coverage really entails.

Usually, Biden’s proposal contains a number of tax coverage modifications aimed toward rising the tax burden on the wealthiest Individuals. The proposal argues that present long-term capital good points tax coverage specifically disproportionally advantages the very rich:

“Preferential tax charges on long-term capital good points and certified dividends disproportionately

profit high-income taxpayers and supply many high-income taxpayers with a decrease tax fee

than many low- and middle-income taxpayers.”

The proposal seeks to shut the so-called “loophole” within the present system that allow’s wealthier people go on the appreciated worth of their belongings to their beneficiaries with out ever paying earnings tax on these good points.

Presently, long-term capital good points — income from the sale of belongings held for greater than a 12 months — are taxed at a most fee of 20%, or 23.8% when together with the three.8% internet funding earnings tax, with a couple of exceptions.

For prime-income earners with taxable earnings exceeding $1 million, Biden’s proposal would tax long-term capital good points at unusual earnings tax charges, which might attain as excessive as 37%, or 40.8% with the NIIT.

Nevertheless, this isn’t the tip of the story. One other proposal throughout the funds seeks to extend the NIIT by 1.2% factors for these incomes over $400,000, bringing the full NIIT to five%.

This mix would successfully push the utmost tax fee on long-term capital good points and certified dividends to 44.6% for the rich.

To interrupt it down: this 44.6% fee is the results of combining the proposed 39.6% high unusual earnings tax fee with the elevated 5% NIIT (which incorporates the extra 1.2% hike for top earners).

What about unrealized good points?

The extremely controversial phrase “unrealized capital video games” is included in Biden’s 2025 proposal as a part of a minimal earnings tax (25%) for the wealthiest Individuals who’ve wealth (which means belongings minus liabilities) of over $100 million. This minimal tax for the”extraordinarily rich”, as beforehand famous, would come with unrealized capital good points and reportedly represents an effort to handle the loophole within the present system.

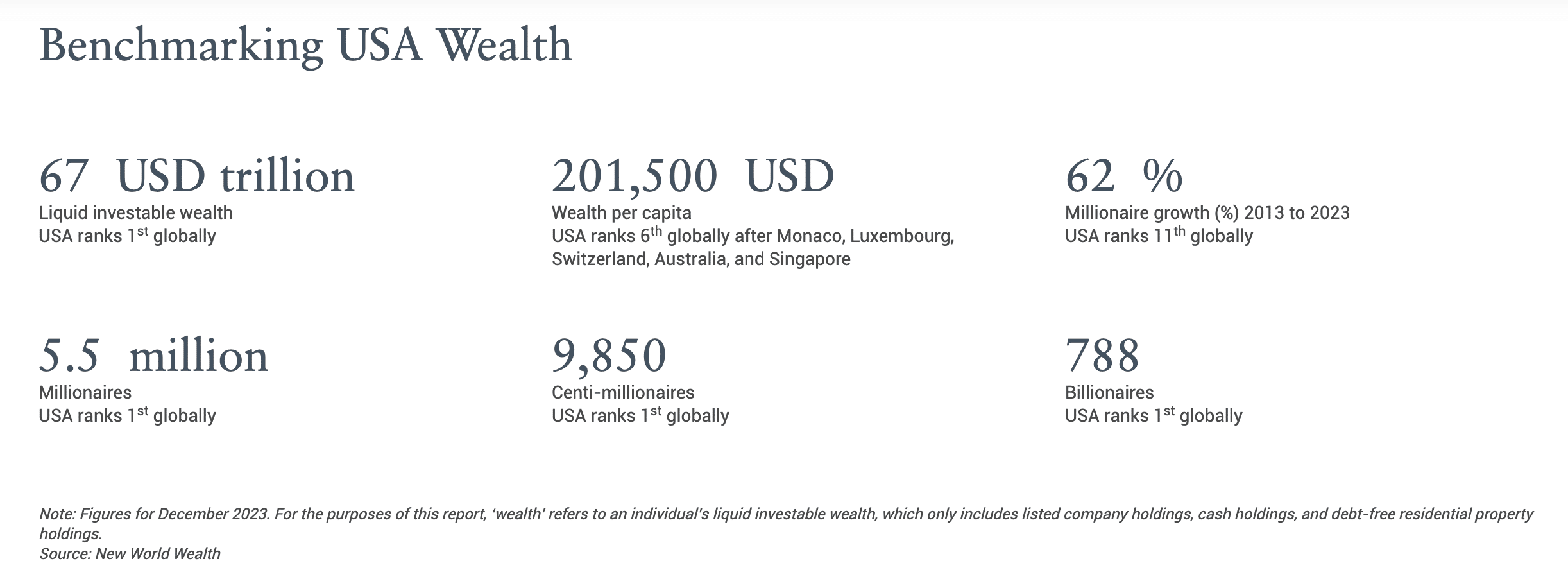

However what number of Individuals would even be affected by such a change in tax coverage? The reply is lower than 10,000. In response to a 2024 U.S. wealth report printed in March, there are at the moment 9,850 people within the U.S. who qualify as “centi-millionaires” — aka have wealth of $100 million or extra.

Meaning, to make clear, that the dialog that took X by storm earlier this week was really a few tax proposal that may have an effect on simply 0.0028% of the U.S. inhabitants — and that the present Democratic candidate for president hasn’t even endorsed.

U.S. wealth report for 2024 | Supply: Henley & Companions

For many crypto merchants and buyers, after all, the extensively mentioned and criticized tax proposal would probably be irrelevant.

Public response and controversy

The latest debate round Vice President Harris and her (rumored) stance on taxing unrealized capital good points ignited a firestorm on social media.

Reviews recommend that Harris is aligned with the Biden administrations 2025 tax proposals, however Harris and her staff have but to endorse the entire proposed modifications formally.

Notably, a January 2024 evaluation by Individuals for Tax Equity revealed that U.S. billionaires and centi-millionaires held a staggering $8.5 trillion in unrealized capital good points in 2022, which may very well be a possible goldmine for federal income, however, clearly, has additionally sparked intense debate.

Licensed monetary planner and CNBC advisor council member Douglas A. Boneparth went for a direct assault, calling the concept of taxing unrealized good points “dumb.”

Only a pleasant reminder that taxing unrealized capital good points is dumb.

— Douglas A. Boneparth (@dougboneparth) August 20, 2024

Aaron Levie, CEO of Field, shares the identical perception, stating that “unrealized good points are merely a subject in a database and never helpful till transformed into one thing of worth.”

Any proposed coverage to tax unrealized capital good points is dangerous coverage. Unrealized good points are merely a subject in a database and never helpful till transformed into one thing of worth.

— Aaron Levie 🇺🇸 (@levie) August 20, 2024

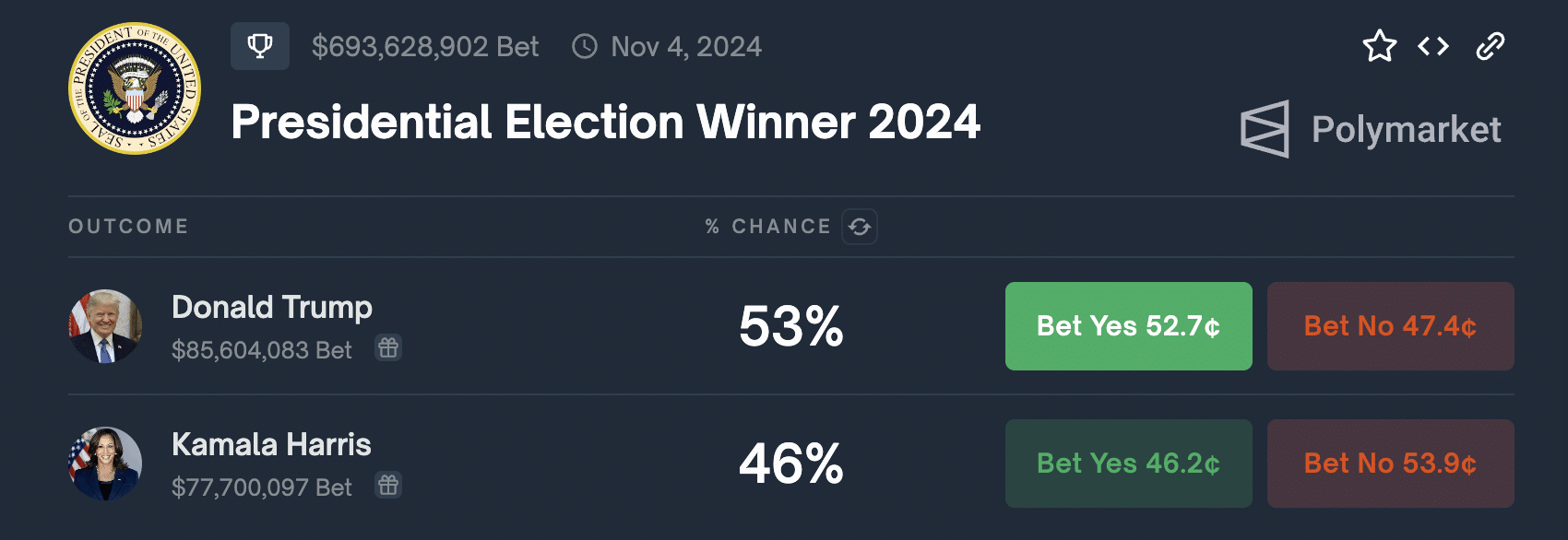

Apparently, in response to Polymarket, whereas Harris was as soon as main the race with sturdy odds of profitable the election, her probabilities have not too long ago dipped to 46%. In the meantime, Trump, who was barely behind, has retaken the entrance seat with odds now at 53%.

2024 U.S. presidential election winner bets on Polymarket | Supply: Polymarket

In the long run, whether or not you view the concept as a vital step towards fairness or as merely “a subject in a database,” one factor’s for positive — with regards to tax coverage, the satan is within the particulars. And if social media has taught us something, it’s that even the smallest element may cause a giant stir.